Boston Scientific Co NYSE: BSX is a global medical device manufacturer that’s seeing a strong influx of investors as shares grind to new all-time highs. The company has a vast portfolio of devices to diagnose and treat medical conditions. The medical technology (medtech) company benefits from the aging population and the chronic diseases that come with it.

Acquiring Silk Road Medical for $1.5 Billion

Boston Scientific Today

BSX

Boston Scientific

$95.08 -0.17 (-0.18%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $66.80

▼

$107.17 - P/E Ratio

- 76.06

- Price Target

- $110.22

The company has grown through research dev, development, and acquisition. Boston Scientific announced its acquisition of medical device maker Silk Road Medical Inc. NASDAQ: SILK for $27.50 per share or $1.1 billion, which is expected to close by year’s end. Silk Road Medical's platform of products helps prevent stroke among patients who have carotid artery disease.

Boston Scientific operates in the medical sector with medical device manufacturers, including Medtronic plc NYSE: MDT, Stryker Co. NYSE: SYK, and Zimmer Biomet Holdings Inc. NYSE: ZBH.

MedSurg Segment Generates 36% of Total Revenue

Boston Scientific's portfolio of products is expansive. However, their business is mainly comprised of two segments, MedSurg and Cardiovascular. MedSurg is short for medical surgery. The segment generates 36% of total revenue. MedSurg devices are used for interventional surgery procedures. It encompasses a wide range of specialties in treating pulmonary, gastrointestinal, urological, gynecological, radiological, neurological, electrophysiological, critical care, and vascular surgery. The segment reported 8% YoY organic growth in net sales to $1.483 billion in the second quarter of 2024. Adjusted operating margin improved 60 bps to 34.6%.

Cardiovascular Segment Is Driving Growth, Generating 64% of Total Revenue

The Cardiovascular segment generates 64% of total revenue. This segment includes devices like pacemakers, implantable cardioverter defibrillators (ICDs), diagnostic and balloon catheters, 3D mapping systems, stents, atherectomy devices, valve repair and replacement systems, and peripheral vascular intervention (PAD) devices. The Cardiovascular segment posted 19% YoY organic growth to $2.637 billion. Adjusted operating margin rose 250 bps to 28.9%.

Q2 2024 Performance Crushed Consensus Estimates

Boston Scientific had a robust second quarter of 2024. The company reported EPS of 62 cents, beating consensus analyst estimates by 4 cents. Revenues impressed investors by rising 14.5% YoY to $4.12 billion, exceeding consensus estimates of $4.02 billion. The United States continued to report the most growth at 16.9% YoY. Europe, Middle East, and Africa (EMEA) saw 13.7% reported growth. Latin America and Cuba (LACA) reported 15.3% YoY growth. Asia-Pacific (APAC) generated 7% reported growth.

Boston Scientific expects its Cardiovascular segment to continue its growth stride. Its POLARx and WATCHMAN FLX Pro Left Atrial Appendage Closure devices received robust market responses after FDA approval in 2023. They should continue to drive sales in 2024. Its FARAPULSE Puled Field Ablation System is also expected to accelerate growth after being approved in January 2024. Growth is expected to continue strongest in the United States, which contributes 41% of total company revenues.

Boston Scientific Raises the Bar With Upside Guidance

Boston Scientific Stock Forecast Today

12-Month Stock Price Forecast:$110.2215.92% UpsideBuyBased on 23 Analyst Ratings | Current Price | $95.08 |

|---|

| High Forecast | $130.00 |

|---|

| Average Forecast | $110.22 |

|---|

| Low Forecast | $90.00 |

|---|

Boston Scientific Stock Forecast DetailsThe company expects net sales for the third quarter of 2024 to grow 13% to 15% year over year and adjusted EPS between 57 cents and 59 cents.

Boston Scientific issued upside guidance for the full year 2024. It sees EPS between $2.38 and $2.42 versus $2.33 consensus estimates. Revenues are expected to grow 13.5% to 14.5% YoY, or $16.162 billion to $16.305 billion, exceeding $16.02 billion consensus estimates.

Boston Scientific Chairman and CEO Michael Mahoney spoke at an industry healthcare conference on Sept. 4, 2024. Mahoney has been at Boston Scientific for 12 years and states there's "never been a more exciting time for the company." The company went from a 0% weighted average market growth rate (WAMGR) to 8%, thanks to its portfolio selection.

WATCHMAN and FARAPULSE Are 2 Disruptive Growth Drivers

Mahoney attributes much of this to the dominant size of electrophysiology (EP) markets and, notably, its WATCHMAN device in its structural heart portfolio. EP helps to identify irregular heart rhythms and delivers energy to correct them. WATCHMAN devices are used to close off the left atrial appendage (LAA), reducing the risk of clots traveling to the brain to cause a stroke.

According to Mahoney, FARAPULSE devices are an "absolute homerun." They've transformed one of the biggest markets in MedTech as a disruptor. These devices treat heart rhythm disorders caused by atrial fibrillation (AFib). Notably, they are used in Pulse Field Ablation, which uses short, high-voltage electrical pulses to create a targeted electrical field that locks in on the specific heart tissue, causing the abnormal rhythm.

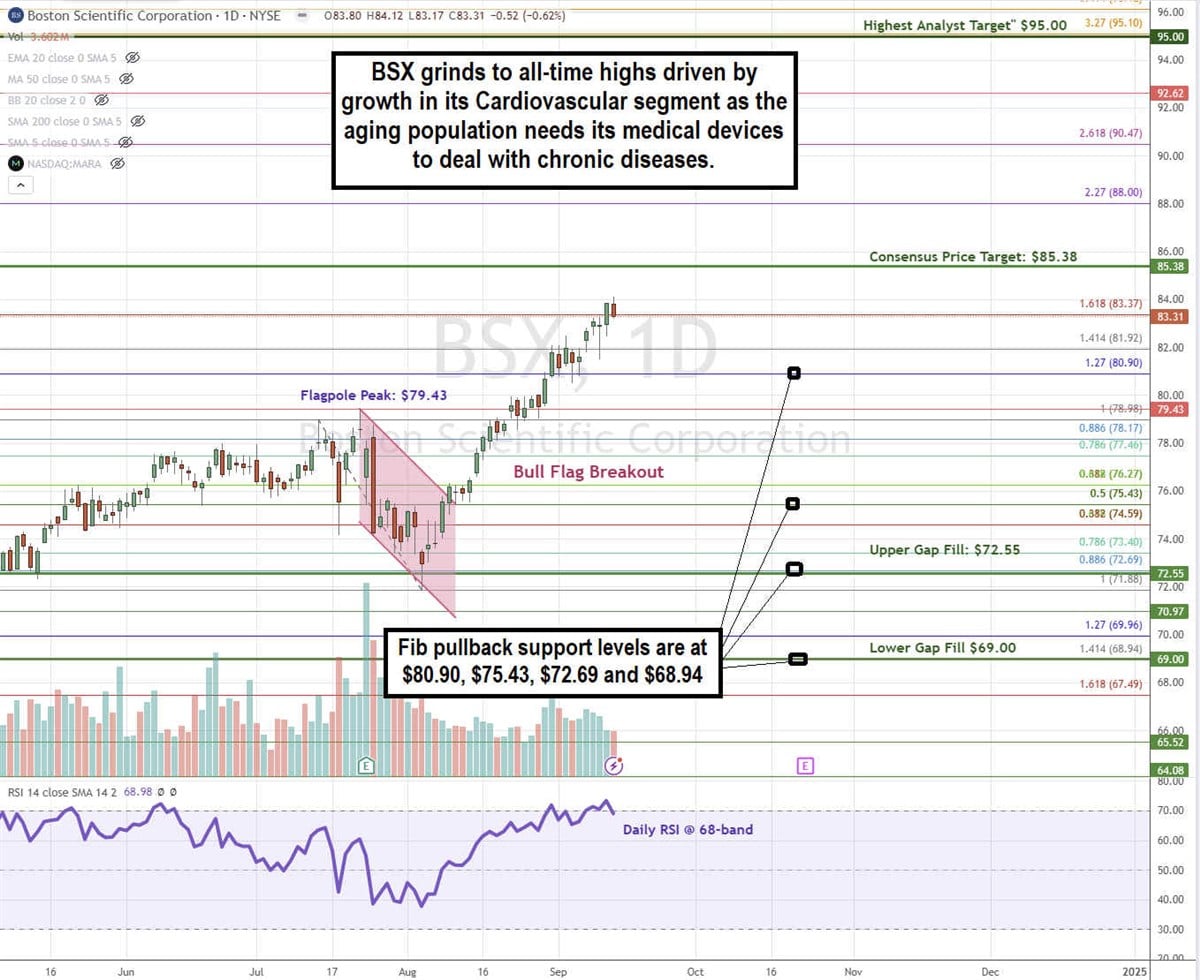

BSX Stock Is in a Bull Flag Breakout

A bull flag pattern is comprised of a sharp rise that peaks and pulls back with parallel upper and lower trendlines forming a flag. When the stock surges through the upper descending trendline, it triggers the bull flag.

BSX triggered the bull flag breakout through the upper descending trendline resistance at the $75.43 Fibonacci (Fib) on Aug. 9, 2024. BSX has been grinding higher towards its consensus price target of $85.38. The daily relative strength index (RSI) has been rising in a choppy manner to and around the overbought 70-band. Fib pullback support levels are at $80.90, $75.43, $72.69, and $68.94.

BSX’s highest analyst price target is at $95.00.

Actionable Options Strategies

Bullish investors can await pulls towards the flagpole peak area by using cash-secured puts at the Fib pullback support levels to buy the dip. If assigned the shares, writing a covered call at upside Fib levels executes a wheel strategy for income since there is no dividend.

A Poor Man’s Covered Call (PWCC) strategy is a cheaper way to generate income by buying deep-in-the-money (ITM) back-month calls and selling out-of-the-money (OTM) front-month calls. For example, a long $72.5 call expiring Jan. 14, 2025, and a short $87.5 call expiring Oct. 11, 2024.

Before you consider Boston Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Scientific wasn't on the list.

While Boston Scientific currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here