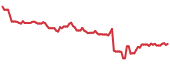

After shares of Under Armour Inc. NYSE: UA plummeted by 15% in the pre-market session of Thursday morning due to the company’s release of its first quarter 2024 earnings results, bearish traders may have reversed their initial decision. The stock ranged within a couple of percentage points during the day, closing lower by 0.3% to finish the day.

The initial reaction was aided by a bearish predisposition surrounding the consumer discretionary sector, with a particular cautionary note attached to retail apparel names like Under Armour. However, things may not be as bad as they seem, as investors soon find out that U.S. consumers may receive a bailout shortly through interest rate cuts.

Focusing on what matters, Wall Street analysts give Main Street enough evidence to potentially consider Under Armour as a top candidate in the sector, even when pegged against leaders like Nike Inc. NYSE: NKE and Lululemon Athletica Inc. NASDAQ: LULU. Before investors get into the weeds of the deal, here’s why the economy is just right for these stocks.

The Right Mix for Portfolios

Under Armour Today

UA

Under Armour

$5.51 +0.05 (+0.92%) As of 04/24/2025 03:59 PM Eastern

- 52-Week Range

- $4.62

▼

$10.62 - Price Target

- $9.00

Economists had to wake up to their worst nightmare this quarter, as the U.S. economy grew only 1.6% in gross domestic product (GDP) while inflation rates remained above 3%. This is known as stagflation, where there’s little to no economic growth with high inflation.

Stagflation is tricky since the Federal Reserve (the Fed) can’t solve the economic growth issue by simply lowering rates. Inflation is persistent and would only get worse in a lower-rate environment. On the other hand, keeping high rates would only worsen already weak economic growth, with the hopes of keeping inflation tamed as a tradeoff.

The good news is investors don’t need to be economists to figure out what to do with their portfolios. The mix is pretty simple: find companies set to grow beyond lackluster GDP projections while keeping up with – and ideally beating – inflation.

Why Under Armour Has the Right Fit

Targeting these characteristics, investors can find a home for their investment dollars in Under Armour stock, particularly when considering Wall Street analyst projections.

Behemoths like Nike and Lululemon can’t – and aren’t expected to – push for high earnings per share (EPS) growth rates like Under Armour can. Being a $2.9 billion company has its perks, and 13.5% EPS growth projections for this year is one of them.

Under Armour’s EPS growth stand above Nike’s 5.9% projections, leading ahead of Lululemon’s 11.6%. Despite being set to grow above its peers, Under Armour stock is still trading at a 60% discount to the consumer discretionary sector, measured on a P/E basis.

A 7.5x P/E multiple gives investors above-average EPS growth at below-average valuations. Nike’s 26.9x P/E barely commands a premium as its EPS is barely escaping the eroding effects of inflation today.

Not much else is to be said about Lululemon’s 27.7x P/E other than that it is still a much more expensive deal than Under Armour.

Management is Well Aware of Discounts

When companies decide to buy back their own stock, it is typically driven by two factors. First, the stock is considered to be cheap by insiders' standards, and second, the stock is expected to rally in a relatively short period of time.

Because management announced a $500 million share repurchase program, investors should have another reason to consider Under Armour. This repurchase amount represents roughly 17% of the company’s size, which is a very aggressive program.

Stocks like Alibaba Group NYSE: BABA announced plans to buy back up to $25 billion in stock, or 12% of the company, and that stock has delivered a more than 12% rally in a single week. What could come of Under Armour’s 17% buyback is up for debate.

Last but not least, investors should have financial stability in their checklist for a potential investment, and Under Armour seems to tie this one together. The company’s quarterly press release would show a net operating cash flow of $353.9 million in the past quarter, compared to a net outflow of $39.9 million a year prior.

A stratospheric improvement in the company’s cash flows made management feel confident enough to buy back stock, hoping this profitability would be sustained in the long run.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.