The guidance and strategies provided by financial advisors have profound implications on people’s financial futures.

We recently conducted a study to unveil the cities with the best and worst financial advisors across America by analyzing Google review scores.

Key Findings:

The top 10 best cities for financial advisors:

- Wilmington, Delaware: 4.9

- Aberdeen, South Dakota: 4.8

- Boise, Idaho: 4.8

- Wichita, Kansas: 4.8

- Omaha, Nebraska: 4.8

- Albany, New York: 4.8

- Bartlesville, Oklahoma: 4.8

- Oklahoma City, Oklahoma: 4.8

- Tulsa, Oklahoma: 4.8

- Sioux Falls, South Dakota: 4.8

The bottom 10 worst cities for financial advisors:

- Big Spring, Texas: 4.2

- Alice, Texas: 4.3

- Oak Ridge, Tennessee: 4.3

- Murfreesboro. Tennessee: 4.3

- Kingsport, Tennessee: 4.3

- Jackson, Tennessee: 4.3

- Cookeville, Tennessee: 4.3

- Chattanooga, Tennessee: 4.3

- Columbia; South Carolina: 4.3

- Bristol, Rhode Island: 4.3

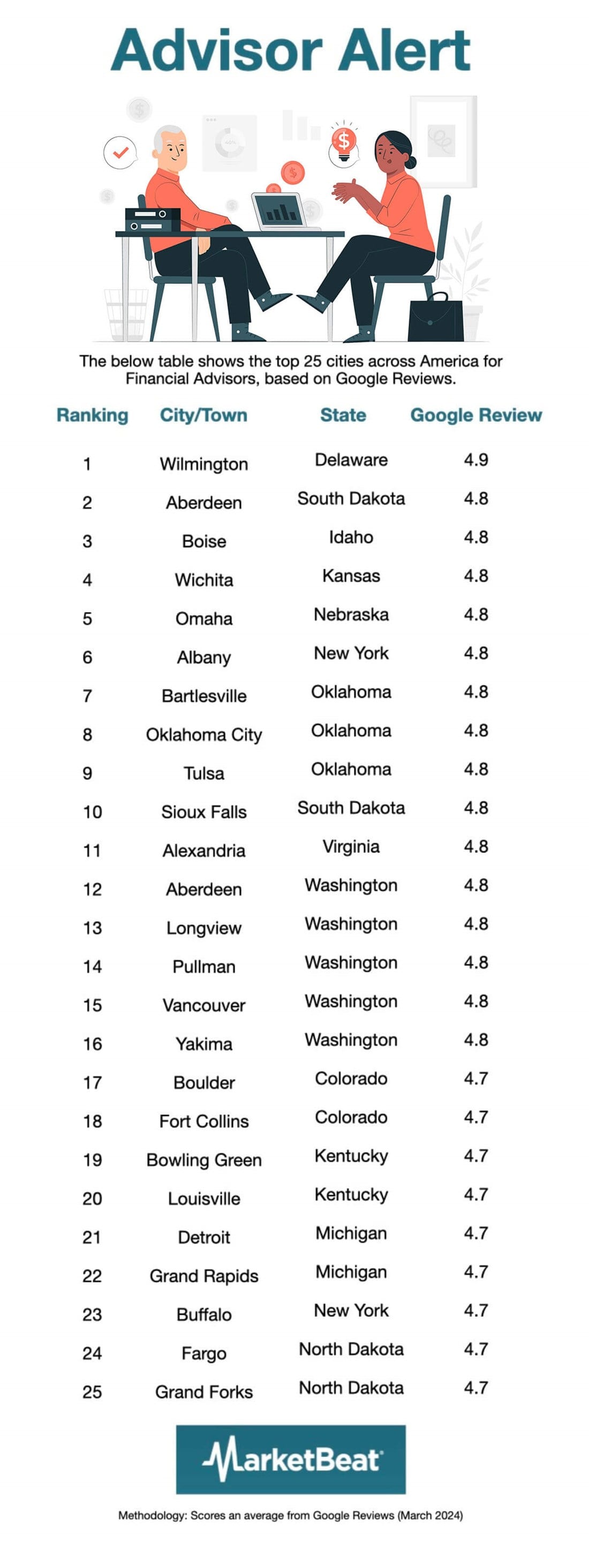

Top 25 cities across America for Financial Advisors, based on Google reviews as of March 2024:

Top 25 cities across America for Financial Advisors, based on Google reviews as of March 2024:

1. Wilmington, Delaware - 4.9 | 2. Aberdeen, South Dakota - 4.8 | 3. Boise, Idaho - 4.8 | 4. Wichita, Kansas - 4.8 | 5. Omaha, Nebraska - 4.8 | 6. Albany, New York - 4.8 | 7. Bartlesville, Oklahoma - 4.8 | 8. Oklahoma City, Oklahoma - 4.8 | 9. Tulsa, Oklahoma - 4.8 | 10. Sioux Falls, South Dakota - 4.8 | 11. Alexandria, Virginia - 4.8 | 12. Aberdeen, Washington - 4.8 | 13. Longview, Washington - 4.8 | 14. Pullman, Washington - 4.8 | 15. Vancouver, Washington - 4.8 | 16. Yakima, Washington - 4.8 | 17. Boulder, Colorado - 4.7 | 18. Fort Collins, Colorado - 4.7 | 19. Bowling Green, Kentucky - 4.7 | 20. Louisville, Kentucky - 4.7 | 21. Detroit, Michigan - 4.7 | 22. Grand Rapids, Michigan - 4.7 | 23. Buffalo, New York - 4.7 | 24. Fargo, North Dakota - 4.7 | 25. Grand Forks, North Dakota - 4.7

Implications of the Study:

- Highlighting the Digital Dilemma: The findings emphasize the double-edged sword of digital information access. While online reviews can democratize information and help identify service providers, they also risk simplifying complex decisions, such as selecting a financial advisor based on superficial metrics that could be manipulated via fake reviews.

- The Need for Educated Choices in Financial Advisory: This study serves as a wake-up call for consumers to adopt a more nuanced approach to selecting financial advisors. It suggests a societal need for greater financial literacy and awareness about the importance of personalized, in-depth research in making financial decisions.

- Potential for Misleading Perceptions: The concentration of lower-rated financial advisors in specific regions could foster misleading stereotypes about the financial advisory quality in those areas. This emphasizes the need for individuals to look beyond aggregate ratings and consider the specific attributes and track records of advisors.

- Call for Improved Advisory Standards: The study indirectly calls for industry-wide improvements and possibly, the standardization of metrics for evaluating financial advisor performance. This could lead to enhanced transparency and reliability in how financial advisory services are rated and reviewed.

- Reflecting on the Trust Economy: The research highlights the growing trust economy facilitated by the internet, where reviews significantly impact consumer choices.

Like this article? Share it with a colleague.

Link copied to clipboard.