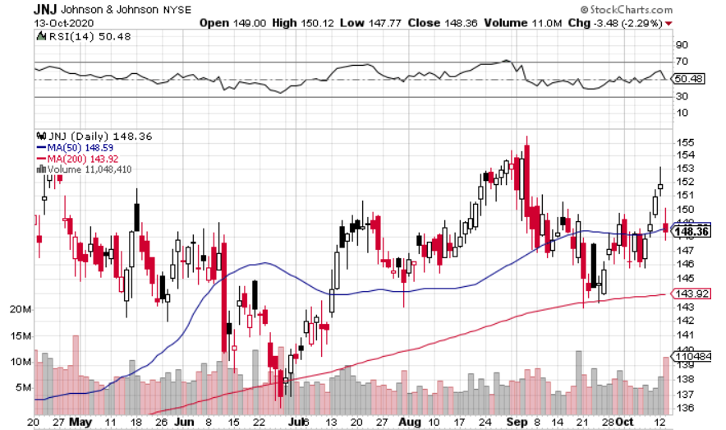

Johnson & Johnson NYSE: JNJ reported its Q3 results before the bell yesterday and the numbers looked great

and beat expectations. But shares dipped more than 2% in yesterday’s session.

Though the whisper numbers could have been a bit higher than the published estimates, I’m not sure if that was the case. There was a clear culprit, however:

Johnson & Johnson halted its COVID-19 vaccine trials after one of its patients fell ill. A couple of weeks ago, I talked about JNJ’s vaccine. Though I struck a bullish tone on its vaccine progress, I acknowledged the inherent uncertainty and said that even if JNJ doesn’t make much from its COVID-19 vaccine, it’s still an excellent buy.

As I said, the numbers looked great for JNJ. But let’s start by talking about the vaccine.

Down, But Not Out

First of all, Johnson & Johnson isn’t the first to halt a COVID-19 vaccine trial. AstraZeneca LON: AZN did the same in the U.K. last month after a patient fell ill. Those trials have resumed, showing that this isn’t the end of the world. JNJ said as much on its Q3 earnings call:

“It's not at all unusual for unexpected illnesses that occur in large studies over their duration. In some cases, they're called serious adverse events or SAEs and may have something or nothing to do with the drug or vaccine being investigated. However, as a company that always puts safety first, we take each and every case seriously.”

Look, the chances of JNJ winning the vaccine race just got lower, but they weren’t really high to begin with and an investment in JNJ banks on much more than its vaccine.

Q3 Was Excellent and JNJ Raised Full-Year Guidance

Q2 was tough, as revenue dipped 10.8% yoy, but two weeks ago I said that there were encouraging signs for Q3.

Well, even I wasn’t expecting business to improve this much, this fast… Revenue jumped 1.7% yoy to $21.08 billion, nearly $1 billion higher than consensus estimates. JNJ raised its full-year guidance, and now expects revenue to be flat to down 1% yoy, compared to previous expectations of a 0.8% to 2.6% decline.

Over-the-counter medicine sales grew 4% yoy, with Tylenol again leading the way partially due to “increased demand driven by COVID-19.” The 4% overall growth was actually down from 11% in Q2, so the COVOD-boost may be diminishing. Either way, there’s no reason for concern as a slowdown was to be expected.

2 Segments Stood Out

Q2 was a tough quarter for worldwide medical device sales, as they dipped 32.7% yoy, largely due to people putting off elective procedures. JNJ hinted at a turnaround, and more than delivered, with medical sales falling by just 3.3% yoy in Q3. On the Q3 call, VP Chris DelOrefice noted:

“The medical device market continued to be impacted by the COVID-19 pandemic in Q3, but procedures began to resume more widely across the globe, and we're reporting significant improvement in sales.”

As I’ve said before, this was only a matter of time, as people can only put off elective procedures for so long. That said, the huge declines could have easily persisted into 2021; that they didn’t is a big win for JNJ investors.

Another segment that stood out was the skin, health and beauty franchise. Sales dipped 14.3% yoy in Q2; with people going out less, they are spending less on skin care. Here, again, a recovery was only a matter of time, but came faster than expected; in Q3, the franchise reported growth of 0.9% yoy led by “strong performance on OGX.”\

Now is a Great Time to Buy JNJ

If it hadn’t been for the vaccine news, JNJ shares may have recorded a 2% gain yesterday as opposed to the 2% loss. Again, I’m not thrilled about the vaccine news, but also don’t see it as a game-changer.

Bottom line, consider taking this opportunity to buy JNJ at a discount. You’ll get a reliable dividend king that is seeing an up-swing in its numbers.

Before you consider Johnson & Johnson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson & Johnson wasn't on the list.

While Johnson & Johnson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.