Bloom Energy Today

BE

Bloom Energy

$18.14 +0.88 (+5.10%) As of 03:59 PM Eastern

- 52-Week Range

- $9.02

▼

$29.83 - Price Target

- $22.97

The artificial intelligence (AI) revolution is sparking the growth of data centers. Data centers require lots of power and stable backup power to operate efficiently. Data Centers now consume nearly 3% of global electricity. Bloom Energy Co. NYSE: BE is a clean energy solutions provider selling solid oxide fuel cells (SOFCs), hydrogen and electrolyzers. The company’s flagship product is the Bloom Energy Server, also referred to as a Bloom Box, which uses natural gas or biogas to generate clean energy on-site. The company gained much credibility when Alphabet Inc. NASDAQ: GOOGL Google was an early customer using 400kW installation of Bloom Boxes to help power Google’s headquarters.

Bloom Energy operates in the oils/energy sector and competes with clean energy providers, including Plug Power Inc. NASDAQ: PLUG and Fuel Cell Energy Inc. NASDAQ: FCEL.

Bloom Energy’s Solid Oxide Fuel Cells (SOFCs) May Hold the Greatest Potential

Bloom Energy’s core product is SOFCs, the fastest-growing fuel cell segment. SOFCs are devices that convert hydrogen, natural gas, biogas, or blends of the fuels into electricity. SOFCs generate power through Bloom Boxes. The electrolyte in SOFCs is a solid ceramic material. Special proprietary inks coat the electrolyte, and the anode (negative electrode) and the cathode (positive electrode) are sandwiched around it to undergo an electrochemical reaction that produces an electric current. No corrosive acids, protective metals, or molten materials are used to create Bloom's SOFCs.

SOFCs Are the Core Components of Bloom Boxes

SOFCs have been deployed in hundreds of applications across various industries, including healthcare, data centers, retailers, and critical manufacturing. They generate combustion-free, emissions-free, and carbon-free electricity. Their solid oxide electrolyzer is constructed on the same platform as their energy server. Bloom claims it’s the most efficient electrolyzer for creating affordable carbon-free hydrogen. SOFCs are the smaller and first component in the Bloom Box. They are combined to create a fuel cell stack. Multiple stacks create a Bloom Box. A 200 kW to 300 kW energy server can be formed by stacking 4 to 6 Bloom Boxes, which is the size of half of a standard 30-foot shipping container.

Bloom Boxes and AI Data Centers Are a Match

Bloom Energy has a track record of supporting data center power needs. They have over 300 megawatts of contracted or deployed orders. As data centers continue to grow, Bloom Energy can benefit from the power needs they require. On May 9, 2024, Bloom Energy announced a power capacity agreement with Intel Co. NASDAQ: INTC, resulting in the largest fuel cell-powered high-performance computer data center in Silicon Valley.

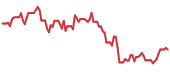

BE Stock is in a Bearish Ascending Triangle Pattern

The daily candlestick chart for BE depicts a descending triangle pattern. The upper descending trendline starts at the $18.14 swing high, capping bounce attempts at lower highs to the lower flat-bottom trendline at $12.51. The daily relative strength index fell to the 41 band. Pullback support levels are at $12.51, $11.19, $9.12, and $7.49.

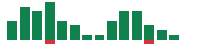

Bloom Energy Short Circuits on Its Q1 2024 Results

Bloom Energy reported a Q1 2024 EPS loss of 17 cents, missing consensus estimates by 5 cents. Revenues fell 14.5% YoY to $235.2 million, missing $249.24 million consensus estimates. Gross margin fell 3.5% to 16.2%. Operating loss was $49 million, an improvement from the year-ago period loss of $63.7 million. Non-GAAP operating loss was $30.7 million, a $3.4 million improvement from the year-ago period.

Bloom Energy MarketRank™ Stock Analysis

- Overall MarketRank™

- 85th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 26.6% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -1.26

- News Sentiment

- 0.78

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- Growing

See Full AnalysisBloom Energy Reaffirms Guidance

The company reaffirmed full-year 2024 guidance, with revenues of $1.4 billion to $1.6 billion versus $1.49 billion consensus analyst estimates. Gross margins are expected to be around 28%.

Bloom CEO Sees Strong Growth Opportunities

Bloom Energy Founder and CEO KR Sridhar commented, “We are seeing strong market interest, increasing momentum, and robust commercial activity across diverse end markets.”

Sridhar continued, “In addition to data centers, we view AI hardware supply chain industries as a good growth opportunity for Bloom, both in the US and Asia. Our customer wins on islanded-power mode without the need for grid interconnection, demonstrates an ideal solution for customers seeking time-to-power advantages."

Bloom Energy analyst ratings and price targets are at MarketBeat.

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.