Friday’s session should be an interesting one for investors of Cardinal Health (NYSE: CAH) as they continue to digest the company’s solid Q2 earnings. They were released before the bell on Thursday and easily beat analyst expectations for EPS and revenue. The former came in over 25% higher than the consensus while the latter was up over 5% year on year.

CEO Mike Kaufmann said "With the first half of the year behind us, we are raising our fiscal year 2020 guidance. This increase was driven by improved performance across our Pharmaceutical segment, particularly within our generics program. As we look forward, we remain focused on executing our strategic growth initiatives.”

This kind of positivity from management along with the decent headline numbers show momentum is going in the right direction. For Wall Street, this is critical considering shares have been under pressure for many years but have recently started to fight the trend.

A Poor Five Years

From April 2015 through August 2019, shares fell over 50% in value and were back at levels that they traded at in 2000 and 2001. Several acquisitions they made in that period seemed to be going against them rather than with them. For example, they picked up Johnson & Johnson’s (NYSE: JNJ) medical division for close to $2 billion in 2015 and a product portfolio from Medtronic for over $6 billion in 2017. Still, the stock dripped lower, driven also by several shoddy earnings releases that helped it waterfall down. Furthermore, the opioid crisis and scandal that broke in recent years meant that Cardinal’s was dragged through the mud, just like Johnson & Johnson’s and many others.

That being said, Johnson & Johnson’s stock has crushed the past 5 years as their innovations and drug pipeline shine above the scandals that have rocked the industry. Since Feb 2015, their shares are up more than 50% while Cardinals are down more than 30%.

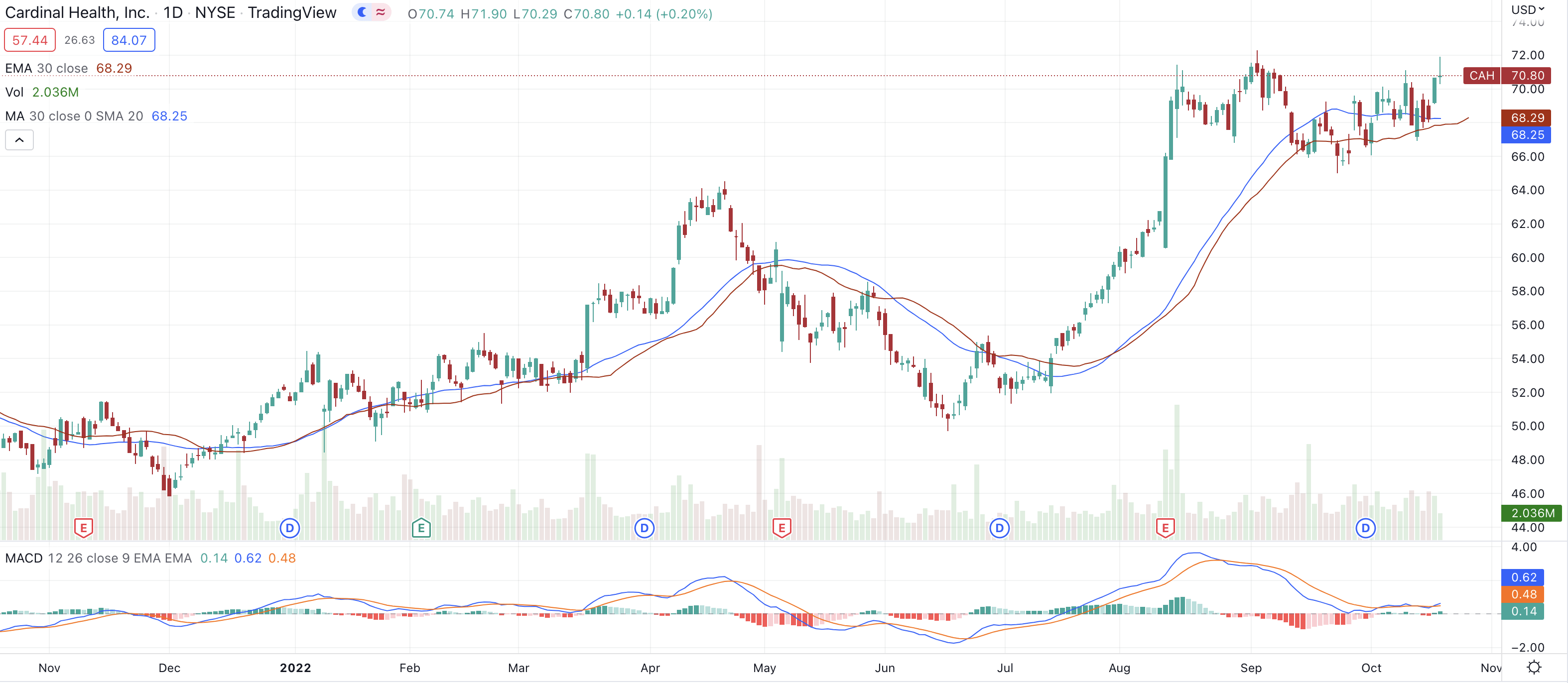

However, a decent support line came into play for the latter around the $40-45 range last August and this looks to have helped stem the tide for now. Since last summer, Cardinal’s stock has rallied more than 40%, helped in part by Thursday’s earnings-driven 10% pop. On top of that, talk of an out of court opioid settlement seems to have quelled concerns about mammoth damages hurting long term prospects for now.

The company’s earnings have beaten expectations for the headline numbers several quarters in a row now so the move higher in the stock is certainly justified.

Getting Involved

For investors looking to get involved, shares are on the verge of breaking a long term downtrend and good things tend to happen when that holds. They have a decent rising support line under them and any move back towards that could be used as a decent entry point. Getting up past the $60 mark would be psychologically beneficial and would mean that $70 would become the most natural target. The MACD is positive and the RSI is just above 60 so there’s plenty of room for Cardinal shares to stretch their legs.

There’s a feeling that Cardinal has almost been forgotten by healthcare investors which means there’s the chance of a huge catch-up rally if they continue to impress. They have a strong cash-flow, impressive revenue growth and a 3.30% dividend yield. While they’ve been beaten down in recent years, all the signs are there that management are doing the right things to turn the ship around. With a breakout through a long term downtrend on the verge of happening as management raise fiscal guidance for the coming year, the odds are with the upside momentum continuing for now.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.