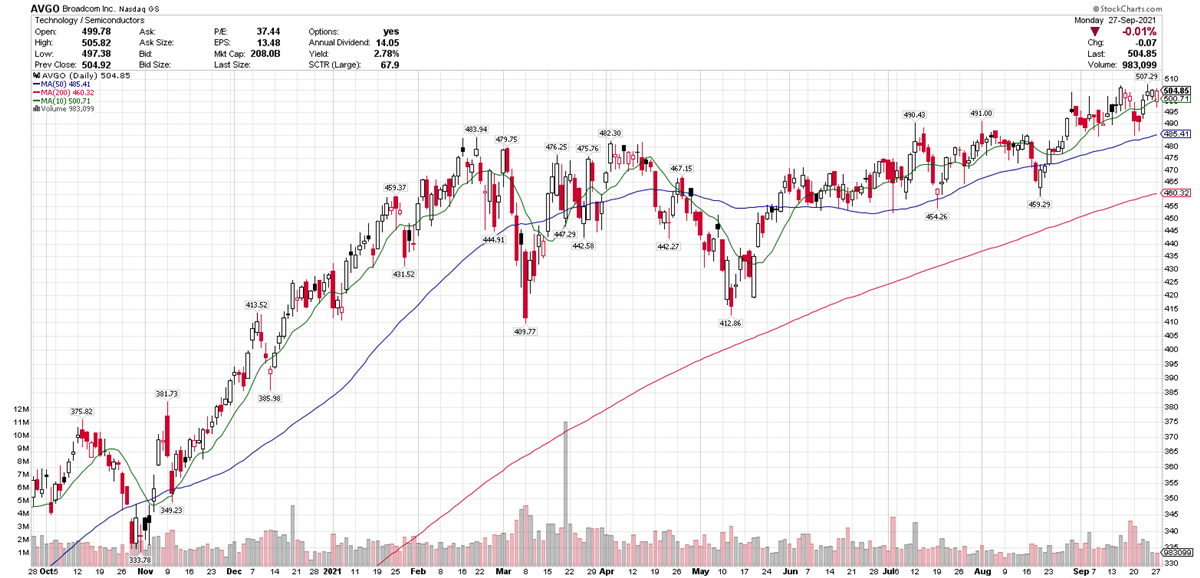

You might not realize this even by looking at its chart, because it’s happened in such a quiet, gradual fashion, but chipmaker

Broadcom NASDAQ: AVGO is trading at all-time highs.

Shares are up 5.63% in the past month, 8.18% in the past three months and 17.78% year-to-date.

Earlier this year, the stock slipped 15% below its February high of $495.14, to a low of $419.14 on May 12. There was no dramatic breakout, accompanied by heavy volume and a fast uptrend.

Instead, the stock hit resistance just below $495 in July and August, before finally bolting to $507.85 on August 30. It reversed lower in the next two sessions ahead of the company's third-quarter report. Following that report, shares climbed to $506 on September 3. They retraced most of those gains but finished higher in the session.

The stock has been trending along its 10-week average since late May. It dipped below that line a couple times but rebounded quickly. It was almost stealthy in its move higher, advancing slowly higher in each month since May.

Revenue and earnings both grew in the past eight quarters. Revenue growth accelerated for six quarters in a row, from 1% to 16%. In the most recent quarter, revenue was $ 6.778 billion.

Earnings in the most recent quarter came in at $6.96 per share, up 29% from the year-ago quarter. On a yearly basis, earnings grew in each of the past six years.

Analysts Have High Hopes

Next year, analysts see earnings of $27.92 per share, a gain of 26% year-over-year. Wall Street is eyeing an 11% increase in 2022, to $31.07 per share.

Those estimates were revised higher recently.

Analysts' consensus rating on Broadcom is "buy," with a price target of $554.80, representing a 9.89% upside.

Since the earnings report on September 2, 14 analysts boosted their price target on Broadcom, according to MarketBeat data. One, Jefferies Financial Group, reiterated its buy rating with a price target of $590.

Since the earnings report, the stock is up 2.6%. Shares closed Monday at $504.84, down $0.07, or 0.01%.

There was much for investors to cheer in the report. In the release, president and CEO Hock Tan cited business units that were revenue drivers in the quarter.

"Broadcom delivered record revenues in the third quarter reflecting our product and technology leadership across multiple secular growth markets in cloud, 5G infrastructure, broadband, and wireless," he said. "We are projecting the momentum to continue in the fourth quarter."

That statement was backed up with the company's fourth-quarter guidance. Broadcom expects revenue of approximately $7.35 billion; and expects fourth-quarter adjusted EBITDA of approximately 61% of projected revenue.

The adjusted EBITDA margin in the third quarter was also 61%. That's up from 57% in the third quarter of 2020.

In the earnings conference call, CFO Kirsten Spears gave some specifics about what's driving margin. She cited the semiconductor solutions segment, where margins were about 70% in the quarter, driven by more next-generation products in broadband and networking.

Gross margins for infrastructure software were 90% in the quarter.

Constraints And Shortages

As to the question of the well-documented semiconductor shortage, Tan said, "Supply is always something that is very much an issue of constraint in this environment, as you well know. But the other side of the picture is we rallied shipping." He reiterated something he said in earlier calls: Broadcom is shipping exactly to meet demand.

"We are trying very hard not to over-ship and end up building pockets of excess inventory within our ecosystem. So I think we're managing very much to what we see out there," he added.

When it comes to the company's capacity for 2022, Tan said Broadcom has "a pretty good supply availability lineup for 2022. And we feel pretty OK about that. I won't say great, but in this environment, all things considered, we're feeling quite good."

That's probably about as confident a statement as a CEO can make, given the multitude of constraints facing the chip industry these days.

So is Broadcom a buy right now? Despite its recent climb, the stock is up less than 2% from its buy point of $495.14. In that sense, it's definitely still in buy range. The biggest caveat is choppiness and uncertainty in the wider market or in the tech sector, which could stymie further price appreciation.

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report