At one point during Tuesday’s session, shares of

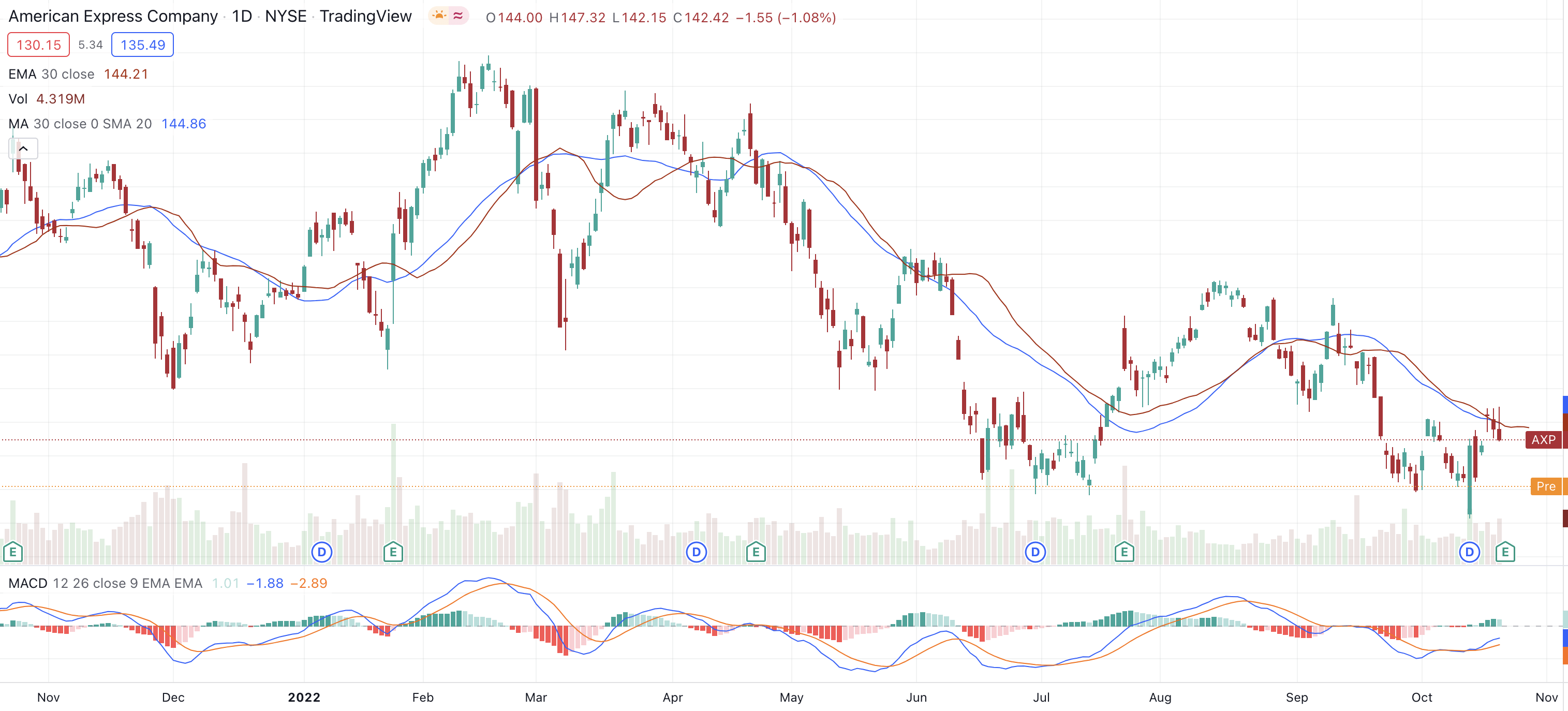

American Express (NYSE: AXP) were up more than 4% and one of the top performers in the Dow Jones Industrial Index. While they pulled back into the afternoon as equities saw some profit-taking, they still finished up on the day and up more than 10% over the past five sessions.

This will be a welcome run for investors who are surely growing impatient with the company’s inability to remain competitive against its closest two peers in the credit card payments space, Visa (NYSE: V) and Mastercard (NYSE: MA). While American Express is the old dog, having been publicly traded since the early 70s, it’s performance has been eclipsed by the other two who only started trading in the middle of the last decade.

Not At The Races

Since 2016, American Express has only managed an 90% return versus 170% and 270% for Visa and Mastercard respectively. To be fair, Amex isn’t a direct apples to apples competitor with the other two, but a rising tide should be helping to float all boats somewhat equally. While all three saw their shares hit hard in Q1 as the coronavirus ravaged equities, Visa and Mastercard have effectively undone all the damage while Amex is still languishing 20% below pre-COVID levels. They’re clearly losing what’s become a two-horse race and management is under pressure to get them out of the slump.

Their Q2 earnings report at the end of July wasn’t particularly inspiring and even though EPS came in ahead of analyst expectations, revenue was below the consensus and down a full 29% year on year. At least the company was able to report a bounce in spending volumes through May and June after they hit record lows in April. They also saw some promising results from their rewards programs and limited time offers which helped reduce customer attrition.

CEO Stephen Squeri spoke confidently about their path forward when he said “as we adjust our business to today’s realities, we are also continuing to invest in areas that are key to our long-term growth. For consumers, we are developing additional product enhancements to meet their changing needs. We extended our digital solutions for our commercial customers with the recent launch of American Express One AP [and] for our merchant partners, we raised our contactless transaction thresholds in 60 countries around the world.”

Solid Momentum

With yesterday’s reports of the company being close to an all cash purchase of Kabbage, an online small business lender, It looks like management is making fresh inroads on their innovation and expansion goals. Shares were up again in early trading on Wednesday and it will be interesting to see how this current rally plays out.

Shares are coming off a solid base around the $92 mark and could be making a run for a post-COVID high at $116. It’s hard to see them powering past there and on to pre-COVID levels but some consolidation should be considered healthy as shares weigh their next move. Those getting involved at these levels are definitely buying into the comeback story and while they wait for they wait for the recovery to be complete, there’s a 1.70% dividend yield to keep them topped up.

It’s important to remember that through the first half of February this year, Amex shares were up 175% from the past four years and at all-time highs. When you take the performance of Visa and Mastercard out of the equation, that’s a solid performance to be building a recovery around and something that investors can buy into. Continued economic recovery and uptick in travel would do a lot to send Amex shares to post COVID highs before the end of the year.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.