Despite having only IPO’d in May 2019,

Beyond Meat (NASDAQ: BYND) investors have experienced their fair share of volatility. If a 400% rally in the first two months of public trading set unrealistic expectations, a subsequent 70% drop brought them back to earth.Even though they rallied off those lows, as part of the overall crush seen across equities in Q1, Beyond Meat shares were hit hard again with the onset of COVID. As a barely profitable, hyped-up stock they were quickly smashed

back to IPO levels with the risk-off sentiment.

To their credit, they’ve managed to run up about 200% since then and have been consolidating in recent weeks for what feels like the first time ever. As the dog days of summer get ready to leave, Beyond Meat shares look ready to make another push.

Lukewarm Earnings

Their Q2 earnings at the start of August painted a company at an exciting point in its growth but not without risk. Even though revenue topped expectations and came in at 68% growth year on year, this was well off the 140%, 210% and 250% year on year growth seen in their last three earnings reports consecutively. When it comes to justifying a higher share price today off the back of expected future sales and revenues, Wall Street doesn’t like to see triple-digit percentage growth in revenue suddenly contract to only double-digit percentage growth.

From a profitability basis, previous earnings reports have teetered on the edge of black and red, sometimes barely in one, other times barely in the other. August’s report posted EPS that was below expectations and the deepest in the red it had been for some time. To be fair though, it appears as if much of this underperformance will be attributed to COVID and is not expected to be long-lasting.

As CEO Ethan Brown said with the release, "I am proud of our record net revenues and growth during a very challenging period. As the toll of the COVID-19 pandemic took hold across the foodservice industry, we repurposed assets and repacked and rerouted products to meet increased consumer activity in the retail aisles. Throughout the quarter, our brand experienced an enviable combination of consumer trends – increasing household penetration; increasing buying levels per household; and strong repeat purchase rates of nearly 50%, well above the success threshold for consumer packaged goods.”

Long Term Growth Story

The higher sales velocity numbers they saw with existing retail customers will hopefully stick around and their continued expansion into the EU and Asia sets them up well for long term viability. The company released its much anticipated new e-commerce site last week which will allow for direct-to-consumer digital sales, a much needed new channel to take advantage of the booming online shopping economy. There’s plenty for the bulls to be excited about and you’d have to think that as soon as foodservice channel sales return to normal, pre-COVID activity, so too will Beyond Meat’s revenue growth numbers.

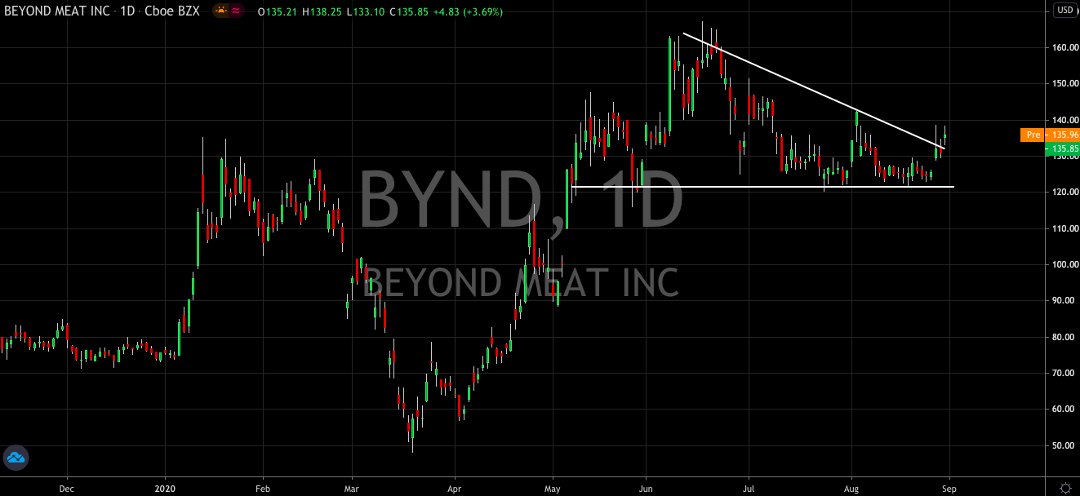

Shares came off a few percent in the aftermath of the lukewarm report but have consolidated in a narrow range since. That is until late last week when they popped 10% for their second-highest close since July. With the band-aid of Q2’s results ripped off and the uncertainty removed, it looks as if Wall Street has digested the numbers and is ready to buy into the growth story once again.

As a case in point, Citi were out with an upgrade to the stock yesterday, moving shares to Neutral from Sell. Shares are starting to mature and move away from the crazy swings in either direction that formed the pattern of their first year or so of public trading. A “more balanced risk/reward profile” makes it easier to buy into their long term potential at current prices, wrote Wendy Nicholson.

Shares are only 25% away from 52-week highs which may be a big gap for some companies but not for Beyond Meat. With the right conditions and a sprinkle of hype, they’ve shown that they can cover that in a matter of days. And as shares break out of a tightening wedge, it looks like they’re about ready to try.

Before you consider Beyond Meat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beyond Meat wasn't on the list.

While Beyond Meat currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.