Warner Music Group Today

WMG

Warner Music Group

$29.22 +0.61 (+2.13%) As of 04/24/2025 04:00 PM Eastern

- 52-Week Range

- $27.06

▼

$36.64 - Dividend Yield

- 2.46%

- P/E Ratio

- 29.82

- Price Target

- $35.47

Warner Music Group NASDAQ: WMG is in the communication services sector and is one of the “Big 3” companies in the music recording and publishing industry, including Sony Music Group and Universal Music Group OTCMKTS: UMGNF.

The company’s returns have moved in the opposite direction of its sector in 2024 so far, down 17%. The Communication Services Select Sector SPDR Fund NYSEARCA: XLC is up 16%.

The company released its fiscal Q3 2024 financial results on Aug. 7, 2024. Let's dive into the company’s operations by reviewing its annual report, examining the results, and detailing key points to watch for.

Warner Music: Recorded Music and Streaming Dominate

Warner Music Group breaks down its business into two main segments: Recorded Music and Music Publishing. The distinction between these two is that they control separate copyrights. Pieces of music contain two components: the composition and the recording.

The composition is the underlying lyrics and musical components of a song, like the melody and harmony. This represents a distinct piece of intellectual property. An artist can then capture their unique interpretation of a composition in a sound recording. This interpretation is another piece of intellectual property.

The Recorded Music segment produces and distributes music recordings. The Music Publishing segment licenses musical compositions for artists to interpret. The composers who write a song often differ from those who perform it, creating a need for these separate rights.

The Recorded Music Segment made up 82% of revenue in 2023, versus 18% for Music Publishing. This shows Warner’s active role in the actual production of song recordings rather than just buying and selling compositions.

Warner is an international firm, receiving 54% of its revenue from outside the United States. The company gets 66% of its revenue from digital sources, most of which are partnerships with streaming services rather than download services.

Warner Grows EPS More than Expected, Compares Favorably to Universal

Warner beat adjusted earnings per share (EPS) estimates, coming in at $0.27. This represented an earnings surprise of 8% and an increase of 17% from the same quarter last year. Revenue came in $20 million below expectations at $1.55 billion, a decrease of 1% from last year.

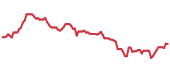

Warner Music Group Corp. (WMG) Price Chart for Friday, April, 25, 2025

Streaming is continuing to light Warner's growth path. Adjusted Recorded Music streaming revenue grew by 10% in constant currency, and the figure increased by 12% for the Music Publishing segment.

The company also did well in increasing its operating margin by 120 basis points to 13.3% and growing free cash flow by 42%.

Shares rose after the earnings release. In addition to beating EPS estimates, another good sign for Warner was its comparative strength in streaming growth versus Universal. Universal released earnings on July 24 and saw overall streaming revenue growth of just 4%. Warner is the smallest player among the Big Three music companies, while Universal is the largest. Seeing the company significantly outperform this competitor in a key growth vector is a very positive sign.

Watch to Watch For: AI Lawsuit, Effect of Spotify Price Increase

Warner needs to successfully navigate one important area: the use of AI to make music. Music from popular artists can be used to train AI models. These models can then create whole new songs that sound eerily similar to the actual artist. Warner must protect its intellectual property from unauthorized use in these models or monetize it if a suitable opportunity arises.

Warner Music Group Stock Forecast Today

12-Month Stock Price Forecast:$35.4721.39% UpsideHoldBased on 17 Analyst Ratings | Current Price | $29.22 |

|---|

| High Forecast | $44.00 |

|---|

| Average Forecast | $35.47 |

|---|

| Low Forecast | $23.00 |

|---|

Warner Music Group Stock Forecast DetailsWarner knows of this risk. It issued a letter to AI companies, warning them to get license agreements before using its IP to train their models. It is also suing two AI startups on the grounds of copyright infringement. It is doing so with Sony and Universal. Winning this lawsuit is crucial for the firms to maintain their competitive advantage in the space; investors should closely monitor the situation.

The three firms share a strong stake in dismantling similar companies and should unite on these issues. Winning this lawsuit would send a signal to future startups not to compete with the Big 3 through this avenue.

Investors should also watch whether the Big Three can expand their margins over the next few quarters in conjunction with Spotify's price hikes. This will show whether the music companies benefit from the increases or if Spotify is keeping all the gains for itself.

Before you consider Universal Music Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Music Group wasn't on the list.

While Universal Music Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.