It was Baron Rothschild who, in the 1800s, famously said that ‘the time to buy is when there’s blood in the streets’. The

Oracle of Omaha obviously follows a different investing methodology as he announced over the weekend that he had dumped his massive stakes in four major airlines. The news was a kick in the teeth to investors as Warren Buffett is one of the world’s leading and most admired investors. The fact that he's throwing in the towel on an industry that’s already been battered from the coronavirus pandemic will be causing many on Wall Street who are still long to rethink their decisions.

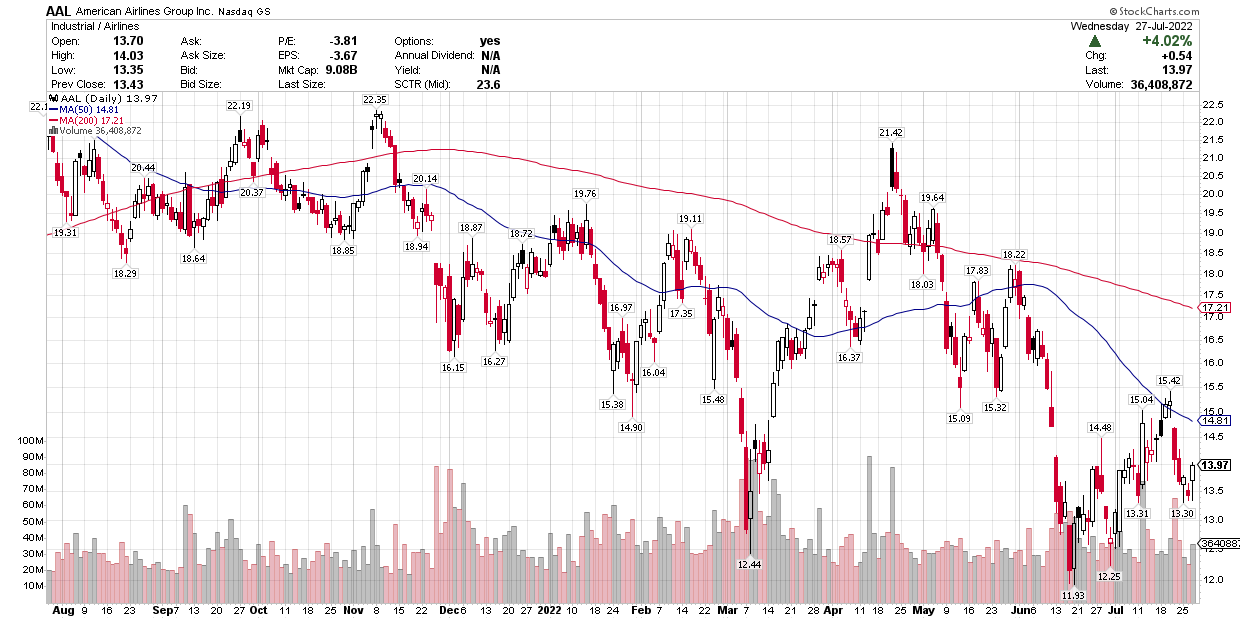

Having staged a modest recovery off the lows of March, the four names he owned, and the broader industry, saw heavy selling once again in Monday’s session. American Airlines (NASDAQ: AAL) finished the day down almost 8%, having at one point fallen more than 30% from last week’s levels. Delta Airlines (NYSE: DAL) and United Airlines (NASDAQ: UAL) traded much the same as American while Southwest Airlines (NYSE: LUV) was sent down to fresh lows and back to 2014 levels.

Hard Hit

The travel industry was one of the first to be hit as COVID-19 took hold of the world's economy in late January and took the heaviest beating in the weeks afterward. As travel bans, shelter-in-place orders, and isolation restrictions were put in place seemingly overnight, air traffic dried up. It’s interesting that Buffett has waited until recently to dump the stocks when many are starting to think that the worst might have passed. Gary Kelly, CEO of Southwest, was only saying on Sunday that he felt it was safe to travel again and that their business was already starting to pick back up. These were bullish words from a man whose company had reported their first quarterly loss in nine years last month.

On top of that, the Trump administration had already committed to a $25 billion bailout of the industry, in effect saying they were too big to fail. However, the fact that much of this bailout will involve loans that the airlines are required to pay back, could have been the final straw for a man who’s famous for his ability to pick winners. The billions of dollars in fresh debt that they’re now saddled with ‘takes away from the upside’, Buffett said.

It’s also worth noting that his company, Berkshire Hathaway had a lot of skin in the game and some are scratching their heads as to why they were so exposed to a single industry. At the end of 2019, his company Berkshire Hathaway was already the largest single holder of Delta’s stock and the second-largest holder of the other three. As huge Q1 losses from the individual airlines were reported in recent weeks, there must have been some tough conversations happening in Omaha. But having seen his entire investment thesis and bull argument flipped on its head in a matter of weeks, it has to be said that he’s had the discipline to get out of the trade.

Getting Involved

Does that mean that no one should be buying airline stocks now? Absolutely not. For investors who only recently got involved or those still on the sideline, Buffett’s announcement could be the signal that many look back on in years to come as the time to buy. The extra wave of unexpected selling has put many stocks trading at prices they saw before the Trump administration's bailout promise.

We’re also seeing restrictions being eased nationwide and internationally as many countries look to have turned a corner in the fight against the virus. There’s less uncertainty now than there was a month ago and while there’s surely still plenty of pain to be felt in the industry, for the long term investor there’s a buying opportunity at hand.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.