When the Soviet Union and the United States began the fierce race to space that gave birth to the ultimate tension termed the "cold war," the U.S. Pentagon, alongside NASA, picked up the phone and requested tremendous aid from chip and computing companies like International Business Machines NYSE: IBM and Honeywell International NASDAQ: HON to provide the computing power and semiconductor technology to allow the successful launch and landing of the Apollo 11 mission.

Fast forward five decades later, and now the United States is in another crucial race, the race to the most human-like artificial intelligence systems and platforms. The successful achievement of such a platform would effectively allow the nation to streamline and unleash its economic capabilities, along with possessing more advanced military capabilities and productivity drivers.

The problem today is China has been drafting behind the West's momentum in A.I. developments as the nation holds an increasing share of the global semiconductor ecosystem and intellectual property.

The ChatGPT Wave

Microsoft NASDAQ: MSFT valued the latest shape that artificial intelligence can take on, ChatGPT, at USD 10 billion as the technology giant bid an offer to buy the up-and-coming platform. This offering sends a message to the global economy that can serve as a wake-up call, as whoever can access this technology and adequately implement it into existing operations will reap the benefits of the next wave of the technological revolution.

Many companies are realizing this "domino fall" and starting to develop their version of the success and adoption experienced by ChatGPT, especially in China, as the nation does not want to see itself fall behind in this race. For example, Baidu NASDAQ: BIDU recently launched the Ernie bot to a private and select base of users to test and gave an entire conference showcasing pre-recorded use cases of the platform to shareholders and the press. Despite this presentation, shares of BIDU stock fell nearly 9.5% in pre-market hours upon the news.

Some speculate that because there is no public launch or live test yet, the company may be hiding some shortcomings and overpromises of the Ernie bot. However, shares recovered within the same trading session and have enjoyed a nice rally ever since.

Alibaba's Turn at Bat

Alibaba Group NYSE: BABA is reportedly taking a stab at the ChatGPT rivalry line. The company will showcase its in-house artificial intelligence tool on Tuesday, April 11th, to select invited users. No other sources or case studies allow for a more explicit expectation of whether this event will follow the price action in the stock that BIDU fell under or if it will be a total disaster. However, many investors realize the untapped value that Alibaba holds as management has announced their intentions to spit the technology giant into six different companies, boosting its sum-of-the-parts valuation higher.

If the function of the banking industry is to manage risk, and the trading department at the banks deals with volatility management and risk, it would be helpful for investors to utilize a similar framework to handle the possible swings that may occur from this news. Starting with the training that Goldman Sachs Group NYSE: GS offers its analysts and traders, looking at Alibaba stock's ATR (average true range) trends and deviations from moving averages may be helpful.

Managing Risk

Alibaba stock has seen a recent spike in volatility and ATR, fortunately this last breakout was to the upside as shares rallied from $86 to $105 in the three-day period covering March 27th and Marth 30th. This volatility breakout would imply an incoming compression of the indicator, this has been the case for the first week of April as the stock hovered in a tight channel and its ATR declined from 6.3% to 3.9%. Realistically, a breakout on the A.I. tool news could bring this indicator back near 8% as historically seen with such news-driven price action days.

What an 8% ATR day would be for Alibaba can translate into the stock going towards its proximate resistance of $120 per share or close support of $87 per share. This range is also backed by the high open interest in options expiring on April 14th around these prices (high open interest can translate to many market participants expecting the strike price to be reached).

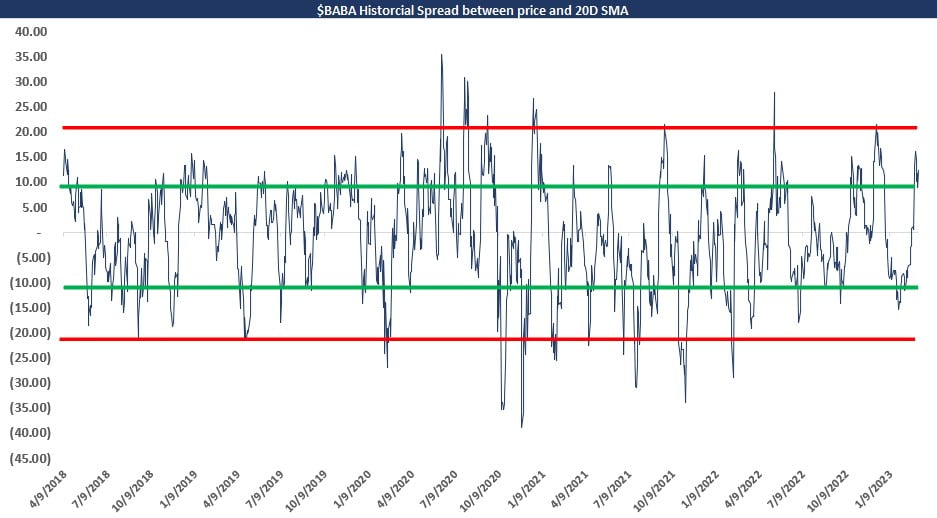

Another useful way to find direction in this stock is through the current price deviation from its twenty-day moving average. When a deviation hits a certain size, the stock price historically returns to its twenty-day moving average. Currently Alibaba stock has reached a +1 standard deviation, meaning that there is a higher probability of a down move than a continued advance to hit the +2 standard deviation level as seen in the image above. After all, probabilities are just probabilities, so what can investors think about doing to manage them?

There is a high liquidity, high-volume zone at the $98.50 level where prices can find some support in case of a decline; however, the next area would fall around the speculated $87 level. In case of a downside, investors who already have a position in the stock can consider opening a covered call position at $120 and using this premium collected to buy a put option at the $98 level. If Alibaba breaks $98 and heads to $87, an investor can close the covered call position for profit and let the long put option deliver extra profits. If the stock charges to the $120 level in a successful scenario, investors could consider writing a cash-secured put at the $98 strike and buying a $120 strike call with this premium to maximize potential upside with a bullish view.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.