Home improvement and services platform

ANGI Homeservices, Inc. NASDAQ: ANGI stock has been a surprising pandemic beneficiary. While shares collapsed with the benchmark

S&P 500 index NYSEARCA: SPY during the pandemic panic, it has blown past its pre-COVID levels year-to-date. New and existing home sales have been bolstered by low mortgage rates and surging demand driven by the effects of COVID-19. ANGI operates multiple digital marketplace platforms including HomeAdvisor, Angie’s List and Handy that connect over 230,000 service providers with homeowners for over 500 different categories of services that include home repairs, maintenance, remodeling, renovation and improvement services. The recent earnings release triggered a sell-the-news reaction presenting pullback opportunities for prudent investors looking to capitalize on the post-COVID recovery narrative.

Q2 FY 2020 Earnings Release

On Aug 10, 2020, ANGI released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported earnings of $0.02 per share missing consensus analyst estimates by (-$0.01) per share. Revenues grew 9.1% year-over-year (YoY) coming in at $375.06 million, beating analyst estimates for $364.45 million. Operating income rose 55% to $17.6 million, net earnings surged 82% YoY to 12.7 million. ANGI ended the quarter with $421 million in cash and cash equivalents with $240.6 million of debt. The Company has not tapped its $250 million credit revolver. ANGI has 20.1 million shares remaining in the repurchase program.

$500 Million Debt Offering

On August 12, 2020, ANGI announced its plans to raise $500 million through a private debt offering through wholly-owned subsidiary ANGI Group, LLC for senior notes due 2028. Proceeds will be used to general corporate practices, potential future acquisitions, and return of capital. The Company had $421 million in liquidity and long-term debt of $225.3 million.

Pandemic and Post-Pandemic Tailwinds

During stay-at-home mandates, the home repair and improvement segment saw big tailwind in activity as evidenced by the performance of Home Depot NYSE: HD , which reported 23.4% year-over-year (YoY) sales growth doubling the consensus estimates. While the do-it-yourself (DIY) trend is active, its contractors and professional service providers mainly responsible for the demand surge. Thinking along these lines, Citi raised price targets for ANGI to $18 per share from $15 per share on sustained pandemic tailwinds continuing to drive the demand in home improvement services.

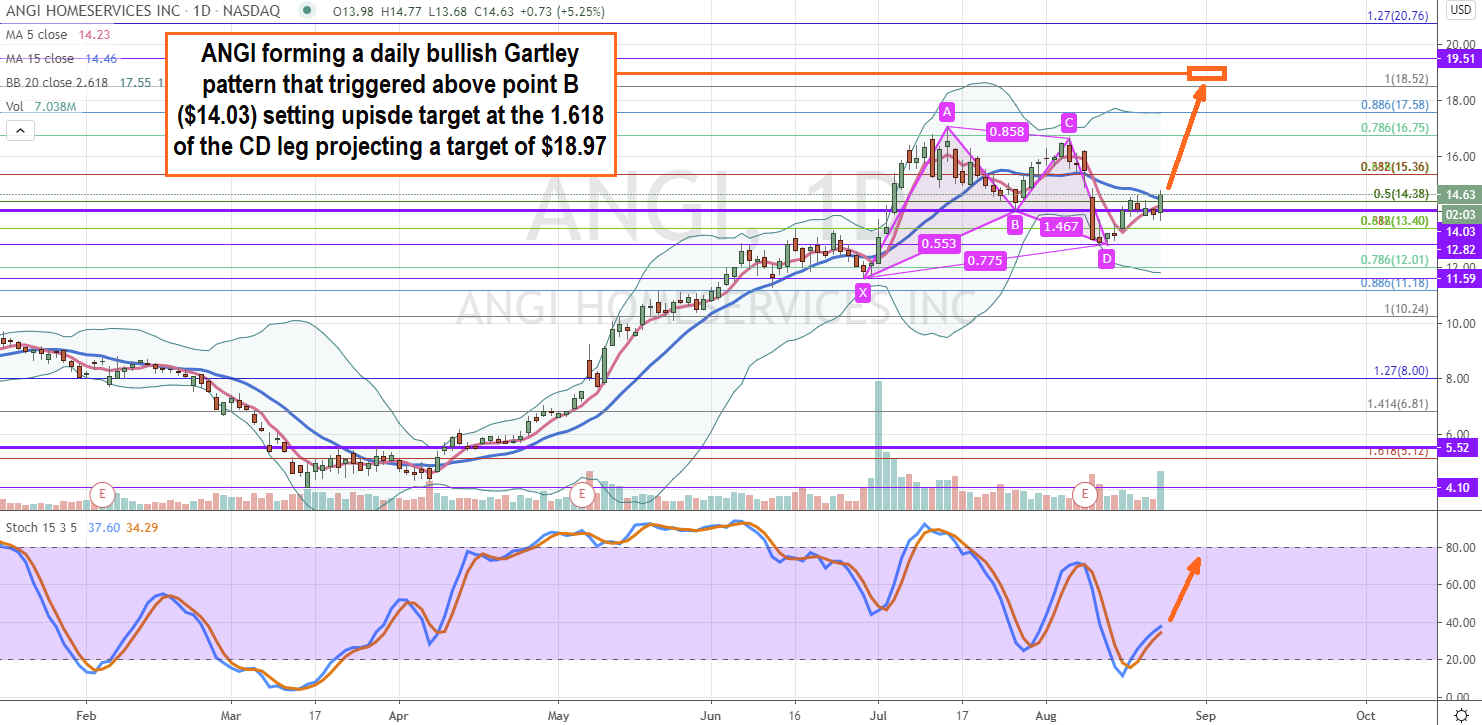

The Bullish Gartley Pattern

A rare price pattern called a bullish Gartley is forming on the daily chart for ANGI. This is a harmonic five-point pattern (X,A,B,C,D) where the length of each leg fits into a specific fib ratio range. The XD leg is close enough to the 78.6% ratio and the AB leg falls into the 88.6% max length. The B point triggered above $14.03, which then sets the upside target of 161.8% of the CD leg which is $18.97. The daily stochastic will need to form a mini pup to achieve the full oscillation to and through the 80-band to accomplish this feat. Harmonic patterns can be exceptionally effective but should be used in conjunction with other methodologies for target forecasting.

ANGI Opportunistic Pullback Price Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for ANGI stock. The monthly rifle chart has been in a stochastic mini pup oscillation currently at the 60-band. The monthly 5-period moving average (MA) support is overlapping the $12.01 Fibonacci (fib) level. The weekly rifle chart triggered a market structure low (MSL) buy above $5.52 and peaked out the full stochastic oscillation as it formed a bearish mini inverse pup falling down through the 80-band overbought level. The weekly MAs can form a pup breakout if the stochastic crosses back up or breakdown if the stochastic continues to fall. This is called a make or break pattern that pits an MA pup breakout versus a stochastic mini inverse pup breakdown. A weekly pup breakout would target the upper Bollinger Bands (BBs) at $20.39. Opportunistic pullback price levels are at the $13.40 fib, $12.82, $12.01 monthly 5-period ma/fib and $11.18 fib. The pullback levels are tight due to the weekly make or break. Stop-losses should be considered if the $10.24 starting fib is breached.

Before you consider Angi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Angi wasn't on the list.

While Angi currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.