The Dow hit 30,000 for the first time yesterday and the S&P 500 surged more than 1.6%. But this wasn’t a day where there was green across the board.

Many of yesterday’s winners were companies that have struggled during the pandemic, but expect to turn it around once a vaccine becomes widely available: Delta Air Lines NYSE: DAL, Planet Fitness NYSE: PLNT, and Wynn NASDAQ: WYNN were a few winners.

Many of yesterday’s losers, on the other hand, were companies that have thrived in 2020 but face questions about their ability to prosper in a post-COVID world: Peloton NASDAQ: PTON, Wayfair NYSE: W, and Freshpet NASDAQ: FRPT are a few examples.

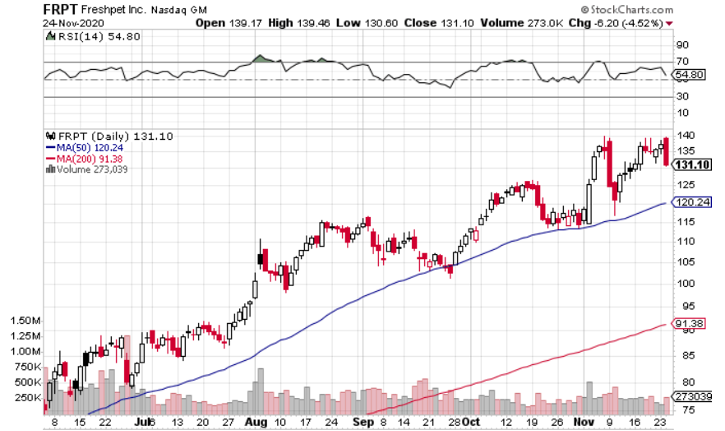

There wasn’t any game-changing vaccine news yesterday, so the moves were a bit puzzling, but it’s a good opportunity to take advantage of discounts in high-flying names. Freshpet, down around 4.5% yesterday and a company that I’ve liked for a while, drew my eye.

Back on August 31, I recommended getting into Freshpet on a pullback to the 50-day moving average. That situation came to fruition a few weeks later; if you caught that opportunity, you have some nice gains right now.

Since my last analysis, Freshpet reported Q3 earnings. In light of the report, let’s re-examine the company, before deciding if it’s still worth buying.

Q3 Shows that Freshpet is Still on Track

Freshpet’s Q3 numbers were solid but not spectacular. Revenue growth of 29% yoy and full-year guidance of $322 million in revenue were both broadly in line with expectations.

It’s often not enough for high-flying growth stocks to merely meet expectations – Freshpet is trading at 16.5x forward sales and 445.7x forward earnings, after all – so the stock dipped nearly 5% after-hours. But shares rebounded the next day, closing up nearly 6%.

I can’t pinpoint the exact reasons for the sell-off and quick turnaround, but I’d say it’s the realization that Freshpet has a lot of growth ahead. Whether it grows at 29% or 35% in one quarter may not matter much in the grand scheme of things.

Still Adding Fridges

Freshpet’s business model, which involves providing branded fridges and coolers for retailers, gives it a heck of an economic moat. Well, Freshpet continued to add fridges in Q3. The company:

- Still expects to get its fridges into 1,000 net new stores in 2020.

- Added 565 second fridges in Q3.

- Upgraded 417 fridges in Q3.

Again, most retailers aren’t going to put several pet food fridges in their stores. Or switch them based on the flavor of the day. Once Freshpet is in, Freshpet is in.

Long-Term Opportunity is Massive

Some of my favorite investment ideas are companies that can see explosive revenue growth for longer than you expect. I can see Freshpet turning into one of those companies.

Back in August, I provided some statistics that show how much people are spending on their pets and how much those amounts have grown over time. To further quantify the opportunity in front of Freshpet, we can turn to the transcript of the Q3 earnings call. CEO Billy Cyr talked about favorable demographics:

“We took a deeper look at who the new users were who joined the Freshpet franchise in the post-COVID period and we're encouraged to see that they were younger, skewing toward millennials and Gen Z, ethnic, unmarried and urban.”

Freshpet’s customers are the opposite of aging-out – they’re only becoming a larger part of the consumer base.

Cyr also addressed the discussion about increased pet adoptions:

“Whether there are 63 million households with a dog or 65 million, we were only in 3.8 million households. The untapped opportunity is enormous either way.”

This goes back to my earlier point:

Should investors really be obsessing over a few percentage points of growth? Or should they instead think about Freshpet’s ability to grow at 20%+ for many years to come?

I’d say the latter. And I like the chances of that actually happening.

The Verdict

To answer the question posed in the headline: Yes, buy the dip on Freshpet. Shares could certainly pull back a bit more, but it’s more important to get into Freshpet – even if you pay a few points extra – than to risk missing out on an incredible growth story.

Before you consider Freshpet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshpet wasn't on the list.

While Freshpet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here