We knew it was coming, and we’ve written about it already, but this morning’s release of their Q1 numbers just confirmed Charles Schwab Corporation’s NYSE: SCHW recovery has begun. It was a breath of fresh air for investors of the online broker. Having seen their shares decimated almost overnight in the fallout from the collapse of SVB, they’ve had to endure a tough couple of weeks.

Shares fell as much as 40% initially as fears spiked last month, and while there was a dead cat bounce for a couple of sessions, they’d worryingly started to trickle lower again through the start of April. However, this morning's report is just one of the reasons investors can start feeling optimistic again. Let’s jump in and take a look.

Decent Numbers

For starters, Schwab’s EPS registered a solid beat on analyst expectations, which helped cover for its revenue which just missed the mark. Despite the miss, the latter figure still managed year-on-year growth of 9.6% and remains close to its all time high. It got a solid boost from rising interest rates which pumped up the income numbers, a trend that many of the banks have been benefiting from.

For all that though, the initial reaction in shares this morning was to drop, and they opened lower by 2.5%. However the initial wobble was quickly eaten up and they’re on track to close at their highest price of the month to date. It’s clear that the worst fears of investors, which did so much damage last month, have not come to pass, and this opens up the lid for the recovery to truly begin.

Uncertainty about a stock or a company is a real headwind that shares have to contend with all the time, and we see it time and time again that when this is removed the bid strengthens. It’s akin to a band-aid being ripped off, and whether the resulting news is a net negative or net positive often doesn’t matter. Monday’s session saw a buoyancy in Schwab’s stock that has been missing since before the SVB crisis, and it will be interesting to see how it performs into the rest of the week.

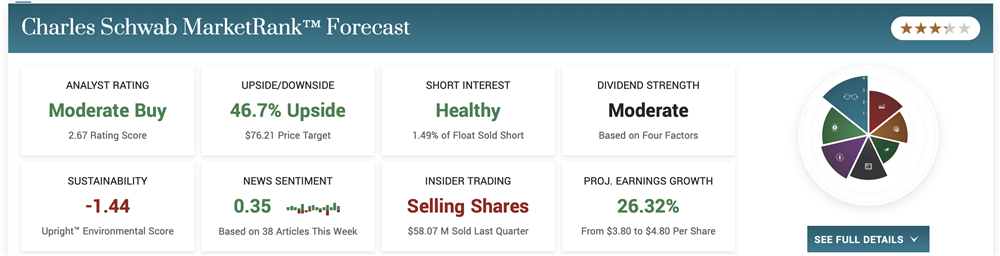

For those of us thinking about getting involved now that the band-aid has indeed been pulled off, it’s worth noting that MarketBeat’s MarketRank Forecaster has Schwab rated as a Moderate Buy with more than 45% upside. This bullish stance has been echoed by several analysts in recent weeks who have also been pointing to the strong likelihood of Schwab reclaiming most if not all of its lost territory.

Getting Involved

Headwinds do exist, however. Schwab made it clear that it anticipates strong revenue challenges in the near future due to the increased costs of funding, as it’s had to rely on more expensive funding sources while its clients adjusted their allocations at a historically fast pace. The risk of these higher-cost liabilities is less than nine months, and most of them are expected to be repaid by the end of 2024. For all that, though, CFO Peter Crawford still flagged that the higher funding costs are likely to cause a mid-to-upper single-digit percentage point year-on-year decline in Q2 total revenue.

But the company is still adding new customers at a solid pace, as they are with new assets. Considering just how grim the past month has been in terms of rapidly growing contagion risk, these results undermine much of the bear’s thesis.

Investors should look for shares to close above $53, after which a rapid move toward $60 isn’t all that unlikely. With the stock’s MACD having had a bullish crossover last week and the RSI is moving up out of the extremely oversold region, there are technical tailwinds for investors also to be getting excited about. It has a long way to go before it’s back at $80, but since last month’s drop the chance of it getting back, there has never been as good.

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.