Albertsons NYSE: ACI,

one of the best values in the market, is slated to report its Q3 earnings tomorrow before the bell. If we get a repeat of the reaction to second quarter earnings, ACI shareholders would be thrilled. On October 20, the supermarket chain blew away estimates and quickly surged nearly 6%. That was just the beginning – shares added

another 15.5% over the last two-and-half months of the year.

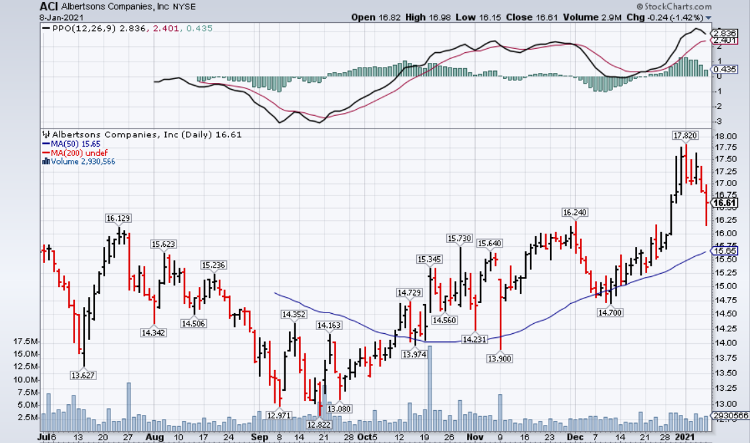

The move pushed ACI, which only went public in June 2020 after a long history, to new highs.

The mild pullback that we got last week was a gift as Albertsons’ business is showing no signs of slowing down.

Albertsons Has Momentum

Albertsons’ last two quarters have been outstanding. In Q1 2020, comp sales jumped 26.5% yoy and e-commerce sales surged 276% yoy. In Q2, growth decelerated a bit, but was still very impressive; 13.8% comp growth and 243% e-commerce growth.

In the Q2 press release, ACI updated its fiscal 2020 projections. Comps are projected to rise 15.5% for the full-year and earnings are expected to come in between $2.75 and $2.85 a share.

Back in October, earnings had been projected at $1.86 per share for fiscal 2020. $2.75 is 47.8% higher than $1.86. Analysts bumped their fiscal 2021 projections; they now expect $1.75 in EPS for the year, up from $1.53. That is a more modest 14.4% higher – still nothing to sneeze at.

Albertsons is now trading at just 6x this year’s earnings and 9.5x next year’s earnings.

Solid Outlook for Q3

Albertsons, as a grocery specialist, has gotten a boost from the pandemic. People are working from home and are afraid (or not allowed) to eat out, so they are cooking and snacking at home a lot.

With COVID-19 cases peaking and the weather cold, there is every reason to expect a strong third quarter. But revenue growth is actually expected to decline sequentially, from $15.76 billion to $15.32 billion.

Granted, revenue declined from $22.75 billion in the first quarter to $15.76 billion in the second quarter, but that was different; first quarter sales got a boost from pantry-loading, so you’d expect to see a pull-forward effect between those quarters. If anything, you’d expect some level of recovery in third quarter sales, not another decrease.

The whisper numbers could, of course, be a lot higher than $15.32 billion, but last week’s pullback suggests that’s not the case.

What About 2021?

The outlook for Q3 looks great, but the end of the pandemic – presumably later this year – will remove a tailwind for ACI. Moreover, the company will face tough comps.

Lower expectations for 2021, however, are already baked into the share price. The question is:

Are expectations too low?

There is a good chance they are. Work-at-home is here to stay in some capacity, which means that people are going to be cooking and snacking at home post-pandemic more than they did pre-pandemic. Americans will likely eat dinner out at similar rates as before since dinner is usually eaten after business hours. But breakfast and lunch will be eaten at home more often. Restaurants that rely on breakfast face a tough road ahead.

And What About the Pension Deficit?

Back in October, we looked at Albertsons’ $4.7 billion pension deficit. Though the deficit will be a drag on the company for years to come, it has the cash flows to comfortably pay it off. Moreover, Albertsons recently finalized an agreement with the unions that looks like as close to a win-win as you could hope for.

ACI Just Set a Dividend

This didn’t come as a surprise, but Albertsons officially set a 40-cent annual dividend in mid-October. At the current share price, it works out to a 2.41% annual yield. Not bad at all.

The Bottom Line

Albertsons remains a strong candidate for multiple expansion and consensus estimates appear to be too low. A strong third quarter could easily push shares to fresh highs tomorrow, and ACI could maintain its momentum into 2022.

Before you consider Albertsons Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albertsons Companies wasn't on the list.

While Albertsons Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.