Alcoholic beverage giant

Anheuser-Busch InBev NYSE: BUD stock has been stagnant in its recovery. Its shares are still trading well below pre-COVID levels and underperforming the benchmark

S&P 500 index NYSEARCA: SPY. Much of the weakness has to due with the slow restarts of bars, sport events and restaurants amid the potential for a second surge of the coronavirus. With nearly 500 alcoholic brands including Budweiser, Corona, Beck’s and Stella Artois, the Company relies on the very social interaction businesses and events that are most prone to the spread of coronavirus. Bars and nightclubs have faced heavy scrutiny as breeding grounds for the

spread of infections causing more restrictions and shutdowns. However, the surprising listing of capacity restrictions for restaurants in Florida sets the stage for an accelerated return to normalcy. Anheuser-Busch is a prime play for risk-tolerant investors who seek to participate in the restart further propelled with the probability of an FDA approved

COVID-19 vaccine in the coming months.

Q2 FY 2020 Earnings Release

On July 30, 2020, Anheuser-Busch released its fiscal second-quarter 2020 results for the quarter ending June 2020. The Company reported an earnings-per-share (EPS) profit of $0.46 excluding non-recurring items versus consensus analyst estimates for a profit of $0.36, beating estimates by $0.10. Revenues dropped (-26.3%) year-over-year (YoY) to $10.29 billion beating analyst estimates of $9.56 billion. Total volumes declined (-17.1%) Q2 YoY. For the first half of 2020, total volumes declined by (-13.4%) composed of beer volume down (-14%) and non-beer product volume down (-7.6%) YoY.

Conference Call Takeaways

Anheuser-Busch CEO Carlos Brito provided more color on the total volumes in Q2. The month of April saw total volumes decline by (-32.4%) marking the low point as total volumes have been improving sequentially resulting to total volume improving to 0.07% growth for the month of June. This progression of improvement swinging from volume declines at the peak of the pandemic to a reversal to volume growth for the month of June can’t be understated. In China, the swing was dramatic with a (-17%) volume decline in April progressing to the highest-ever monthly volumes in June with accelerated growth in e-commerce. Performance in Europe was heavily impacted from on-premise restrictions but improved as they were pulled, similar to the U.S.

Premiumization Growth Driver

The Company is positioned to become the #1 player in the premium beer category in key markets after capturing 12% of the segment through their High-End Company unit. The Company has also heavily invested in building out digital and e-commerce B2B and B2C channels. For example, they launched a live stream concert series called lives which “activates several of the top brands and innovations in our portfolio.” The platform received 57% more views in Brazil than the 2018 FIFA World Cup Finals at 675 million. The return of sporting events like the English Premier League is bolstering the resilience of its brands. Total liquidity at the end of Q2 was more than $35 million consisting of $25 billion in cash and $9 billion revolver.

Florida Moves to Phase Three Reopening

On Sept. 28, 2020, Governor Ron DeSantis released an executive order for the state of Florida to move into Phase Three of its reopening plans which allow for all restaurants and bars to open to 100% capacity. While this is a relief for the industry, each county still has jurisdiction over the execution of Phase Three. For example, Miami-Dade County will keep the 50% capacity caps in place for indoor capacity with a requirement for six-feet of distance for each table and no more than six people seating per-table.

Developments Since Q2 Earnings

Evercore ISI raised its price target on BUD shares to $72 on the analyst upgrade to outperform. Beverage giant the Coca-Cola Company NYSE: KO reentered the alcoholic beverage market with Topo Chico Hard Seltzer product. This is a seltzer beverage spinoff from the non-alcoholic Topo Chico sparkling mineral water is the Company learned is very popular with bartenders/mixologists. The Company is rolling out this product in select Latin American cities in 2H 2020. Nielson NASDAQ: NLSN data reported that August 15 off-premise beverage sales grew 17.8% for the last week in August 2020. Hard seltzers is the strongest growth segment with a 300% YoY sales spike in the months of March and April 2020. On Sept. 30, 2020, Anheuser-Busch closed the acquisition Craft Brew Alliance NASDAQ: BREW which include Kona Brewing Co., Appalachian Mountain Brewery, Cisco Brewers, Omission Brewing Co., Redhook Brewery, Square Mile Cider Co, Widmer Brothers and Wynwood Brewing Co.

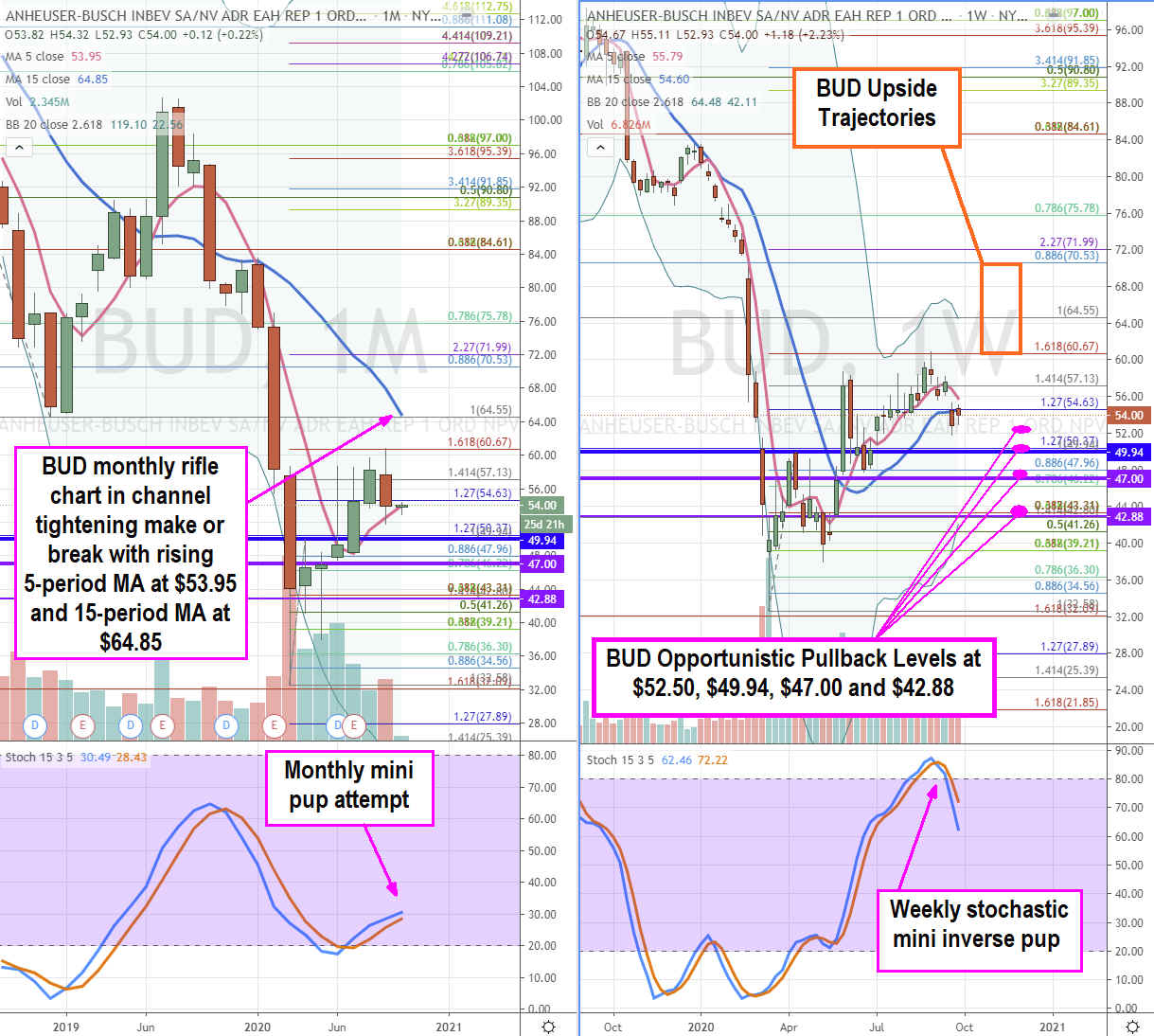

BUD Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for BUD stock. The monthly rifle chart has a make or break situation with the rising 5-period moving average testing at $53.95 as it attempts to channel tighten to the $64.55 Fibonacci (fib) level. The monthly rifle chart triggered a market structure low (MSL) buy above $49.94 and the weekly MSL triggered above $47.00. The weekly rifle chart has a falling stochastic mini inverse pup can provide opportunistic pullback levels at the $52.50 sticky 2.50s range, $49.94 monthly MSL trigger, $47.00 weekly MSL trigger and the $42.88 fib. The upside trajectories on a weekly stochastic pup breakout range from the $60.68 fib to $70.53 fib. Keep an eye the price action of peers including specialty premium brewer Boston Beer Company NYSE: SAM and Molson Coors Brewing NYSE: TAP as they all tend to move together.

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.