For a non-travel or hospitality-related business,

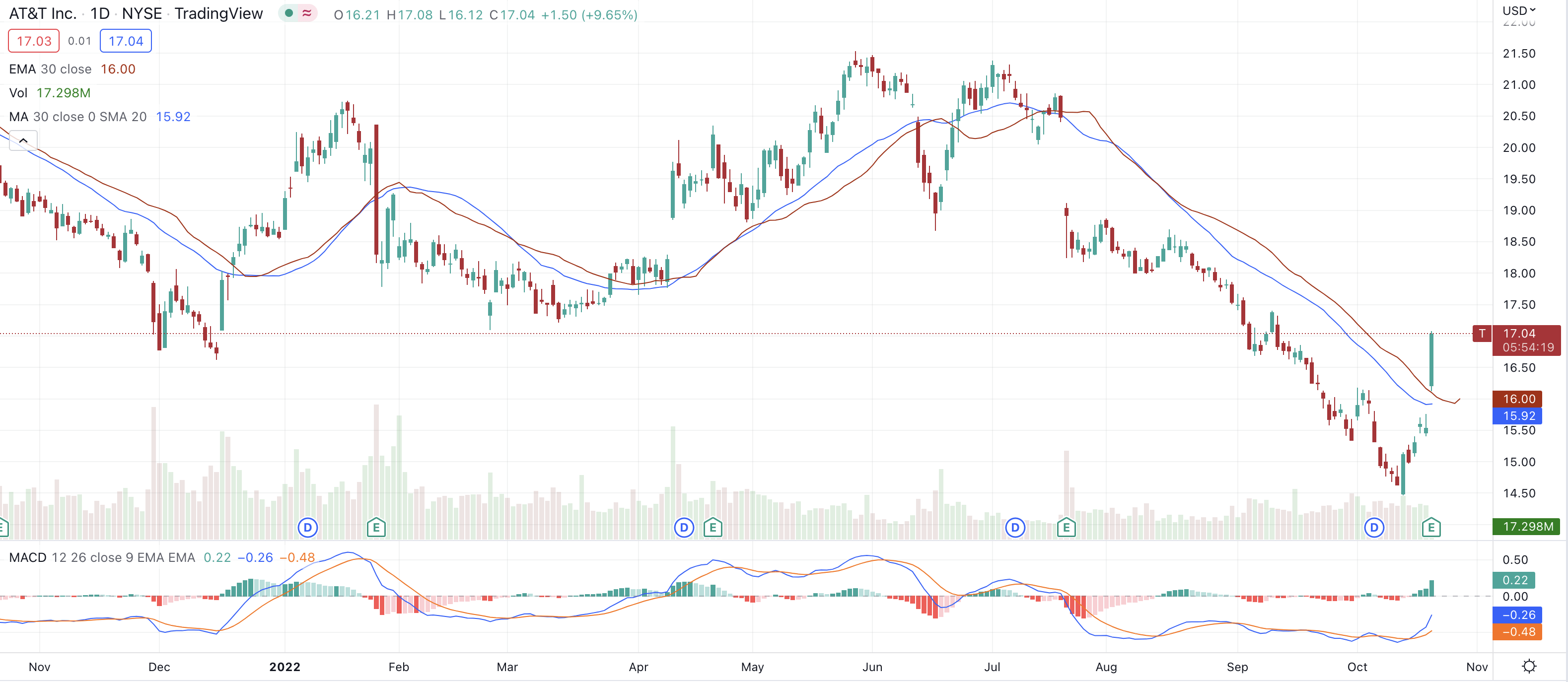

AT&T (NYSE: T) is certainly making hard work of its recovery from Q1’s crash. Granted, it’s not

an e-commerce business or an obvious winner from the fast-growing work-from-home economy, but still, it’s a $200 billion telecommunications company whose shares are still down 25% from pre-COVID levels and only up 13% from March’s lows.

It would be somewhat understandable if shares had been under pressure already coming into the pandemic, but they weren’t. From December 2018 to December 2019 they rallied 45% and had reversed 2 and a half years of constant decline. That being said, there had been some weakness creeping into the company’s earnings and a few eyebrows were starting to be raised on Wall Street. In hindsight, it looks as if that rally in shares was very much against the run of play, with little justification from the company’s top-line performance ever materializing.

Revenue Contracting

Case in point, as recently as last October, when the S&P 500 index was printing all-time highs on a weekly basis, AT&T reported Q3 results that missed expectations and showed revenue contracting almost 3% year on year. In January, with the S&P at even higher highs, AT&T’s Q4 results disappointed investors again as they painted an almost identical picture to October, and that was before COVID hit.

Maybe it was always going to happen with consistently disappointing results like that, but the onset of the COVID pandemic and the risk-off sentiment that swept markets was the straw that broke the camel’s back and brought shares back down to reality. In less than five weeks from the end of February, shares had fallen more than 30% and as mentioned above, have since struggled to undo even half that damage. April’s Q1 report confirmed the backward momentum with another miss on analyst expectations and almost a 5% contraction in revenue.

Downgrades

Some bears have been saying for a while that the outlook was far from rosy. In November, MoffettNathanson cut the stock to a Sell with weakening fundamentals driving the decision. This was a brave move given shares were trading at two-year highs at the time. In April, when their $30 price target had been hit following AT&T’s fall, they reiterated the Sell rating and dropped their price target to $23 which was even lower than the lows the stock hit in March.

The ‘highly cyclical’ nature of most of AT&T’s businesses was and is a red flag for Moffet which means AT&T’s EBITDA is particularly exposed to a pandemic driven recession. The company’s 7% dividend yield is at risk of being cut while bond rating agencies could soon be circling and threatening downgrades.

One catalyst that could help spur a turnaround and drive recovery is the introduction of 5G phone networks. As demand increases for phones that can handle 5G, AT&T’s revenue should see a much-needed bump. While this is of course an oversimplification, there’s no doubt that many investors will be viewing the company’s ability to make hay off the back of the 5G rollout as a make or break event.

With so many tech and e-commerce stocks trading at all-time highs, it’s an uphill battle to convince investors with cash on the sidelines to back a $200 billion company that is far from being the most COVID-exposed business but that is still struggling to grow. For the additional bearish sentiment, just stretch out the timeline on the stock’s chart; it was trading at current prices as far back as 1996.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.