Advanced Micro Devices Today

AMD

Advanced Micro Devices

$137.93 -0.59 (-0.43%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $76.48

▼

$187.28 - P/E Ratio

- 101.42

- Price Target

- $138.74

Fabless semiconductor developer Advanced Micro Devices Inc. NASDAQ: AMD stock had been largely unresponsive during the artificial intelligence (AI) boom as its shares peaked at $227.30 on March 8, 2024. On the other hand, rival NVIDIA Co. NASDAQ: NVDA has taken all the spotlight, hitting all-time highs and rocketing 36%. The market made its verdict, casting AMD as a deep laggard regarding AI chips. However, this lack of interest may soon conclude as AMD regains momentum again on news of its acquisition Silo AI.

Advanced Micro Devices operates in the computer and technology sector and competes with rival semiconductor companies, including NVIDIA, Intel Co. NASDAQ: INTC, Qualcomm Inc. NASDAQ: QCOM and International Business Machines Co. NYSE: IBM.

Is AMD The Rodney Dangerfield of AI Chips?

The iconic comedian Rodney Dangerfield was famous for his catch line, purporting he got "No respect." AMD is in a similar boat when it comes to AI chips. Even despite news that major hyperscaler customers include Meta Platforms Inc. (NASDAQ: META), Microsoft Co. NASDAQ: MSFT, and Oracle Co. NYSE: ORCL, the market doesn’t place them in the same boat as NVIDIA. In fact, all 3 of the aforementioned hyperscalers are also major customers for NVIDIA. It appears that due to the backlog of NVIDIA H100 GPUs, AMD is getting some overflow business as hyperscalers want choice.

At the Microsoft Build conference, AMD showcased its end-to-end computer capabilities for Microsoft developers and customers. These included AMD Instinct MI300X accelerators, ROCm open software, Ryzen AI processing, and Alveo MA35D media accelerator to provide a powerful suite of tools for AI-based deployments.

ARM Versus x86 Architecture

In addition to the more than 90% market share that NVIDIA commands in the AI chip space, it also uses the Arm Holdings plc NASDAQ: ARM ARM architecture versus x86 architecture with AMD chips. With the latest Armv9 rollout, its architecture is more versatile and power efficient than the Intel-based x86. This is why Apple Inc. NASDAQ: AAPL also switched from the x86 to the ARM architecture.

Does the Silo AI Acquisition Buy AMD the Respect It Needs with Investors?

On July 10, 2024, AMD announced the acquisition of Silo AI for $665 million in cash. Silo AI is Europe’s largest private AI lab. The company has over 200 successful innovations and more than 125 AI scientists with PhDs. The company accelerates the development and deployment of AMD-power AI models and software solutions to enhance training and inference on AMD compute platforms. Silo AI develops state-of-the-art large language models (LLMs). Silo AI works with every vertical, from energy to automotive, and is expected to fortify AMD's AI business meaningfully. Past customers of Silo AI include Unilever plc NYSE: UL, developing a machine learning (ML) tool to improve packaging efficiency, and Intel for quality control technology.

In other words, AMD has finally addressed the software void regarding AI, which could improve sentiment in its stock. Silo AI will become part of AMD's AI Group. The deal is expected to close in the second half of 2024.

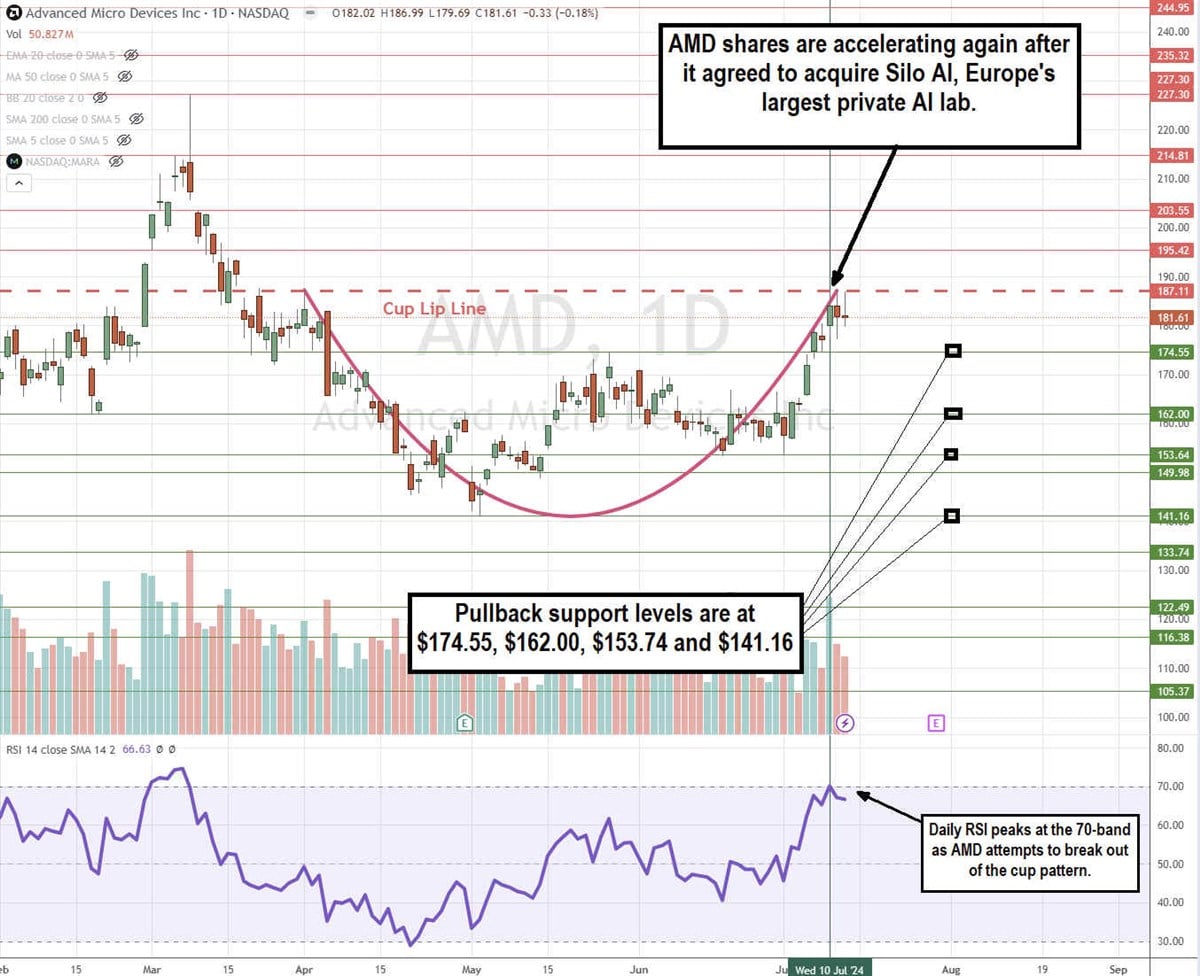

AMD Completes a Daily Cup Pattern

The AMD candlestick chart completed a cup pattern. The cup lip line formed at $187.11 on April 1, 2024, before shares fell to a low of $141.16 on May 2, 2024. AMD shares staged a rally back to $174.55 and pulled back to $153.64 support. AMD surged back to retest the cup lip line hitting multi-month highs after releasing news of its deal to acquire Silo AI. The daily relative strength index (RSI) initially tested the 70-band but hasn’t been able to burst through it. Pullback support levels are at $174.55, $162.00, $153.74, and $141.16.

AMD Hasn’t Felt Major Tailwinds from AI, Yet

Advanced Micro Devices MarketRank™ Stock Analysis

- Overall MarketRank™

- 85th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 0.6% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -1.91

- News Sentiment

- 1.12

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 36.43%

See Full AnalysisIn its Q1 2024 earnings release, AMD reported EPS of 62 cents, which met consensus expectations. Revenues rose just 2.2% YoY to $5.47 billion, missing the consensus estimates of $5.8 billion. AMD's Data Center segment revenues rose 80% YoY to $2.3 billion, driven by AMD Instinct GPUS and 4th Gen AMD EPYC CPUs. The Client segment revenues grew 85% YoY, driven by AMD Ryzen 8000 chips, but fell 6% sequentially. The Gaming segment revenues tanked 48% YoY and 33% sequentially to $922 million due to a decrease in semi-customer revenue and lower AMD Radeon GPU sales. Guidance was also in line for Q2, with revenue expected between $5.4 billion and $6 billion versus $5.73 billion consensus estimates. This caused AMD shares to sell off to the $141.16 swing low.

AMD analyst ratings and price targets are at MarketBeat. The consensus analyst price target of $191.00 implies a 5.17% upside. There are 30 analyst ratings comprised of 27 Buys and three Holds.

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.