The world’s largest brewer

Anheuser-Busch InBev NYSE: BUD stock still trades below its 2020 pre-COVID levels making it an attractive reopening play still worth pursuing with the acceleration of

COVID-19 vaccinations. The Company has amassed a portfolio of over 500 brands ranging from beer to hard seltzers and non-alcoholic beverages and owns nearly 30% of the global beer market share especially after its acquisition of SAB Miller. BUD should see a recovery in its higher-margin on-premise segment from the easing of capacity limits and restrictions for in-restaurant dining, bars and nightclubs,

amusement parks and the relaunch of

live events globally. The Company continues to focus on trimming its long-term debt with a health dividend. Prudent investors still looking for exposure in the reopening plays can monitor shares of BUD for opportunistic pullback levels.

Q4 FY 2020 Earnings Release

On Feb. 25, 2021, Anheuser-Busch released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported a non-GAAP earnings-per-share (EPS) profit of $0.81 excluding non-recurring items versus consensus analyst estimates for a profit of $1.14, missing estimates by (-$0.33). Revenues dropped (-4.3%) year-over-year (YoY) to $12.77 billion beating analyst estimates for $12.59 billion. Volumes in Q4 2020 grew by 1.6% comprised of owned brands up 1.8% and non-beer volumes up 1.7%. Full year 2020 total volumes fell 5.7% driven by the impact of COVID-19. Net debt to normalized EBITDA was 4.8X for 2020. The Company drove its high end premiumization strategy to bolster High-End Company grew by 4.1% and global premium brands grew revenues by 4.7% YoY, with brands such as Modelo in Mexico and Michelob ULTRA in the U.S. The proprietary B2B platform, BEES, grew to over 6 million global customers (serving over 2 billion customers worldwide) capture over $3 billion in gross merchandise value (GMV) of which mover $2 billion was delivered in Q4 2020. Monthly active users (MAUs) reached 900,000 users across 9 markets as the Company plans to expand access to several new markets in 2021. The Company ended 2020 with $24.3 billion in total liquidity consisting of $15.3 billion in cash and the $9 billion undrawn revolver.

Conference Call Takeaways

Anheuser-Busch InBev CEO Carlos Brito set the tone, “We’re leading the way in digitizing our relationships with our more than 6 billion customers and more than 2 billion consumers with investments we have been making for years in the B2B sales, e-commerce and digital marketing.” Top line growth was offset by higher costs involved with supply chain adjustments to accommodate evolving demand from customers. The Company was able to return to volume growth in H2 2020 after COVID-19 related volume plunges at the start of 2020. The U.S. saw strong momentum in Michelob ULTRA and Bud Light Seltzer as they, “are committed to win in the fast-growing seltzer segment with a portfolio approach, enhanced by recent innovations such as Michelob Ultra Organic Seltzer and Bud Light Seltzer Lemonade.” The Budweiser brand grew by 5.8% outside the U.S. in led by China, Brazil and the U.K. with Stella Artois growing 6.1% outside of Belgium as it promoted in-home meal occasions to achieve strong results in Brazil and Argentina.

Customer First Innovations

The in-house marketing agency, DraftLine created customer-first experiences through its “Lives” online concert series in Brazil, delivering over 350 concerts generating 678 million views in 12 weeks. This project bolstered the activation of tops brands like Brahma Duplo Malte. “We have seen that these innovative activations meaningfully contribute to increased awareness and trial of our products, helping us outperform the market,” noted CEO Brito.

Occasions

CEO Brito pointed out, “Occasions become more fragmented and diverse as markets matures, demanding a portfolio approach to effectively meet consumer needs. For example, the number of brands within a consumer’s consideration set in the late-stage maturity market is more than double that of an early-stage maturity market.” The Company owns three of the top five most valuable beer brands in the world, Budweiser, Stella Artois, and Corona. The Company also owns the world’s largest portfolio of specialty and craft brands. Prudent investors can watch for opportunistic pullback levels to gain exposure in BUD shares.

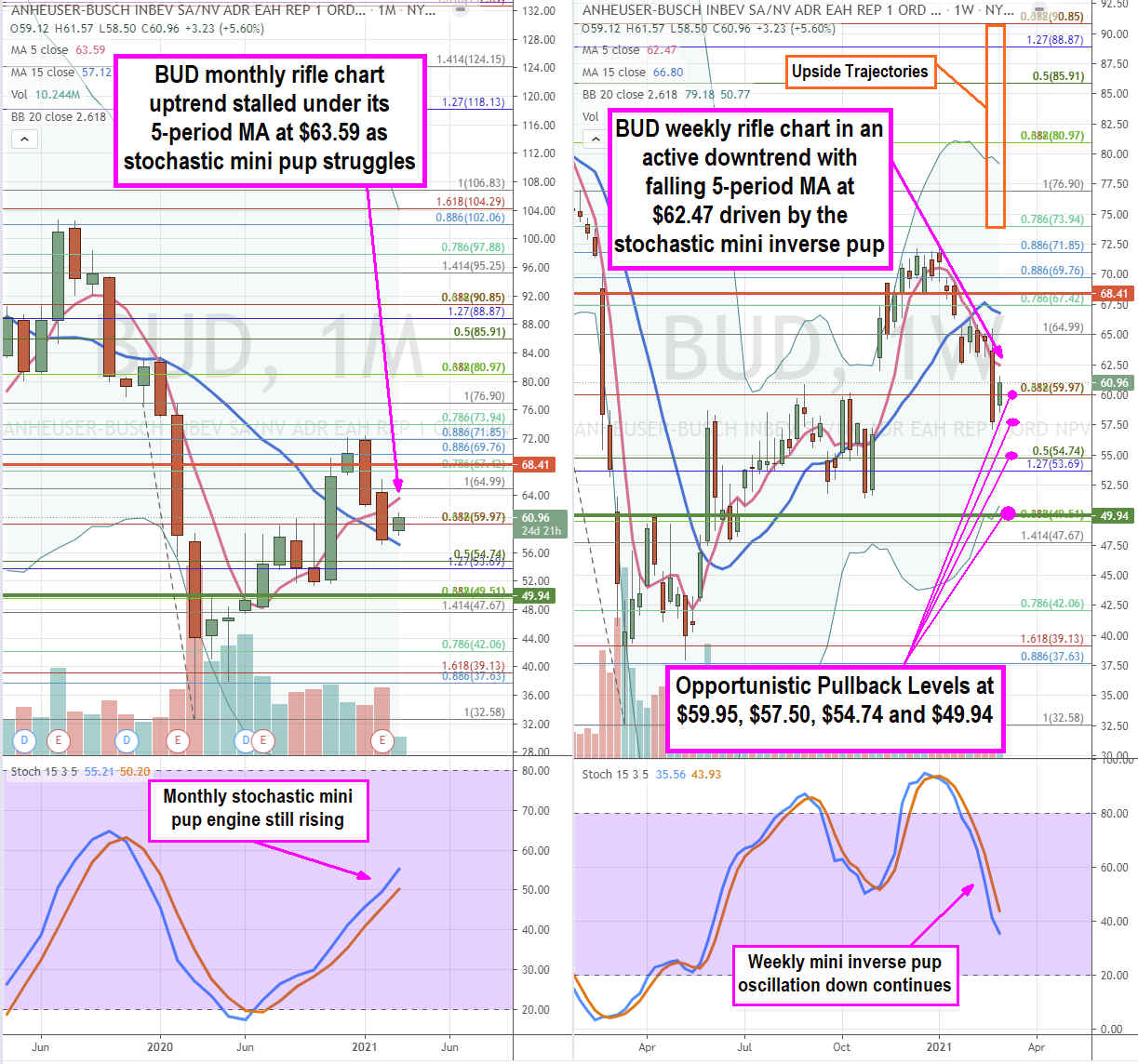

BUD Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for BUD stock. The monthly rifle chart uptrend has stalled as shares fell under its 5-period moving average (MA) support at $63.59 which still holding above the 15-period MA support at $57.12. Shares are hovering around the $59.97 Fibonacci (fib) level. The monthly rifle chart triggered a market structure low (MSL) buy above $49.94 in May of 2020. However, the weekly rifle chart triggered a market structure high (MSH) sell when shares fell under $68.41. The monthly stochastic mini pup is still rising but won’t become active under shares are rising back above the monthly 5-period MA. The weekly rifle chart continues its downtrend as the 5-period MA holds resistance at $62.47. The weekly stochastic mini inverse pup continues falling at the 40-band. This can provide opportunistic pullback levels at the $59.97 fib, $57.50 sticky 2.50s range, $54.74 fib, and the $49.94 monthly MSL trigger. The upside trajectories range from the $73.94 fib to the $90.85 fib. Keep an eye on peers specialty premium brewer Boston Beer Company NYSE: SAMand Molson Coors Brewing NYSE: TAP as they tend to move as a group.

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.