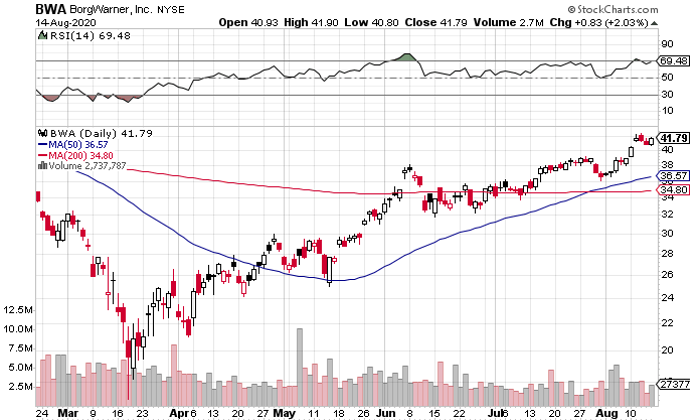

BorgWarner NYSE: BWA shares are now trading above pre-pandemic levels, after completing a V-shaped recovery, basing for a couple of months, and then breaking out.

While some companies’ numbers have improved since the onset of the pandemic, leading to increases in their share prices, BWA has occupied the other end of the spectrum.

In BorgWarner’s recently released Q2 earnings, the auto parts supplier reported $1.4 billion in sales, down around 43% organically yoy. And even though business is expected to improve in the second half, BWA’s revenue is still expected to dip in Q3 and Q4 yoy.

But the numbers beat expectations, and shares increased by around 4% on the announcement.

The overall outlook for BWA shares is good… But there are still short and long-term headwinds.

Weakness Across the World

While production is expected to improve over the second half of the year, BWA is still expecting double-digit declines over the next six months. CEO Frederic Lissalde talked about the full-year global outlook on the Q2 earnings call:

“We expect the market decline to be in the minus 22% to minus 25% range compared to our prior expectation of a 25% to 31% decline. Looking at this by region, we're planning for Europe to be down in the 26% to 28% range. And in North America, we expect a 24% to 27% decline. On a relative basis, the outlook for China is stronger where we still expect 13% to 15% decline for the full year.”

New Car Sales May be Soft Moving Forward

BorgWarner sells its products to original equipment manufacturers, which means that new car sales increasing is good for business… But a preference for used cars over new cars is bad for business.

Unfortunately, there are short and long-term trends working against new car sales.

In the short-term:

With all the job losses and economic uncertainty, many people have been hesitant to buy new cars, opting to purchase used cars instead.

And in the long-term:

The average lifespan of a car was 10 years in 2007, but in 2019, it had increased 18% to 11.8 years. So even before the onset of the pandemic, people were getting more life out of their cars.

But Cash Flow is Still Very Strong

Considering all the challenges of Q1 and Q2, BWA’s cash flow over the first six months of 2020 was nothing short of remarkable. CFO Kevin Nowlan offered some color on it during the Q2 call:

“During the first half of 2020, we generated $156 million of free cash flow, which we view as a tremendous achievement in such difficult markets. And as you can see on the slide, we expect the trend of positive free cash flow generation to continue with $300 million to $400 million of free cash flow for the full year. This implies approximately $150 million to $250 million of free cash flow in the second half, despite the working capital investment needed to fund the production ramp-ups and the sequential increase in capital spending in the second half.”

It's easy to see why investors are so optimistic about BWA in the face of all the short-term struggles. If cash flow is this good during a crisis, how will it look when the economy markedly improves?

And while there are some reasons for pessimism on new car sales, traffic is already returning to pre-pandemic levels, which bodes well for both new and used car sales.

Furthermore, BWA is trading at just 12.5x projected 2021 earnings and .88 projected 2021 sales.

Look For a Slight Pullback

BWA shares are a bit extended in the near-term, up around 15% over the past few weeks and flirting with overbought territory on the RSI.

On the other hand, the 50-day moving average crossed over the 200-day moving average a few weeks ago, which is the sign of an emerging uptrend.

I’d look for a pullback to the $38-39 range before getting in. This would take shares back to the breakout point from the recent two-month base, and the 50-day moving average should meet (or at least be close to) BWA by the time it gets there.

The Final Word

Downturns are often a good time to buy excellent companies at a discount. You want to buy a company that is:

- Well-positioned to weather the storm

- Outperforming expectations

- Trading at an attractive long-term valuation

BorgWarner satisfies all three of these conditions; look to get in when the time is right.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.