Upscale hotel real estate investment trust (REIT)

Ashford Hospitality Trust NYSE: AHT stock has been performance well on the

pandemic recovery but took a severe sell-off upon the a 1-for-10 reverse stock split announcement. The sell-off is providing opportunity pullback opportunities for speculative high-risk tolerant investors. The Company owns 100 hotels consisting of 22,286 room in 28 states in the U.S. as of June 2021. Hotel brands range from

Marriott NYSE: MAR 56%,

Hilton NYSE: HLT 31%, Hyatt 5%, IHG 2% and various independent brands 6% with most of its properties operating in the upscale to luxury scale. The

reopening rebound is underway with the acceleration of

COVID-19 vaccinations. The biggest problem with the Company is the excessive debt-load and the continued dilution of shares to finance its debt. A 1-for-10 reverse split is a positive event that will trim the float, but that’s on top of the 1-for-10 reverse split in 2019. With nearly 200 million shares outstanding, the 1-for-10 reverse split should thin it out to a razor thin 20 million share flat. Usually, reverse splits are a bad sign as shares tend to sell off after the split. However, there have been recent examples where shares actually managed to rise like with

Groupon Nasdaq: GRPN and

Office Depot NYSE: ODP. Speculators looking for a reopening play can watch shares for opportunistic pullbacks.

Q1 Fiscal 2021 Earnings Release

On May 6, 2021, Ashford released its first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings per share (EPS) loss of (-$1.10) beating consensus analyst estimates for a loss of (-$1.44), a $0.34 beat. Revenues fell (-58.91%) year-over-year (YoY) to $115.83 million missing analyst estimates by (-$4.95 million).

Conference Call Takeaways

Ashford Trust CEO, Rob Hays set the tone, “We reported positive hotel EBITDA for the quarter for the first time since the first quarter 2020. Secondly, early in the quarter, we secured a $200 million strategic financing with additional future commitments of up to $250 million to provide multiple years of liquidity for the Company. Third, we have re-levered our balance sheet by over $500 million during the past 12 months. And lasty, even with an already attractive loan maturity schedule, we have successfully modified property loan extension tests on two large pools for 2023 and 2024 as well as another large loan pool for 2024 and 2025 making it easy to us or easier to quality for those extension options. The loan modification initiative will continue to be a focus for us going forward.” He went on to update on many positive developments. The Company drew $200 million with an option to draw $250 million as needed in January 2021. He concluded, “We are optimistic about the long-term outlook for the Company and by taking decisive actions to strengthen our balance sheet with this strategic financing and other steps we have taken we now have multiple years of runway that will allow us to capitalize on recovery we are seeing in the hospitality industry… The lodging industry is clearly showing signs of improvement… And while our hotels continue to have negative operating income in January and February, our hotels performed well in March enough so that Ashford Trust had positive net operating income for this quarter. The second quarter looks to be building up that strong March as April numbers look to exceed March numbers.”

Dilution and Conversion of Preferred Shares

The Company has been assertive in converting their preferred shares into common equity through various offerings. This has had the effect of diluting their common shareholders. CEO Hays thanks retail investors for helping drive up the shares from a market cap of $15 billion to well over $1 billion since October 2020. On July 8, 2021, the Company announced the latest 1-for-10 reverse stock split post-market causing shares to collapse nearly 30% and providing opportunistic pullback levels.

AHT Opportunistic Pullback Levels

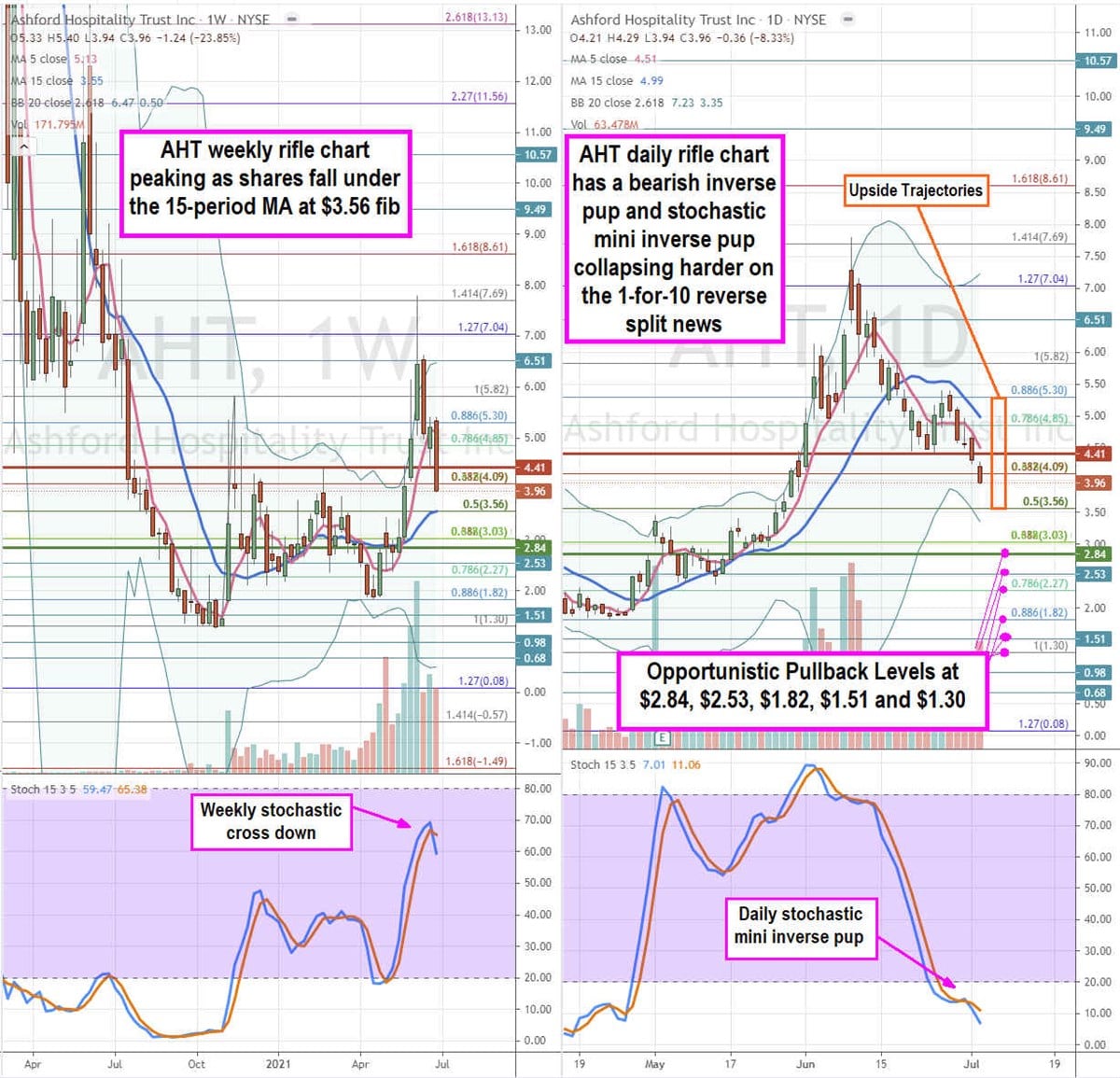

Using the rifle charts on the weekly and daily time frames provide a precision view of the price action playing field for AHT stock. The weekly rifle chart peaked off the $7.49 Fibonacci (fib) level. Shares collapsed down through the weekly 5-period moving average (MA) at $5.13 and 15-period MA at the $3.52 upon the 1-for-10 reverse split. This triggered the weekly market structure high (MSH) on the $4.41 breakdown. The weekly market structure low (MSL) buy triggered on the breakout through $2.84. The daily rifle chart has an inverse pup breakdown and a low band stochastic mini inverse pup with falling 5-period MA at the $4.51 and daily lower Bollinger Bands (BBs) at $3.35. Speculators can monitor for opportunistic pullback levels at the $2.84 weekly MSL trigger, $2.53 stinky 2.50s, $2.27 fib, $1.82 fib, $1.51, and the $1.30 fib. The upside trajectories range from the $3.56 fib to the $5.30 fib.

Before you consider Ashford Hospitality Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashford Hospitality Trust wasn't on the list.

While Ashford Hospitality Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.