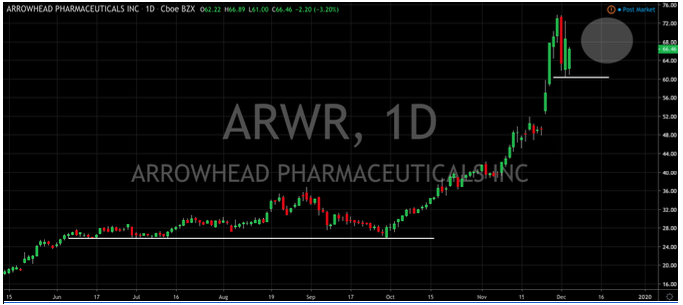

Shares of Arrowhead Pharmaceuticals NASDAQ: ARWR changed hands in heavy trading on Wednesday after the company announced an equity offering before the market opened. Having reported earnings last week that smashed estimates and sent the stock to all-time highs, this was a nasty surprise to investors and a timely reminder of the risks inherent to biotech stocks.

Shares were down 8% in pre-market trading and gapped down even further on the open. However, they quickly caught a bid and finished the day near their session high.

There’s no doubt that many on Wall Street viewed the dip as a potentially great buying opportunity considering the quality of Arrowhead’s earnings last week.

The stock hit a 12 year high in the days following last Tuesday’s report as revenues soared an eye-watering 945% year on year. Amidst all the bottle popping though, it looked as if there was some significant profit-taking starting to set in. The stock gave up 15% on Monday and tested those lows again on Tuesday and Wednesday, but the strong close seen even in the face of the offering last evening bodes well for momentum.

Performance of recent years

Shares of the $6 billion biotech company have had an outstanding year so far and are up over 450% year to date. Even XBI, the benchmark biotech index, has only logged a 30% gain for 2019 so far.

Arrowhead’s shares were already buoyed going into the latest earnings report by a bullish upgrade from Baird. One of Arrowhead’s competitors in the growing field of RNAi technology, The Medicines Co. NASDAQ: MDCO, was purchased by Novartis for $7 billion late last month and this seems to have put a very attractive spotlight on Arrowhead.

Coupled with the fact that much of Arrowhead’s drug pipeline has seen promising results and progress this year, big pharma is sure to be taking an interest in them and their investors know exactly what that could mean more than anyone.

Technical analysis

The stock has been a dream to trade for technical traders this year. It spent September cooling off from August’s highs but bounced sharply off a strong support line at $26 (which it tapped in July) to start October with a spring in its step. A bullish MACD crossover at the start of that month confirmed the buy and shares had already rallied 90% before last week’s upgrade and subsequent earnings doubled those gains.

However, this also meant RSI became super hot as it almost touched a reading of 90, indicating extremely overbought conditions. The pullback and consolidation we’ve seen since look like nothing more than a bit of steam being let off and there’s nothing unhealthy about that. The fact that shares were bought after the offering shows the internal momentum this stock has and just how attractive it is to Wall Street right now. Let’s see some continued consolidation in the coming sessions before a move up towards the $75 level and a resumption of ‘normal business’ for shares of this biotech leader.

Looking Ahead to Coming Weeks

It’s worth noting that aside from the technical qualities of the stock and it’s current momentum, there are one or two fundamental based red flags popping up. Arrowhead’s PE ratio of 90, in particular, has started to catch a little heat, with pressure shifting to management to keep exceeding quarterly expectations. It’s certainly a little rich compared to the industry average of 25 but all these exploratory companies are somewhat speculative and indeed, this is what attracts so many investors and so much attention.

If you’re interested in less volatile biotech and pharma names that are still worthy of being on your watchlist, check out our recently published article “Pharmaceutical Stocks - Best Pharmaceutical Stocks to Buy” and “Biotech Stocks - Best Biotech Stocks to Buy”.

For now though, with the S&P 500 at all-time highs, we’re certainly in a risk-on trading environment and there’s nothing more attractive in such a setting than promising biotech like Arrowhead that’s got incredible forward momentum.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.