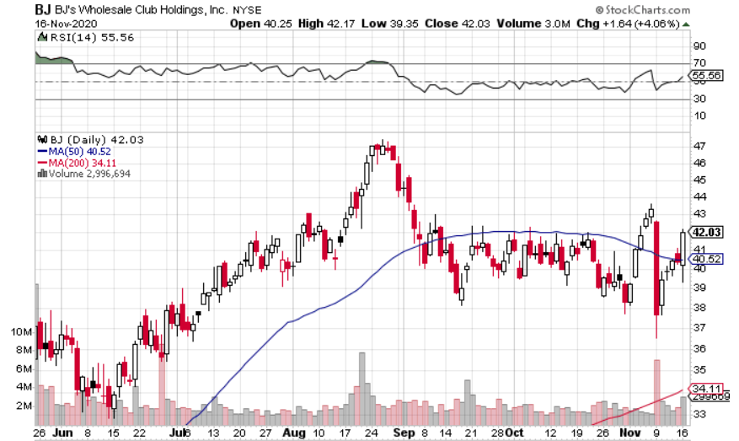

BJs NYSE: BJ shares took a shellacking on November 9

th, dipping nearly 13% on huge volume. The reason was obvious: Investors feared that BJs will not fare as well if the “new-normal” becomes the “old-normal.”

The move was surprising, however, because BJs isn’t some high-flying tech company – it’s a warehouse club chain.

BJs won’t grow at 2020 rates in 2021 and beyond. But that was apparent before the vaccine news came out. With shares trading at just 15.9x forward earnings, if BJs sees modest growth going forward, it would have a lot of room to run. I expect that bullish scenario to come to fruition. Here are five reasons why:

1. Digital Still Has Plenty of Upside

BJs digitally enabled sales grew 350% yoy in Q1. The second quarter was almost as impressive, with 300% yoy growth.

Digital, however, was just 1.5% of BJs business in Q1 2019. As of the end of Q1 2020, digital still represented just 5% of BJs merchandising comp sales. It’s clear that BJs digital presence, though quickly growing, still has a lot of upside.

Yes, digital isn’t going to grow at 300%+ in 2021 and beyond – vaccine or no vaccine. But even a small fraction of 300% is a heck of a lot of growth.

BJs recognizes the opportunity, and is taking steps to seize it. On the Q2 earnings call, CEO Lee Delaney said, “We built a database that allows us to market more specifically to individual members across our footprint with a whole set of demographic and behavioral characteristics so that we can get very specific in our outreach across both analog and digital channels.”

BJs isn’t just making digital sales. It is also acquiring new members through digital channels.

2. New Member Acquisition Predicts Future Success

BJs new member acquisition increased 28% yoy in Q2, following a 40% yoy increase in Q1. The increases were, unsurprisingly, driven by digital:

The chain acquired 30% of its members through digital channels in Q1. Pre-pandemic, that number was in the 10-12% range.

The beauty of the membership business model is that many – probably most – of those new customers will turn into long-term BJs members. The company’s value proposition is excellent; at just $55 or $110 for a 12-month membership, it’s easy for customers to save enough money to justify re-upping at renewal time.

3. BJs is Appealing to Millennials

Millennials love spending money on their health. So, BJs is turning its focus to organic foods. BJs hasn’t traditionally made organic foods a priority but noted that it’s “important for the long-term.” The early results have been promising.

BJs is also making a play in the fitness equipment space. I’m not too optimistic about this move; it’s a crowded market and I think the home workout trend is going to (mostly) die with the coronavirus. But it can’t really hurt, and it can be a minor attraction to millennials and older customers alike.

4. Same-Day Delivery Makes BJs Future-Proof

Nobody wants to wait for anything anymore, so same-day delivery is becoming more of a necessity than a bonus for customers.

BJs same-day delivery business has turned into a growth driver. On the Q2 earnings call, CFO Bob Eddy noted, "About three-quarters of the Q2 growth in digitally-enabled sales was driven by same-day delivery and buy online, pickup in club, or BOPIC."

5. BJs is Buying Back Shares Again

During the early days of COVID-19, when BJs feared a sustained slowdown, the company opted to pause its stock buyback program.

Now that business is booming, BJs is buying back shares again. The chain bought back $34.1 million of shares in Q2. The program isn’t a make-or-break factor for BJs shares, but it’s a nice tailwind.

The Final Word

BJs has a lot going for it, and if this vaccine comes through, the company is not going to struggle. Far from it.

The valuation is also attractive relative to its peers. I love me some Costco NASDAQ: COST, but it ain’t cheap at 39.9x forward earnings. BJs isn’t going to make you rich, but solid returns are likely. Look to get in before the value becomes apparent to the rest of the market.

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.