The world's largest cinema operator, AMC Entertainment Holdings Inc. NYSE: AMC, has already had a rollercoaster year, spiking over 300% in a matter of days in May 2024. The meme stock resurgence led by GameStop Co. NYSE: GME quickly came and went. AMC shares have fallen back down to support levels in the $4s. Is it time to step back into this meme stock as an investment?

While this consumer discretionary sector company competes with movie theater stocks like Cinemark Holdings Inc. NYSE: CNK and IMAX Co. NYSE: IMAX, it also moved with meme stocks like GameStop, Blackberry Inc. NYSE: BB and Koss Co. NASDAQ: KOSS.

AMC Entertainment's Long Road to Recovery

AMC Entertainment Today

AMC

AMC Entertainment

$4.48 -0.09 (-1.97%) (As of 11/15/2024 ET)

- 52-Week Range

- $2.38

▼

$11.88 - Price Target

- $5.44

The COVID-19 pandemic crushed the motion picture business as studios like The Walt Disney Co. NYSE: DIS, Paramount Global NASDAQ: PARA and Warner Bros. Discovery Inc. NASDAQ: WBD experienced major production cancellations. Their migration to streaming significantly impacted movie theater chains causing many of the smaller ones to close shop permanently. With the help of the meme stock mania, AMC was able to raise funding to continue to be one of the last chains standing. The company had to go through major dilution and debt burdens to stay afloat but has yet to turn a profit.

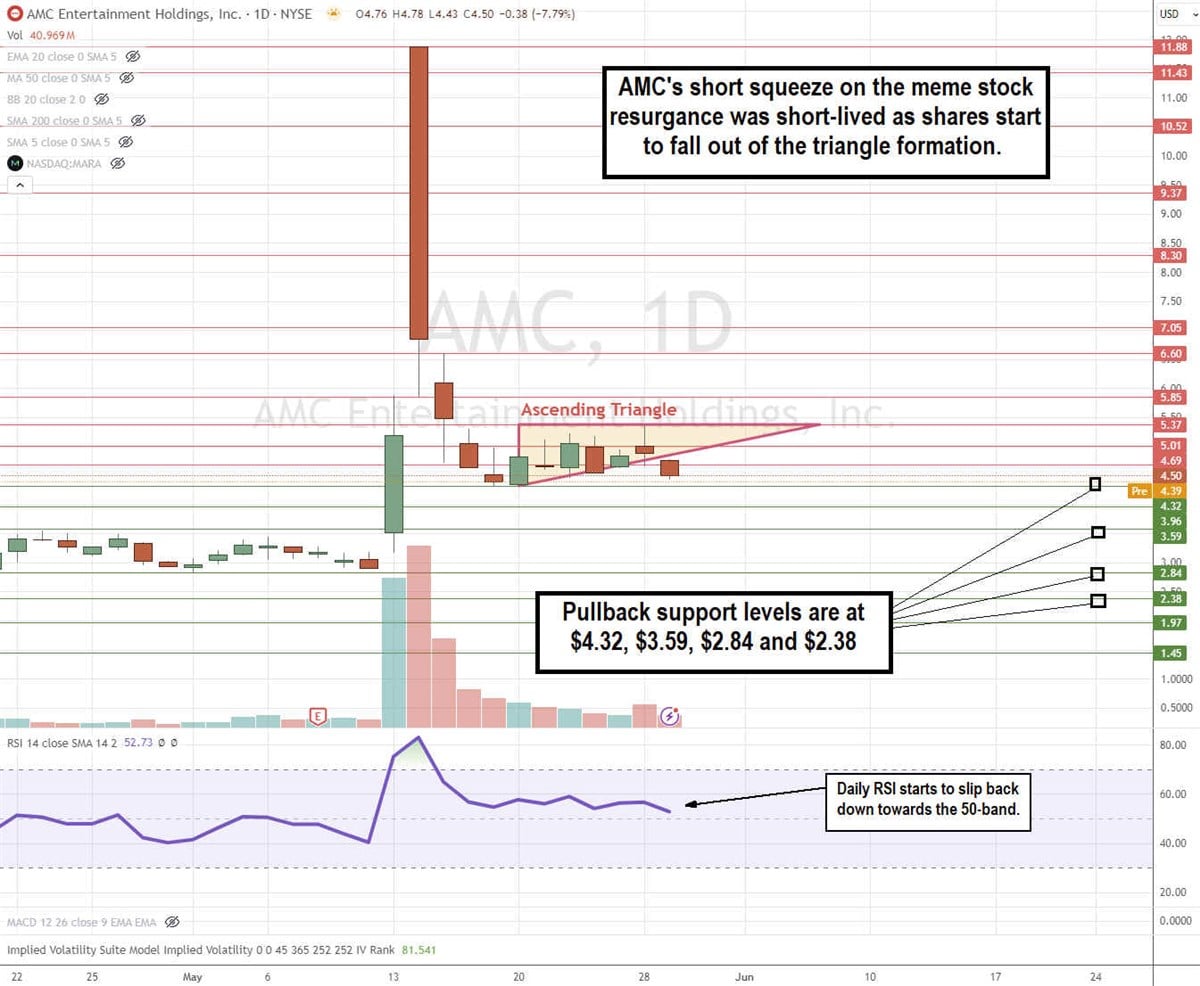

Daily Ascending Triangle Pattern Failing on AMC Stock

AMC displays a daily ascending triangle pattern that appears to be starting to break down. The ascending trendline formed at $ 4.32 on May 20, 2024. This was the bottom after shares peaked at $11.88 and collapsed. The flat-top resistance at $5.37 was able to cap bounce attempts as shares started to break down under the ascending trendline at $4.80. The daily relative strength index (RSI) has been flat but may also be starting to slip to the 50-band. Pullback support levels are at $4.32, $3.59, $2.84 and $2.38.

AMC's Q1 Revenues Beat Estimates, Losses Lower Than Expected

AMC reported a Q1 2024 EPS loss of 62 cents, 13 cents better than consensus estimates for a loss of 75 cents. Net loss improved to $163.5 million compared to $235.5 million in the year-ago period. Adjusted EPS net loss improved from $1.71 to 62 cents from a year-ago period. Adjusted EBITDA was a loss of $31.6 million compared to a profit of $7.1 million in the year-ago period. That profit came from the benefits of an early terminated lease last year. The company used net cash of $188.3 million for operating activities with a balance of $624.2 million in cash and cash equivalents at the end of the quarter.

AMC's Effective Strategies for Reducing Debt Levels

The company reduced its debt load by $17.5 million in the quarter by exchanging 2.5 million common shares. Since Jan. 1, 2022, AMC has reduced the principal balance of debt and deferred rent by over $974 million. The company has also raised an additional $124.1 million in gross proceeds from the sale of 38.5 million shares since the end of Q1 2024. The company was also able to negotiate a private exchange of 23,280,295 shares of class A stock in exchange for $163.85 million aggregate principal amount of its 10%/12% Cash/PIK Toggle Second Lien Subordinated Notes due 2026, valuing shares at $7.33 per share.

AMC Capitalizes on Meme Rally, Raises $250 Million in Equity

On May 13, 2024, AMC raised $250 million of new equity capital by selling 72.5 million shares at an average price of $3.45 per share, before commissions and fees. The following day, AMC shares gapped up to $11.88 and sold for the next three days to $4.50.

AMC Entertainment's CEO Sees the Glass Half-Full

AMC Entertainment CEO Adam Aron remained upbeat as moviegoing bounced back in March 2024. However, he cautioned that last year's Hollywood strikes will affect the Q2 2024 box office numbers. However, the second half of 2024 and through 2025 have a strong upcoming film lineup. Aron pointed out that its surging revenues per patron and surging profit per patron numbers put AMC on a path to hit pre-pandemic EBITDA levels and even more so if the movie industry recovers.

Aron commented, “Moviegoer sentiment is clear. Guests want to see movies on a huge silver screen, and they are consistently willing to pay more for the best possible experience. That certainly favors AMC as we have more premium large format screens, namely IMAX, Dolby Cinema and Prime, than any other cinema operator in the world.”

Aron concluded, “Consumers are also paying up for innovative food and beverage offerings and AMC continues to outsell all our major competitors in F&B. All moviegoers also are now buying movie-themed merchandise from us, online, and in our concession stands in quantities that we have never before seen.”

AMC Entertainment analyst ratings and price targets are on MarketBeat.

Before you consider AMC Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMC Entertainment wasn't on the list.

While AMC Entertainment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.