The Home Builders have been on a tear in 2019. The SP Homebuilders ETF (XHB) rising more than 50% from the December 2018 low to lead the broader market higher. The strength is driven by expanding activity within the construction industry and there is no end in sight.

U.S. housing data came in better than expected for October and point to ongoing expansion in the sector. Building Permits figure, a leading indicator of activity, is up 5.0% from the previous month and 14.1% YOY. Building Permits and suggests solid increases in building activity are coming. The only negative in the report is the Housing Starts figure but that's OK, Housing Starts are a lagging indicator. The Housing Starts figure came in slightly below estimates but is still positive at 3.8% MOM and 8.5% YOY.

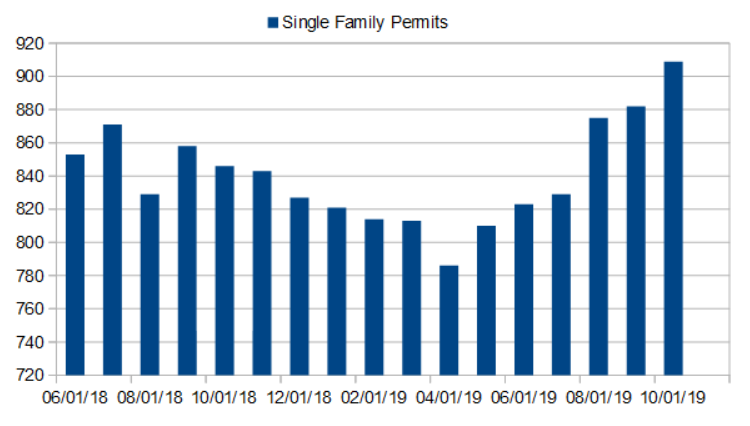

While not as robust as the headline data, the single-family Permits and Starts figures are also on the rise. Single-family permits are up 3.2% for the month and at the highest level in over three years, single-family starts are likewise showing strength.

The Outlook For Construction Activity Is Solid

The data is good news for the builders in general and the homebuilders in particular. Single-family starts and permits had been dragging on overall construction activity until earlier this year. The FOMC's decision to pare back on interest rates opened the door to a generation of home buyers and demand is far from satisfied.

A look at the November NAHB Housing Market Index echoes this sentiment. The index headline figure fell one point last month but that's off a 3-year high. Within the report sales of single-family homes have been rising all year and is also hanging at a +2-year high. The most compelling figure, the 6-month outlook for single-family home sales, advanced a point this month to hit a fresh +2-year high.

As if this isn't enough to convince markets that homebuilders will be strong in 2020, Fannie Mae just increased its 2020 GDP outlook based on strength in the housing sector. Fannie Mae is now expecting the U.S. GDP growth in the range of 1.9% According to them, growth might be more robust if not for supply-constraints on the market. What this means for the homebuilders is a virtual guarantee that new homes will be purchased as quickly as they are built.

“Housing should also continue to function as a positive contributor to growth in the near term, as indicated by both new and existing single-family home sales advancing in the third quarter, as well as pending home sales, permits, and starts. However, persistent supply and affordability constraints continue to hold back household formation, inhibiting housing market activity.”

The Technical Outlook Is Mixed

Earnings reports from the big-three homebuilders were a bit mixed for the 3rd quarter but they all had one thing in common; backlogs of orders are on the rise. With 2019 revenue and EPS down from the previous year, this sets the industry up to produce moderate to strong YOY revenue gains in 2020. Couple this with November's housing data and the odds that 4th quarter revenue and earnings will beat consensus start to look compelling.

On a technical basis, the XHB Homebuilders ETF is approaching a near-two-year high. The price action over the past few weeks suggests consolidation is in process with resistance to higher prices at the $46 level. The indicators are bearish and point to a retest of support at the short-term 30-day EMA but do not yet indicate a reversal in-process. Provided support holds it is likely the Homebuilders will continue to move sideways while the market waits to see if the promise of future home builder profits plays out.

Is The Homebuilders ETF A Buy?

Based on the outlook for sales the Homebuilders are looking at modest to moderate revenue and EPS growth in 2020. Based on the charts the expectation for 2020 revenue and EPS growth may already be baked into the cake. With that in mind, new money may want to sit on the sidelines until the market begins to make its next move higher.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.