Chipotle Mexican Grill Today

CMG

Chipotle Mexican Grill

$64.66 -0.14 (-0.22%) (As of 11:28 AM ET)

- 52-Week Range

- $44.08

▼

$69.26 - P/E Ratio

- 60.18

- Price Target

- $66.55

Chipotle Mexican Grill Co. NYSE: CMG popularized the “build-your-own-bowl” concept, allowing customers to select items to put in their salad bowls. The customization concept combined with Mexican cuisine was the proverbial “lightning in a bottle” for the fast-casual restaurant chain.

Chipotle has grown from a single location in Denver, Colorado, in 1993 to over 3,600 locations worldwide by November 2024, transforming into a best-of-breed mature company that continues to grow.

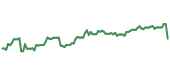

Shares have risen 41.2% year-to-date (YTD) as of Dec. 13, 2024.

CAVA Group Today

$123.83 -2.96 (-2.33%) (As of 11:22 AM ET)

- 52-Week Range

- $39.05

▼

$172.43 - P/E Ratio

- 269.20

- Price Target

- $143.80

CAVA Group Inc. NYSE: CAVA has often been called the “Chipotle of Mediterranean” food, as they also use a build-your-own-bowl model. Rather than offering Mexican ingredients, it offers up to 14 different toppings and sauces with choices of protein.

The retail/wholesale sector company is a relative newcomer, having been launched in 2006 as Cava Mezze in Rockville, Maryland. CAVA has grown to 366 locations by November 2024.

Shares have risen 188.6% as of Dec. 13, 2024.

Investors may wonder which stock has more room to grow in 2025: the mature, steady incumbent or the young, up-and-coming growth monster. Let's take a look at both stocks.

Comparing CAVA and Chipotle: Growth Versus Scale

As of Dec. 13, 2024, Chipotle has an $88 billion market capitalization compared to CAVA at $14.2 billion. CAVA’s Q3 2024 revenue rose 39% YoY to $243.82 million compared to Chipotle’s 13% YoY growth to $2.79 billion, roughly 10 CAVA’s revenue. CAVA’s Q3 comparable sales growth was an eye-watering 18.1% compared to Chipotle's comps of 6% YoY growth.

CAVA grew its average unit volume (AUV) to $2.8 million. For the full year 2024, CAVA raised its comp sales growth to 12% to 13%, up from 8.5% to 9.5% previous estimates. CAVA plans to open 56 to 58 new restaurants in 2024. It's important to understand that comparable sales only take into consideration stores that have been open for at least a year.

Chipotle Mexican Grill Stock Forecast Today

12-Month Stock Price Forecast:$66.363.21% UpsideModerate BuyBased on 27 Analyst Ratings | High Forecast | $77.76 |

|---|

| Average Forecast | $66.36 |

|---|

| Low Forecast | $55.00 |

|---|

Chipotle Mexican Grill Stock Forecast DetailsChipotle reaffirmed its full-year 2024 comparable sales growth target of 5% to 9%. The company plans to open 285 to 315 new restaurant locations in 2024. Looking ahead to 2025, Chipotle expects to add 314 to 345 new company-owned restaurants, with over 80% featuring Chipotlanes (drive-thru lanes). The company aims to reach 7,000 total restaurants in North America while pursuing international expansion.

While Chipotle faces potential saturation, it enjoys economies of scale when ordering meats, ingredients, and products, which leads to improved margins over time. In Q3 2024, Chipotle reported a restaurant-level operating margin of 27.2% compared to 25.6% for CAVA.

Chipotle is a mature brand that's built up a loyal following and a solid reputation. The company finds new growth drivers with product innovation, like the return of its smoked brisket, which led to transaction growth. Chipotle’s mobile app is much more refined than CAVA. Chipotle enjoys a much larger lead, with its reward program members closing to 33 million in Q2 2024, compared to CAVA Rewards members surpassing just 4.8 million in the same period.

CAVA Has More Growth Potential, But Chipotle Presents a Better Value

CAVA Group Stock Forecast Today

12-Month Stock Price Forecast:$143.8015.56% UpsideModerate BuyBased on 16 Analyst Ratings | High Forecast | $190.00 |

|---|

| Average Forecast | $143.80 |

|---|

| Low Forecast | $110.00 |

|---|

CAVA Group Stock Forecast DetailsCAVA is the growth leader between the two. The company is still in its early stages of growth. In terms of new potential markets, CAVA has more upsides than Chipotle. CAVA is still in its early growth stage as it expands to more demographics that have never heard of the brand. This gives CAVA the advantage when it comes to growth, which equates to more potential upside for the company. CAVA is pursuing a 15% YoY growth rate for new stores compared to 5% YoY growth for Chipotle.

Chipotle has 10x the locations and 10x annual sales but trades at just 8.1x sales. CAVA trades at 15.5x sales. As for the stock prices, CAVA seems pricy at $124, but it is worth noting that Chipotle executed its first-ever 50-to-1 stock split in June 2024, which equates to a $3,230 per share stock price pre-split. Based on financial metrics, Chipotle has the better value, while CAVA has more upside in 2025.

Before you consider CAVA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAVA Group wasn't on the list.

While CAVA Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.