Network storage maker

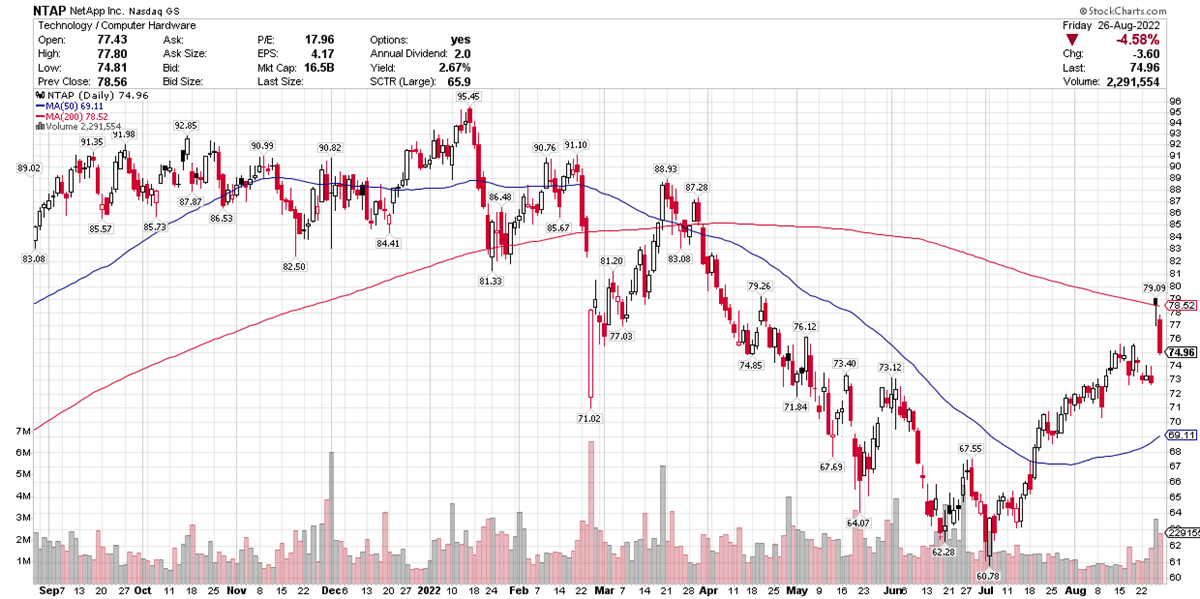

NetApp NASDAQ: NTAP gapped up nearly 8% Thursday following its earnings report, but reversed course Friday, closing 4.58% lower.

It’s safe to say Friday’s action reflected a broad market selloff in the wake of Fed chairman Jerome Powell’s remarks about further interest rate tightening and “some pain” ahead.

But NetApp itself is flashing some painful signs. Earnings growth slowed in the past two quarters, from 31% to 4%. Revenue growth is in the single digits, following low double-digit growth in 2021 and early 2022.

The company earned $1.20 per share in the fiscal first quarter. MarketBeat earnings data show that topped analysts’ views, which called for $1.10 per share. Meanwhile, revenue of $1.59 billion also came in ahead of views.

NetApp also boosted its guidance for the current quarter to a range of $1.28 to 1.38 per share and said it expects to earn between $5.40 and $5.60 for the full year.

The company’s board also OK’d a quarterly dividend of $0.50 per share, payable on October 26. The stock goes ex-dividend on Thursday, October 6, meaning shareholders as of that day will receive the payout. NetApp’s current dividend yield is 2.67%.

Analysts have a “moderate buy” rating on the stock, according to MarketBeat data. The price target is $91.72, representing a 22.36% upside.

Evolved From Data-Center Specialist

NetApp provides enterprise data management and storage products and services. Its offerings include cloud services, data storage, data protection, data management, enterprise applications, DevOps (which combines software development and IT operations), and artificial intelligence. As the cloud and various storage and security trends evolved, NetApp transitioned from being a data-center storage specialist to a company with a much more broad mission.

The stock has been correcting since January, and undercut its previous structure low from last November. That can be significant, as lower valuations can set the stage for a fresh round of institutional buying that can lead to a new rally.

As any market watcher knows, there are plenty of stocks out there right now that are trading at mid-2021 levels, and developments like Fed Chair Powell’s remarks aren’t inspiring investor confidence, at least not yet.

NetApp’s performance in recent months is as follows:

- Year-to-date: -16.88%

- Past three months: +7.05

- Past month: +7.98

Will the stock’s rally continue? Certainly, the company’s own performance and guidance seem to bode well. But the broader market worries have potential to pull down not just NetApp, but perhaps 75% of the market, at least in the near-to-medium term.

Mid-Cap Industry Leader

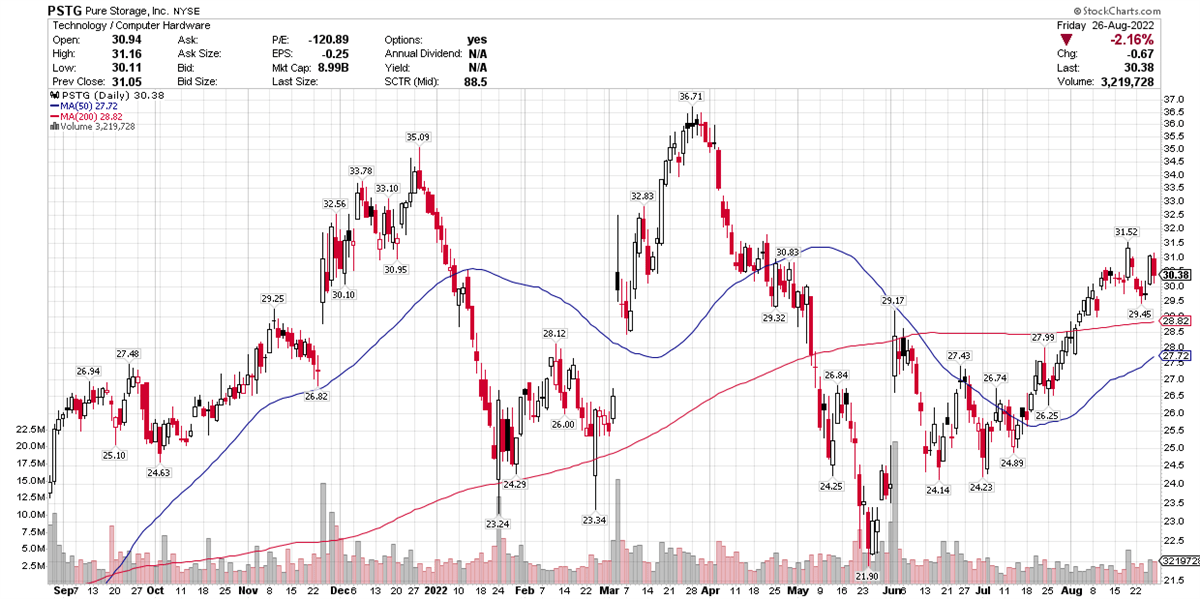

Within the data storage sub-industry, the best price performer is mid-cap Pure Storage NYSE: PSTG.

The company makes flash storage systems for enterprise users internationally. This stock, too, is in a correction, but year-to-date is outperforming the most appropriate benchmark, which is the S&P 400 mid-cap index.

Fundamentally, Pure Storage has shown robust strength in recent quarters, with triple-digit earnings growth. Revenue growth accelerated in the past five quarters, from 2% to 50%.

Pure Storage has been getting support above its 21-day moving average. Like pretty much everything else, it reversed lower Friday but settled just slightly above its 10-day moving average, a line it crossed definitively on Thursday.

That support at the 10-day line is potentially a good sign for the stock, although market action this week may determine its fate. In addition, the company reports its second quarter Wednesday, after the closing bell. As always, a miss or beat, or guidance or some note buried deep in the fine print, could cause a sharp move in either direction.

MarketBeat earnings data for Pure Storage show that the company has beaten top- and bottom-line views in every quarter since February 2020.

With the earnings report just around the corner, it’s best to carefully consider whether you want to risk making a purchase that could turn lower. When a stock beats views or offers better-than-expected guidance, institutions often pile into the stock. Because these institutions add to their positions over weeks and months, a big price move after earnings can be just the beginning of a productive rally. That means you aren’t necessarily missing out if you buy after the report.

Before you consider NetApp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetApp wasn't on the list.

While NetApp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report