Health insurance giant UnitedHealth Group NYSE: UNH stock has been on a gravity-defying uptrend reaching all-time highs again in 2022 just as inflation hits a 40-year high at 7.5%. The Company continues to grow its top and bottom lines powered by the surge in Medicare Advantage consumers and pandemic related care. The repeal of the health insurance tax along with productivity advances and business mix helped drop its full-year 2021 operating cost ratio from 16.2% to 14.8%. The Company is wildly profitable and has proven that the Medicare Advantage model can work for insurers. It’s mission to use improving technology in connecting the fragmented pieces of the healthcare industry appears to be playing out. However, their $8 billion acquisition of Change Healthcare is being blocked by the Department of Justice set for trial on Aug. 1, 2022. Prudent investors looking for exposure in a top health insurer can watch for opportunistic pullbacks in shares of UnitedHealth Group.

Q4 Fiscal 2021 Earnings Release

On Jan. 19, 2022, UnitedHealth reported its fiscal Q4 2021 earnings report for quarter ended December 2021. The Company reported an earnings-per-share (EPS) profit of $4.48 excluding non-recurring items versus consensus analyst estimates for a profit of $4.31, a $0.17 beat. Revenues grew 12.6% year-over-year (YoY) to $73.74 billion beating analyst estimates for $72.86 billion. For full-year 2021, the medical care ratio rose to 82.6% versus 79.1% due to COVID-19 and repeal of the health insurance tax. Days claims payable improved to 46.8 days versus 47.8 days in Q4 2020. UnitedHealth Group CEO Andrew Witty commented, “Our strong 2021 performance and confident growth outlook for 2022 and beyond reflect the accelerating innovation and expanding capabilities across Optum and UnitedHealthcare.”

Reaffirms Guidance

UnitedHealth reaffirmed its full-year fiscal 2022 EPS of $21.10 to $21.60 versus $21.65 consensus analyst estimates. The Company expects revenues to come in between $317 billion to $320 billion versus $317.55 billion.

Conference Call Takeaways

CEO Witty covered the two key areas driving growth for the Company, to accelerate transitioning of patients to Optum value-based care and growing UnitedHealth’s footprint serving Medicare Advantage customers. This should help drive 13% to 16% annual EPS growth rates. The leveraging of technology to optimize physician and hospital capabilities was key in adding an extra $30 billion in annual revenues in 2021. This momentum should continue as the Company sees even more opportunities to bring together the fragmented pieces of the healthcare system. He covered the five key areas of growth. Healthcare deliver drive growth in home, behavioral, ambulatory, and virtual care capabilities. Improving the quality of healthcare benefits. Thirdly, to improve technology to better provide tailored solutions to more system partners. Fourth, to vastly improve healthcare financial services like streamlining and simplifying claims payments for providers, payors, payees, and patients whiling reducing frictions. Lastly, pharmacy services, “…where people interact most often with the health care system. We can better use the significant breadth, volume and value of our foundational pharmacy services and data capabilities and integrate our medical pharmacy and behavioral capabilities.”

Change Healthcare Buyout Block

On Feb. 24, 2022, the Department of Justice and Attorney Generals in New York and Minnesota, filed a civil lawsuit to block United Healthcare’s acquisition of Change Healthcare. They believe this $8 billion acquisition would harm the competition in the health insurance marketplace in addition to the market for vital technology used by health insurers to reduce health care costs and process insurance claims. The trial is set for Aug. 1, 2022 and set to last for 12 days to end on Aug. 16, 2022. Additionally, Change Healthcare wants more than a 5% reverse fee if the deal falls through as Change Healthcare was to be acquired for $25.75 per share by United Healthcare. Change Healthcare is also selling its ClaimsXten to alleviate concerns from the DOJ lawsuit.

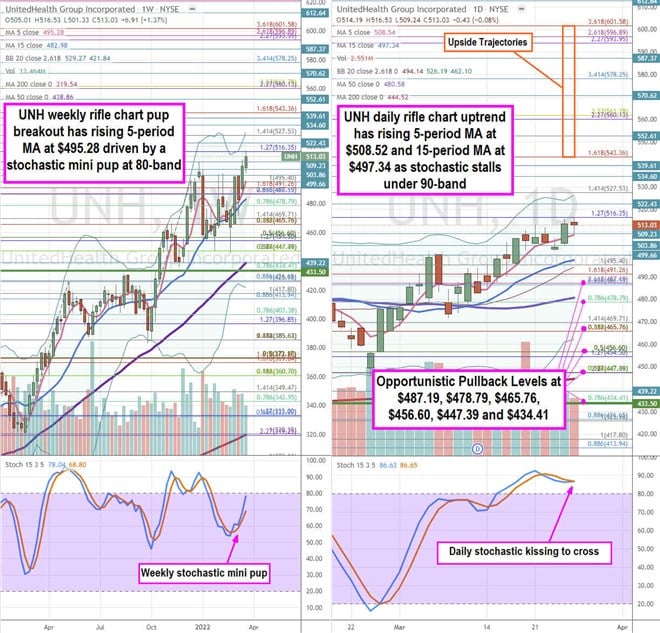

UNH Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precision view of the price playing field for UNH. The weekly rifle chart peaked around the $516.35 Fibonacci (fib) level. The weekly rifle chart pup breakout continues to grind with the rising 5-period moving average (MA) support at $495.28 and 15-period MA at $482.98 as the stochastic forms mini pup towards the 80-band. The weekly upper Bollinger Bands (BBs) sit at $421.84. The weekly market structure low (MSL) triggered on the breakout through $133.50. The daily rifle chart has a pup breakout too with a rising 5-period MA at $508.54 and 15-period MA at $497.34. The daily stochastic is kissing near the 90-band preceding a cross up or down. On the upside is the daily upper BBs at $526.19 and on the downside is the daily 50-period MA at $480.58 and the daily lower BBs at $462.10. Prudent investors shouldn’t chase this one, but instead watch for opportunistic pullback levels at the $487.19 fib, $478.79 fib, $465.76 fib, $456.60 fib, $447.39 fib, and the $434.41 fib level. Upside trajectories range from the $543.36 fib up towards the $601.58 fib level.

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.