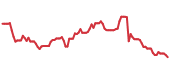

It’s been a tough year for Bath & Body Works NYSE: BBWI. So far, in 2024, the home fragrance, body care, and soap retailer founded in Columbus, Ohio, has seen its shares fall around 24%. That is in stark contrast to the modestly growing but still positive consumer discretionary sector. The Consumer Discretionary Select Sector SPDR Fund NYSEARCA: XLY is up around 4% this year.

Bath & Body Works Today

BBWI

Bath & Body Works

$29.70 +0.96 (+3.34%) As of 03:59 PM Eastern

- 52-Week Range

- $24.96

▼

$52.99 - Dividend Yield

- 2.69%

- P/E Ratio

- 7.24

- Price Target

- $42.69

This poor performance has come alongside a rash of Wall Street analysts' downgrades. Citigroup NYSE: C and Barclays NYSE: BCS both lowered their price targets nearly 30% earlier in August, and both firms now see Bath & Body Works as close to fairly valued.

However, some are still bullish. Deutsche Bank’s NYSE: DB price target of $54, released a couple of days ago, implies an upside of over 50%.

Together, we'll examine the company's annual filing and recent earnings to gauge its performance, concluding with a discussion on its turnaround efforts.

Bath & Body Works' Financials Show Little Light of Day

With over 1,700 stores in the United States, Bath & Body Works is still primarily a walk-in retail business. It maintains a substantial presence outside the U.S., with over 100 stores in Canada and close to 500 stores operated internationally by its partners.

In fiscal Q1 2025, 77% of net sales came from physical stores in the U.S. and Canada. Online direct-to-consumer sales in the U.S. and Canada made up 19% of total sales, and international sales made up 4%.

Through Q1 2024, the company saw its last twelve months’ sales decline in each of the previous six quarters. Revenues sit around 40% below the peak levels the company achieved pre-pandemic. However, due to substantially increasing its margins, the company is bringing in similar levels of net income and free cash flow.

Bath & Body Works Stock Forecast Today

12-Month Stock Price Forecast:$42.6943.73% UpsideModerate BuyBased on 18 Analyst Ratings | Current Price | $29.70 |

|---|

| High Forecast | $52.00 |

|---|

| Average Forecast | $42.69 |

|---|

| Low Forecast | $35.00 |

|---|

Bath & Body Works Stock Forecast DetailsA rather bad sign for Bath & Body Works is that it has no top-line item growing substantially. Store sales have barely increased since January 2023, even though the company has added over 50 stores. Online sales are down nearly 10%.

Nationwide slowdowns in retail sales growth are having a negative impact on this. U.S. retail sales have increased less than 1% since the start of 2023, but Bath & Body Works' growth is slower than the overall specialty retail industry.

Bath & Body Works shares fell after Q2 2024 earnings. Earnings and revenue both declined in line with expectations; however, the company significantly lowered its full-year adjusted earnings per share (EPS) guidance. The midpoint guidance now sits at $3.16. Analysts expected $3.25, which is equal to the previous guidance.

BBWI’s Strategy Revamp: Digital Enhancements and Off-Mall Expansion

Bath & Body Works is working through several vectors to revitalize the firm. First, it recently partnered with Accenture NYSE: ACN to overhaul customers' digital experience. This includes using technology to increase the company’s marketing prowess and AI to deliver better customer experiences.

An example is the company’s “fragrance finder," which will help customers find perfumes, candles, or soaps that they will most enjoy. This feels like more of a gimmick than something that will truly drive sales; however, marketing improvements could prove beneficial.

Another strategy is transitioning to off-mall locations. The company’s stores were typically located in malls, but declining mall foot traffic has scared many retailers away. Around half the firm’s stores are now off-mall, and it wants to increase that percentage to two-thirds.

Although it doesn’t seem to be leading to higher sales, it is probably part of the reason for its higher margins, as off-mall properties often have lower rent.

Loyalty Program and Male Customers Provide Opportunity for Growth

A big area of strength for the company is its loyalty program. The 37 million members increased by 8% from last year, making up 80% of U.S. sales. This is quite impressive, as the program began just two years ago. Additionally, new customers made up 43% of enrollees.

Bath & Body Works should capitalize on its loyal customer base to boost sales. Strategies could include promoting frequent purchases and introducing a subscription tier to monetize memberships. Additionally, expanding offerings for male customers, where it has shown strength, could further enhance its market presence.

Bath & Body Works, Inc. (BBWI) Price Chart for Thursday, April, 24, 2025

Before you consider Bath & Body Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bath & Body Works wasn't on the list.

While Bath & Body Works currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.