An IPO Many Missed

Albertsons Companies (NYSE: ACI) is not a new name for investors, far from it. The company, as an investment opportunity, has been around for quite some time but its shares made their public debut just a month or so ago. Previously held by a consortium of private investors, the nation’s second-largest grocery store made its IPO to little fanfare despite a generally bullish outlook from the analyst’s community. Now, after releasing Q1 results, the stock is down about 5.0% begging the question “is it a buy or not?”

In the few weeks since the stock listed on the NYSE no fewer than 17 analysts initiated coverage. And all at least at a buy with a consensus for price action near $20.50 or roughly 33% upside with shares trading at $15. Bank Of America thinks the stock deserves a higher multiple than Kroger which is trading at a low 12X forward earnings. According to Bank Of America analysts “a slight premium vs. KR is justified given ACI’s higher forecasted EPS growth vs. KR and its merchandising, digital, Own Brands and loyalty programs (where ACI has greater remaining opportunity vs. KR)."

Don’t Doubt eCommerce

Albertsons released its fiscal Q1 earnings report and by all accounts the news is good. The company saw revenue jump 21% on a YOY basis and strength is expected to continue the remainder of the year. Growth was fueled by the company’s organic growth and COVID-19 inspired pantry-loading. On the bottom line adjusted EPS came in at $1.35 and beat consensus by a nickel. Adjusted EPS was aided by the impact of lower fuel cost/need, lower SG&A expense and store closures both planned and unplanned (COVID-19 and civil disruption were both cited as cause).

Where Bank Of America thinks Albertsons is lacking is in the eCommerce arena. They say Albertsons doesn’t warrant as high a multiple as Walmart or Target (for that and other reasons), but the eCommerce channels should not be counted out. In terms of comps, Albertsons saw a 26.5% increase in quarterly comp sales driven by a 276% surge in eCommerce. That’s nothing to sneeze at and, if what I’m seeing from other companies with comparable business, a sticky trend.

Vivek Sankaran, President and Chief Executive Officer. "Their hard work and dedication have also allowed us to successfully navigate this extraordinary environment and we have accelerated our digital and eCommerce strategy to adapt to market conditions. We generated strong financial performance in the first quarter, including robust cash flow and enhanced liquidity, which support our continued investment to benefit our associates, customers, communities and stockholders."

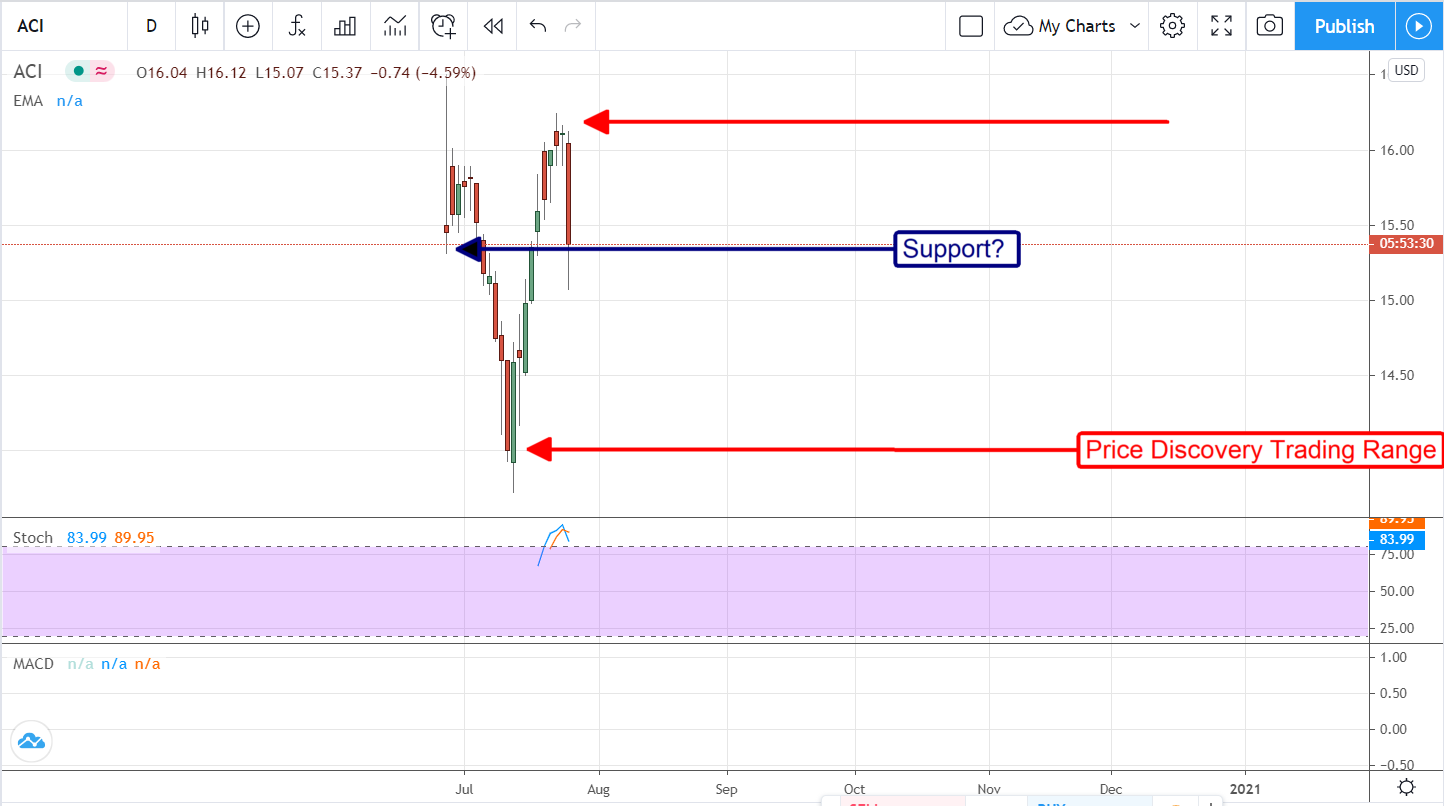

The Technical Outlook: Price Discovery In Progress, But It's Still Too Low

Albertsons is a stock that is in price discovery and there are some factors causing volatility. On the one hand, it is a new issue with only a little history on the charts to judge it by. On the other, it is a long-standing, well-established company with proven results and easy comps within the industry. I expect to see some more volatility in share prices near-term while the market wrestles with value but the long-term outlook for this stock is bullish. The problem for me is judging where the top might be and how long until near-term resistance begins moving higher.

Assuming that Bank Of America is right and Albertsons will trade at a slight premium to Kroger there is quite a bit of upside to be had. Much more than the $22 price target BoA has on the stock. At $22 BoA is assuming only $1.70 in annual EPS and the first-quarter results suggest that figure will be doubled or more. In that scenario, Albertsons could trade up to the $30 $40 range or greater than 100% from today’s price levels. And that doesn't count the company's expansion plans, plans aside from eCommerce, plans that are moving forward even now. Albertsons is definitely a buy.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.