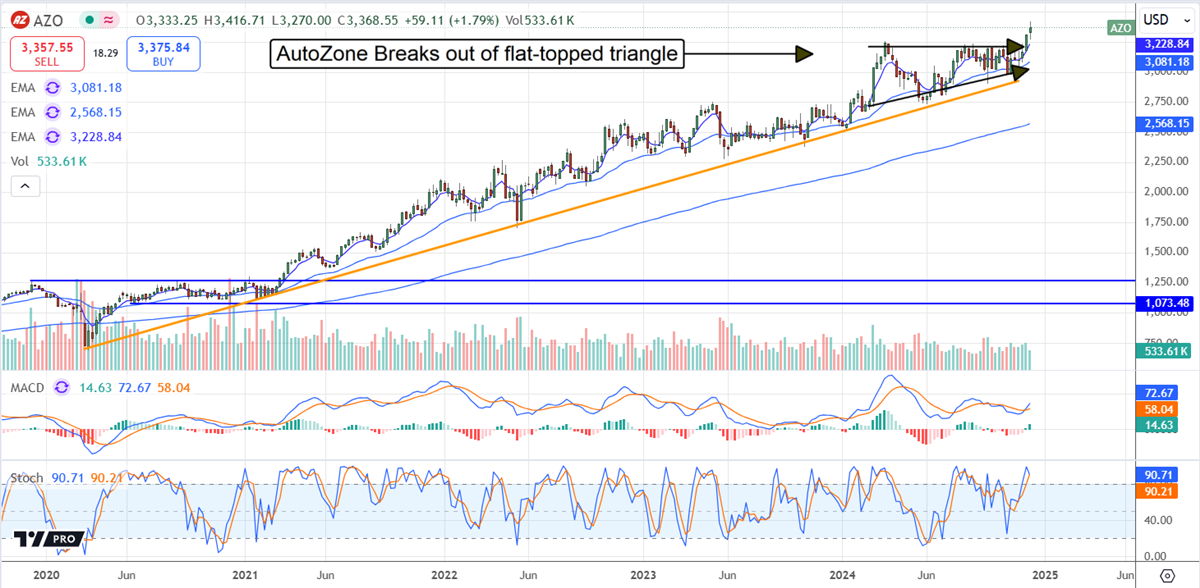

AutoZone NYSE: AZO faces headwinds in 2024, but its FQ1 2025/CQ3 2024 results prove why it is a high-caliber buy-and-hold stock. The company sustains growth in difficult times, maintains margin, provides robust cash flow, and pays its shareholders to own it. It delivers a steadily increasing value, which is clearly seen in the stock’s price. This stock has trended steadily higher for decades. The trend went into overdrive in 2020 when growth accelerated, and the market is breaking out to new highs now that the outlook for 2025 has cleared.

AutoZone Today

$3,601.29 +34.43 (+0.97%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $2,728.97

▼

$3,916.81 - P/E Ratio

- 24.06

- Price Target

- $3,724.00

AutoZone stock doesn’t pay dividends but doesn’t have to, repurchasing shares aggressively with no signs of stopping. The buybacks in FQ1 amounted to $505 million in returned capital, helping to reduce the total count by 4.7% year-over-year, and there is ample funding left under the current authorization. The current authorization is worth another $1.7 billion, or about 3% of the market cap, and sufficient for another three financial quarters of buybacks at the current pace. The board will likely authorize additional funding by then.

The balance sheet has but one red flag, and it isn’t exactly a bad sign. The highlights from Q1 include increased cash, inventory, current, and total assets only partially offset by liability. The bad news is that the company continues to run with a shareholder deficit, but share repurchases offset it. The buybacks effectively turn cash into ashes regarding the balance sheet but increase shareholder value by decreasing the count, and all other balance sheet metrics are sound. The company uses debt, but leverage is low, with a total of less than 0.5x assets and 0.2x market capitalization.

AutoZone: Mixed Q1 Results Offset by Sequential Improvement and Outlook

AutoZone’s FQ1 results are tepid relative to the consensus estimates reported by MarketBeat but reveal the business's underlying strengths, including international expansion efforts and diversification. The $4.28 billion in net sales is up 2.1% compared to last year, missing the consensus by a slim 70 basis points as domestic comp sales decelerated.

AutoZone MarketRank™ Stock Analysis

- Overall MarketRank™

- 76th Percentile

- Analyst Rating

- Buy

- Upside/Downside

- 3.4% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -1.59

- News Sentiment

- 1.41

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 13.35%

See Full AnalysisHowever, the company reported strength in the domestic commercial business, offset by weaker but improving trends in the DIY auto-repair market that point to sustained improvement in coming quarters. International is also an area of strength, growing by 13.7% on an FX-neutral basis and 1% as reported. Store count growth underpinned the results, rising by 34 for the quarter to end the period with a growth of 3.1% compared to the prior year.

The margin news is also mixed but no less favorable to investors. Increased expenses offset gross margin improvement to cause a decline in operating profit, but the decrease is minimal. The 0.9% contraction isn’t great news but provides sufficient cash flow to sustain the balance sheet and capital return outlook, and there are reasons to expect improvement. Economic headwinds are expected to ease for businesses and consumers as 2025 progresses, and tailwinds may form in the back half. Lower interest rates and an economically-friendly White House are why.

The Sell Side Provides a Strong Tailwind for AutoZone Stock Price

The sell side of the market, including institutions and insiders, supports AutoZone’s stock price’s upward trajectory. Although the analysts' consensus estimate reported by MarketBeat lags the price action, it is rising compared to last year, the prior quarter, month, and week, with the first revisions following the release increasing.

The first revision picked up by MarketBeat’s tools is from Evercore ISI, which increased to $3400 or $200 above the consensus. Evercore’s price target assumes the stock is fairly valued, with the market at a new all-time high. Still, the business trends, analysts, and institutional activity suggest even higher prices are coming. Regarding the institutions, they have bought this stock on balance every quarter this year, and buying was strong in Q4 ahead of the earnings report, setting the stage for the post-release price-pop.

The price action in AutoZone stock is bullish. This market is in rally mode and moving to new highs following a significant consolidation. The price action in 2024 aligns with a flat-topped or ascending triangle, a bullish signal confirmed by the new highs. This signal implies the trend will continue, and the ensuing minimum rally could equal the magnitude of the pattern. At the same time, the bull case suggests a move equal to the magnitude of the rally leading up to the breakout. In that scenario, this stock could gain another $2,450.

Before you consider AutoZone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoZone wasn't on the list.

While AutoZone currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.