After its third consecutive daily increase,

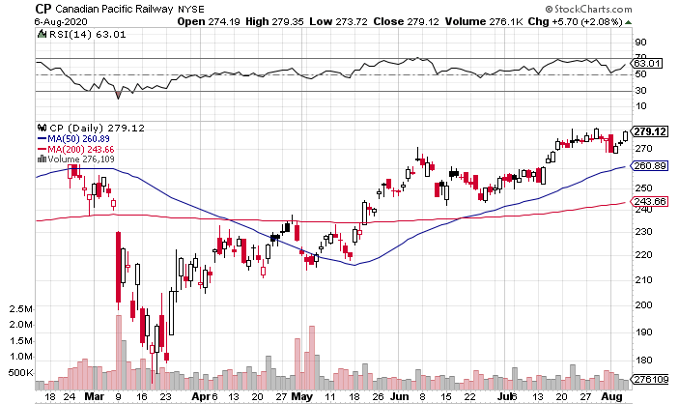

Canadian Pacific Railway NYSE: CP is less than 1% away from breaking all-time highs set a couple of weeks ago.

Canadian Pacific, which owns and operates a transcontinental freight railway in Canada and the United States, has seen its shares soar since putting in mid-March lows – despite significant pandemic-related headwinds.

But similar to Kansas City Southern NYSE: KSU, another rail company that has seen strong recent demand for its shares, Canadian Pacific took the pandemic as an opportunity to make its operations more efficient.

And since early June, volume has been recovering. According to the Association of American Railroads, rail traffic in the US and Canada is now close to pre-pandemic levels.

Q2 was a tough quarter for CP, but there is a lot of reason for optimism in Q3 and beyond.

Lower Revenue in Q2 2020

Canadian Pacific saw Q2 revenue decrease by 9% yoy to CAD1.8 billion.

The company transports a lot of different commodities including grain, coal, potash, consumer automotive, and much more. Additionally, CP handles intermodal traffic, moving retail goods in overseas containers.

CP enjoyed strong performance with some commodities; grain and potash had record quarters.

But other segments saw revenue plummet, including coal and consumer automotive.

The pandemic caused supply chain disruptions and impacted consumer demand. Some of CP’s segments were affected by one or the other. But in the case of coal, for example, volumes dipped as a result of both supply chain disruptions and softer consumer demand.

CP expects some segments to improve more quickly than others but expects its overall numbers to trend upwards over the remainder of 2020.

Better Efficiency in Q2

While CP’s Q2 revenue is nothing to get excited about, its recent operational improvements are.

On the Q2 earnings call, CFO Nadeem Villani talked about CP’s record operating ratio:

“Overall, the operating ratio decreased 140 basis points to 57%, which is a new CP second quarter record. I've been in this industry for 22 years, and this quarter is a significant milestone. When you can report a 57% operating ratio in a quarter with volumes down this significantly, it gives me a high level of confidence to eventually achieving a mid-50s OR on an annual basis and continue to widen the gap with our Canadian peer.”

Canadian Pacific went into detail on its cost-cutting measures, saying that:

- Comp and benefits expense decreased 11% yoy due to furloughed employees and efficiency gains from lower crew starts and increased train weights.

- Train weights and lengths increased 7% and 8%, respectively, both to record levels.

- Locomotive productivity went up 2% yoy.

- Fuel efficiency set a Q2 record at 0.92 gallons per 1,000 GTMs.

- In Q2, CP’s engineering crews had just 6 zero-block days (days where they couldn’t access the track) compared to 30 zero-block days in the same quarter a year ago.

All of these improvements combined to help CP increase cash from operations by 17% yoy despite the 9% dip in revenue.

Reasonable Valuation + Solid Growth

Canadian Pacific is trading at around 21x projected 2020 earnings and approximately 19x projected 2021 earnings.

Taking a look back, revenue has grown at a CAGR of around 7% over the past three years and operating income (EBIT) has grown at a CAGR of almost double that over the same period.

There’s a bit of growth baked into CP’s share price at current levels. But if CP’s revenue grows at a CAGR in the mid-single digits over the next three years and EBIT grow at a CAGR in the low-double digits over the same period, shares would be a bargain at current levels.

Canadian Pacific’s long-term track record and Q2 performance makes that a very realistic (even a likely) scenario.

Where Can You Get In?

With Canadian Pacific in striking distance of its all-time highs, you can look to get in on a breakout.

CP shares actually aren’t too extended at current levels. The stock has increased by a little over 60% off the mid-March lows, and trades just a bit higher than January/February levels.

Since setting the all-time highs a couple of weeks ago, shares have gone sideways and digested the recent gains. The RSI remains around seven points shy of overbought territory.

CP would be an excellent buy if it decisively breaks out into the mid-$280s – keep a close eye on it moving forward.

The Final Word

The pandemic has introduced several challenges across Canadian Pacific’s business. But the way that CP has handled those challenges bodes well for the future.

Recent trends in rail traffic combined with the operational improvements implemented in Q2 could lead to blowout earnings in Q3 and Q4. Look to get in before this becomes obvious to the rest of the market.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report