Online automotive marketplace platform

Cars.com NASDAQ: CARS shares have been lagging the benchmark

S&P 500 index NYSEARCA: SPY during the recovery rally. COVID-19 epicenter stocks within the travel, lodging, leisure, dining, and automotive industries are seeing money flowing back in as a vaccine nears. While the SPY has recovered literally all losses, CARS is still trading well below its February 2020 highs of $13.39. The discount is even more glaring when compared to shares of

disruptive competitor Carvana NASDAQ: CVNA which have already doubled its February 2020 highs. Prudent investors looking for laggard stocks in the acceleration of the automobile sales market should

consider adding shares of CARS at opportunistic pullback price levels while still trading in the single digits.

Q2 FY 2020 Earnings Release

On July 30, 2020, Cars.com released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported a non-GAAP profits of $0.12 per share beating consensus analyst estimates for a loss of (-$0.17) per share, by $0.29 per share. Revenues for the quarter fell (-31.2%) year-over-year (YoY) to $102 million still beating consensus estimates of $94.37 million. The revenue drop was primarily due to invoice credits of 50% in April and 30% in May and June 2020. Average revenue per dealer (ARPD) actually grew on a sequential quarterly basis if backing out the discounts. DI revenue was flat YoY and national advertising revenue fell (-17%). Due to the uncertainty of the continued effects of COVID-19, the Company continues to suspend 2020 financial guidance.

Car Sales Trends 2020

New car sales started 2020 with 16.9 million units and dropped (-48%) in April 2020 to 8.7 million units. Sales rebound to 13 million in June 2020, up 49% from April pandemic lows. The used car market averaged 3.3 million units in January and February 2020, up 2% YoY. Sales plunged to 1.7 million units in March 2020, down (-49%). Used car sales have recovered back to 3.4 million units in June, bouncing 102% off March lows. Strong demand coupled with tighter supply actually resulted in an 11% YoY increase in used car values.

Innovative Digital Solutions

FUEL is an integrated strategy offering that leverages the Company’s first-party data, Dealer Inspire’s delivery technology and inhouse media production to power targeted video marketing and geographies. Cars.com profiled a platform customer dealer case study of Paragon Honda and Acura of New York. When their Manhattan and Bronx dealerships were under mandatory lockdown, they adopted the FUEL offering which enabled delivery of cars to customer’s homes. The strategy drove Paragon Honda and Acura to number one sales status for new cars and certified preowned sales for the month of June 2020 utilizing the Cars.com exclusively. In April 2020, the dealership sold 342 cars online. In June 2020, they sold 1,130 cars online. This was highlighted as a testament to the FUEL platform. By the end of June, thousands of dealer customers were offering home delivery. This also lends to an internal study that discovered, “approximately 70% of shoppers want to execute at least some parts of the auto purchase online”. Dealers are advancing to support home delivery.

Cars.com Record-Breaking Metrics

CARS experienced record-breaking search engine optimization (SEO) traffic in June surging 31% YoY. Q2 marked a quarterly record with 37.5 million website visits from clicking search engine results. Mobile traffic grew 71% YoY representing 75% of total traffic. The increased traffic resulted in a 12% YoY improvement in conversion rates despite reduced marketing spend and steep decline in dealer counts due to mandatory lockdowns. Cancel requests started in mid-March and peaked in May and normalized by June and July 2020. Standard subscription pricing resumed on July 1, 2020. By all accounts, car sales are improving and Cars.com revenue shortfall was primarily due to invoice credits which are gradually thinning out as demand rebounds.

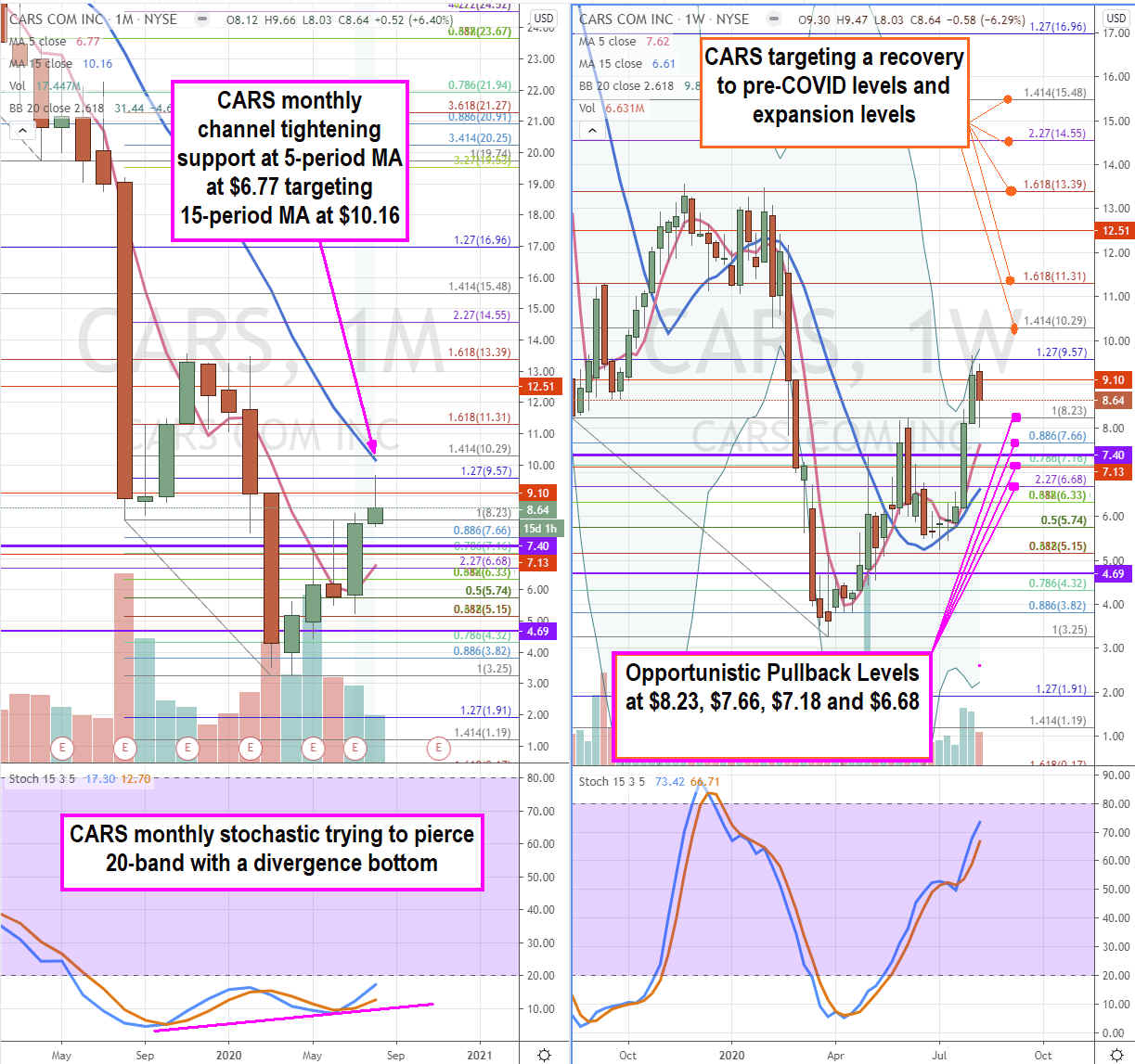

CARS Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for CARS stock. The monthly rifle chart triggers a market structure low (MSL) buy above $7.40. The weekly rifle chart triggered its MSL buy above $4.69. The monthly rifle chart is forming a mini pup above its 5-period moving average (MA) at $6.77, which sets up the channel tightening recovery towards its 15-period MA at $10.16. The probability of hitting the target is higher due to the divergence bottom of the monthly stochastic which needs to break through the oversold 20-band level. The weekly stochastic is coiling up but too close to its upper Bollinger Bands (BBs) at $9.80 to chase. Opportunistic pullback levels are at the $8.23 Fibonacci (fib) level, $7.66 fib, $7.18 fib and $6.68 monthly 5-period MA/fib. As the weekly Upper BBs expand, upside trajectories are at $10.29, $11.31, $13.39, $14.55 and $15.48.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.