School bus manufacturer

Blue Bird Corporation NASDAQ: BLBD stock has weathered the recent sell-off in the

electric vehicle (EV) sector. They are recovering from the

pandemic effects from school closings. While the Company has been a major player in the school bus industry, they also have a robust electric bus pipeline that has already delivered over 400 electric school buses to date. Blue Bird is the only school bus maker that produces and sells

EV versions of all three school bus body configurations. Blue Bird is in a unique position to benefit from the EV revolution and the back-to-school reopening trend. The Company is not a start-up or a

concept EV company or SPAC, they are an operating company generating nearly a billion in annual revenues. Prudent investors seeking exposure in a stable dual narrative tailwind play in the EV industry can watch shares of Blue Bird for opportunistic pullback levels.

Q1 2020 Earnings Release

On Feb. 10, 2021, Blue Bird released its fiscal first-quarter earnings report for the quarter ending in Jan. 2, 2021. The Company saw diluted earnings-per-share (EPS) loss of (-$0.06) per share versus (-$0.02) in the prior year comparable period. The Company had 1,255 units sales compared, down (-205) units year-over-year (YoY). GAP net loss was $1.6 million, down (-$1.2 million) YoY. Adjusted EBITDA was $5.8 million, which was (-$2.2 million) YoY. Adjusted net income was $0.1 million versus (-$2 million) YoY. Naturally, the effects of the pandemic impacted the financials, but as schools reopen, metrics are set to improve. The Company increased average selling price per bus by 2% YoY or $1,600 in Q1 2021.The transition to single shift production schedule in Q3 2020, drove quality and efficiency generating the same daily efficiency as two shifts. The alternative-powered bus sales mix improved to 46% versus 39% in the prior year. The interest in electric buses was “unprecedented” as fiscal 2021 booking grew 24% YoY. The Company is increasing its focus and resources on the EV business stating, “As COVID-19 vaccinations accelerate, coupled with the new administration’s commitment to open schools within 100 days of term start, we are confident that an industry rebound is in sight.” Blue Bird confirmed previous FY 2021 guidance of net revenues between $750 million to $975 million with Adjusted EBITDA between $40 million to $65 million and Adjusted Free Cash Flow of (-$5 million) to $20 million.

Conference Call Takeaways

Blue Bird CEO, Phil Horlock set the tone, “One fact is clear, when schools are closed, buses aren’t being orders. The good news is that when schools are open, it’s business as usual, with school bus orders being places. That’s great for us to know moving forward… it’s our expectation that the industry recovery will begin in the second half of fiscal 2021 in support of the next school year start.” The Company was number one in trailing 12-month market share for both electric and propane powered buses. CEO Horlock pointed out, “We’re excited with the comments made by the new administration on support the electrification of 500,000 school buses that transport our children every day.” Blue Bird will be offering its electric chassis to the Class 3 through Class 7 markets, “Now this is a new business opportunity for us that we will launch later in 2021 and is an obvious outcome from having the broadest range of alternative private chassis in the business led by zero emissions and low emissions propane products, all of which I should remind you are built in our factory.” Fiscal year-to-date, the Company has 107 electric bus orders sold or in firm order backlog which is up 24% YoY. CEO Horlock notes that it’s “just the beginning for electric vehicles.” This underscores the momentum the Company has regained moving forward.

EV Hub Wheels

This is the dawn of the recovery for schools, as the CEO noted that schools will be placing orders for the next school year as in-class learning resumes with re-openings. It’s also the dawn of its EV business as bookings gain momentum and the rollout of its EV chassis business launches in H2 2021. Prudent investors can stay alert for opportunistic pullback levels to gain exposure on this dual tailwinds play.

BLBD Opportunistic Pullback Levels

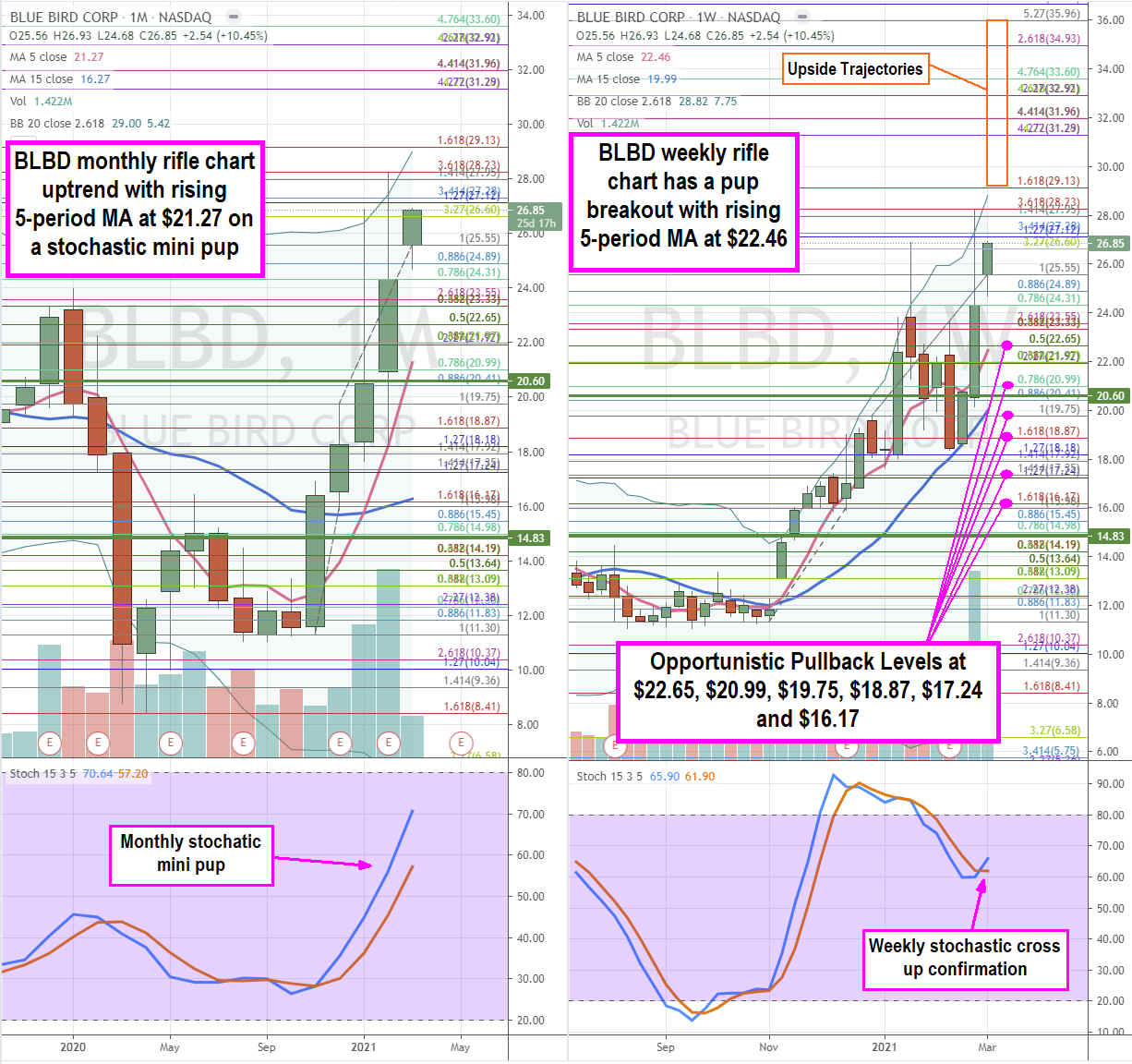

Using the rifle charts on the monthly and weekly time frames provides a broad view of the landscape for BLBD stock. The monthly rifle chart is uptrending with a rising 5-period moving average (MA) support at $21.27 and the monthly upper Bollinger Bands (BBs) near the $29.13 Fibonacci (fib) level. The monthly stochastic mini pup triggered on the market structure low (MSL) above $14.80. The weekly rifle chart formed a pup breakout with a rising 5-period MA support at $22.46 and a 15-period MA at $19.99. The weekly stochastic crossed back up to confirm the pup breakout. A daily MSL buy triggered above $20.60.

Prudent investors can look for opportunistic pullback levels at the $22.65 weekly 5-period MA/fib, $20.99 fib, $19.75 fib, $18.77 fib, $17.24 fib, and the $16.17 fib. The upside trajectories range from the $29.13 fib up to the $35.96 fib.

Before you consider Blue Bird, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Bird wasn't on the list.

While Blue Bird currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.