Can Chinese Internet companies

Alibaba Group Holdings NYSE: BABA and

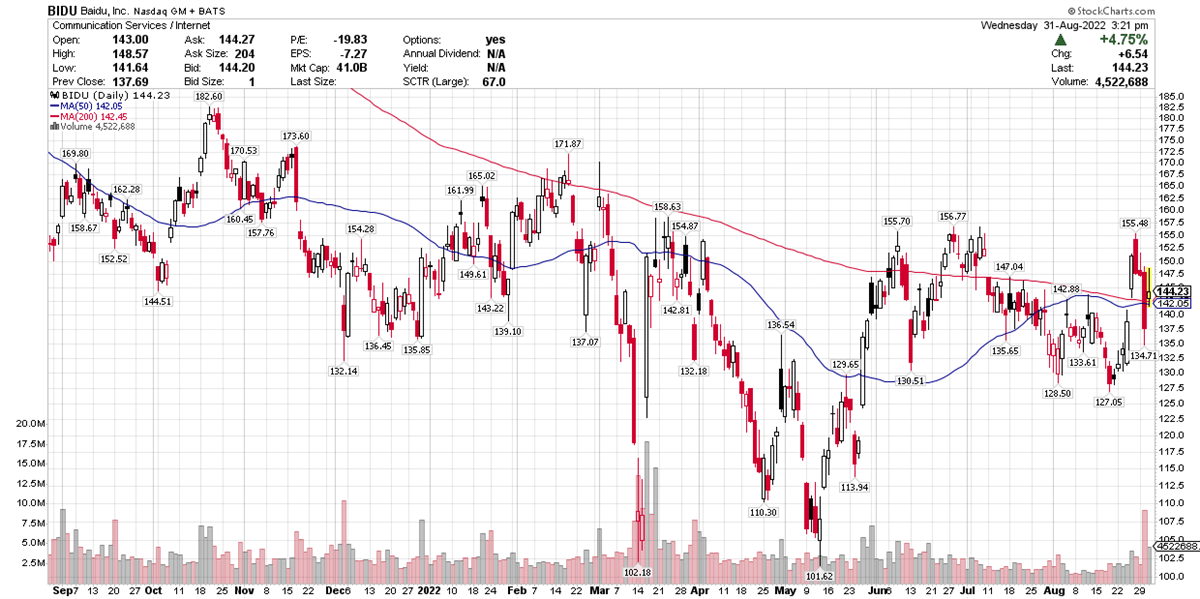

Baidu NASDAQ: BIDU recapture their glory days as high-flying growth stocks?

Both companies have been on downward trajectories when it comes to stock price and earnings slowdowns.

Alibaba began trading in the U.S. as an American Depositary Receipt in 2014. Baidu has been available to U.S. investors for even longer, having made its debut way back in 2005.

They are just two among hundreds of Chinese stocks that can easily be traded in the U.S. these days. However, they get attention because they are two of the largest, when it comes to market cap. Other China or Hong Kong-based megacaps include JD.com NASDAQ: JD, PetroChina NYSE: PTR, Pinduoduo NASDAQ: PDD, NetEase NASDAQ: NTES and China Petroleum and Chemical NYSE: SNP.

While the broader global market is showing price declines this year due to economic uncertainty, there is an additional reason that some Chinese stocks have been punished.

A little back story: For the past decade, U.S. securities regulators have asked for access to various financial and other data for Chinese companies listed in the U.S. However, Beijing blocked this access, saying it was because of national security concerns.

That tiff eventually put Chinese companies at risk of being delisted from U.S. stock exchanges.

However, on August 26, Beijing and Washington inked an agreement allowing U.S. regulators to inspect Chinese audit documents of the companies in question.

Alibaba is one of the first companies chosen for an audit. The company operates a global online and mobile marketplace for various goods. Its business model is similar to Amazon (NASDAQ: AMZN).

The company got a bounce on August 4 after first-quarter earnings but reversed lower in the next session. Results came in better-than-expected, with earnings of $1.40 handily topping analysts’ views, as you can see by viewing MarketBeat’s earnings data. Revenue of $30.69 billion came in below views, but analysts were still cheered that search ad revenue was bouncing back, and the company was managing its costs.

Huge Upside Anticipated

Analysts have a “moderate buy” rating on the stock with a price target of $166.53, which would be an upside of 74.30%. That’s kind of an amazing increase that analysts expect over the next 12 to 18 months.

Shares are down 21% year-to-date. The stock is underperforming the FTSE China 50 index, of which it is the second-largest component, by weighting. The index is down 18.87% so far this year.

Meanwhile, Baidu, which operates a search engine with targeted advertising and other content services it monetizes - think Alphabet NASDAQ: GOOGL - is down just 7.46% in 2022.

The company reported earnings on Thursday. It marked the fourth quarter of declines, but at least the pace of declines is slowing. Earnings came in at $2.36 per share, down just 1% from the year-ago quarter. Sales were $4.425 billion, down 9% from a year earlier.

Revenue has slowed for the past five quarters, always a worrisome sign. However, Amazon has seen similar declines as consumers shifted some of their buying away from pandemic-era online orders, and back to more in-person shopping.

No Current Quarter Visibility

The quarterly decline was due at least in part to weaker demand for advertising in China. Shares fell on the heels of the earnings announcement, as Baidu revealed that it did not have good visibility into ad revenue in the current quarter.

According to MarketBeat analyst ratings, the consensus on Baidu is a “moderate buy” with a price target of $216.15, representing a 50.79% upside. For the full year, analysts expect the company to earn $7.47 per share, a decline of 11%. In a little piece of good news, that estimate was actually revised higher recently.

With both these stocks languishing well below prior highs, you could view a buy opportunity in one of two ways. First, as analysts expect strong double-digit price gains in the next 12 to 18 months, it could be a chance to get in early. On the other hand, it can be a mistake to park money in stocks trending lower or sideways while others are on the rise.

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.