Semiconductor testing equipment maker

Amkor Technology NASDAQ: AMKR stock has surged in 2021 as it emerges from legacy status. The legacy player blew out its Q4 2020 earnings estimates, raised guidance, and was added to the S&P 600 index. The widely publicized

semiconductor chip shortage is also helping to drive momentum as shares hit multi-year highs. Shares finally exploded through the pre-

pandemic highs as it was a major laggard. In addition to being a laggard, 5G tailwinds and the

recovery in the automotive sector in addition to

electric vehicle (EV) demand, should continue to drive shares higher. Prudent investors looking for a turnaround play in the

semiconductor equipment sector can monitor opportunistic pullback levels to consider scaling into a position.

Q4 2020 Earnings Release

On Feb. 8, 2021, Amkor released its fiscal four-quarter 2020 earnings report for the quarter ending in December 2020. The Company reported an earnings-per-share (EPS) profit of $0.52, excluding non-recurring items, versus consensus analyst estimates for $0.38, a $0.14 beat. Revenues grew 16.3% year-over-year (YoY) to $1.37 billion beating consensus analyst estimates for $1.31 billion. Q4 2020 gross margins were 20.4% with an operating margin at 11.6%. Full-year 2020 net sales were $5.05 billion, rising 24.6% YoY with full-year net income of $338 million or diluted EPS of $1.40. Net cash from operations was $770 million and free cash flow of $221 million, representing the sixth consecutive year of positive free cash flow. The Company paid down approximately $300 million in debt ending 2020 with all-time low debt of $322 million. The leverage ratio was lowered to 1.22 debt-to-EBITDA. Amkor ended the year with $832 million in cash and short-term investments for a total liquidity of $1.2 billion.

Conference Call Takeaways

Amkor CEO, Giel Rutten, set the tone, “Strong demand for our advanced technology and a partial recovery of our mainstream business produced an all-term growth in revenue records… The fourth quarter through full-year 2020 revenue above $5 billion for the first time in Amkor’s history. An increase of close to $1 billion or 25% over 2019.” He noted that the Communications business rose 35% YoY, which represented 41% of the total top-line up from 38% in 2019. Most of that from 5G phone, which Amkor expects to be a key growth driver for the next several years particularly In the RF domain as well as modems, sensors, and peripheral devices. Higher semiconductor content is expected in the next-gen 5G phones. The current 5G penetration in 2020 was only 20% and expected to grow to 35% in 2021. The automotive recovery is expected to accelerate in Q1 2021. Supply chain constraints are being worked out as the Company expects produce pipeline changes in the quarter. Semiconductor industry growth is expected around 9% YoY with key drivers in 5G deployments as the leading growth segment. The Company recorded a one-time $20 million tax benefit of $0.08 per-share.

Raised Q1 2021 Guidance

Amkor raised its estimates for Q1 2021 for EPS in the range of $0.29 to $0.48 versus $0.20 analyst estimates. The Company raised its Q1 2021 revenue guidance to $1.27 billion to $1.37 billion versus $1.20 billion analyst estimates. The Company expects a full-year capex around $700 million. Gross margins are expected between 17% and 20%. Amkor continues to see IoT wearables, 5G deployment, high-performance computing, and recovery in automotive as key drivers in 2021. While shares are still elevated, prudent investors can monitor opportunistic pullback levels for exposure.

AMKR Opportunistic Pullback Levels

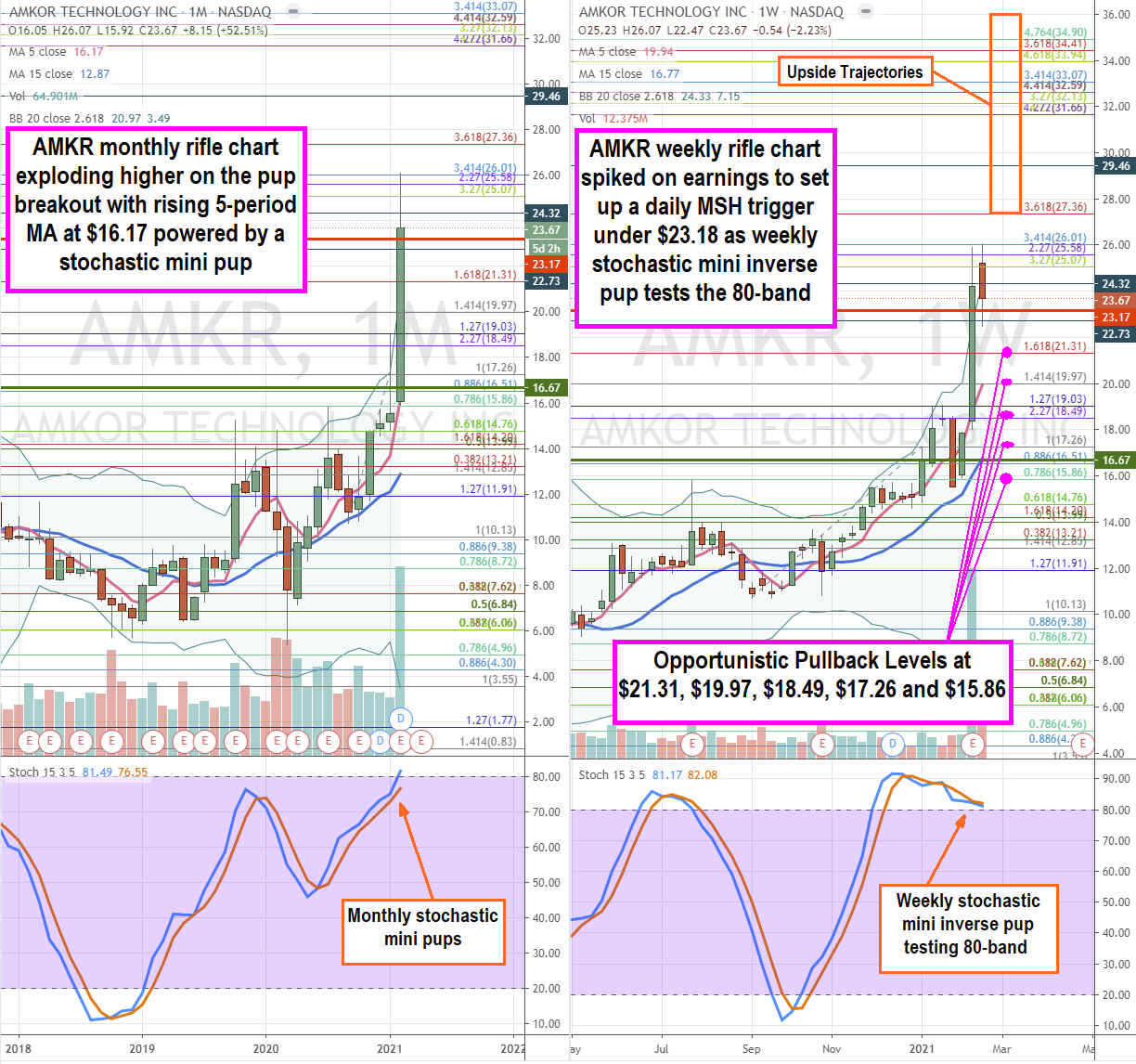

Using the rifle charts on the monthly and weekly time frames provides a full view of the price action playing field for AMKR stock. The monthly rifle chart formed a powerful pup breakout with a rising 5-period moving average (MA) at $16.17 as it peaked at the $26.01 Fibonacci (fib) level. The monthly upper Bollinger Bands (BBs) are at $20.97 with a monthly stochastic mini pup thrusting through the 80-band. The earnings reaction was extreme and likely calls for a pullback as indicated by the weekly rifle chart stochastic slipping down to test the 80-band with a mini inverse pup. The weekly rifle chart is still uptrending with the 5-period MA trying to catch up at $19.94 and rising 15-period MA at $16.77. The daily market structure low (MSL) above $16.67 but also formed a market structure high (MSH) sell trigger under $23.17. Prudent investors can watch for opportunistic pullback levels at the $21.31 fib, $19.97 fib, $18.49 fib, $17.26 fib, and the $15.86 fib. The upside trajectories range from the $27.36 fib up to the $36.00 level.

Before you consider Amkor Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amkor Technology wasn't on the list.

While Amkor Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.