Ciena Today

$87.93 +0.31 (+0.35%) (As of 12/24/2024 05:10 PM ET)

- 52-Week Range

- $43.30

▼

$91.82 - P/E Ratio

- 93.54

- Price Target

- $77.00

Just as stocks can gap and crap on an earnings report, meaning the price initially gaps higher on the market open and sells off back to red during the day, stocks can also do the opposite, dump, and gap. Such was the case with leading optical networking solutions provider Ciena Co. NYSE: CIEN after releasing its fiscal fourth quarter 2024 earnings.

The computer and technology sector giant’s stock initially sold off from $73.21 to $67.01 after the close but reversed course to surge up to $82.00 on the morning price gap. This price action delighted investors and panicked short sellers to cover their losses as the stock continued to surge to a high of $91.82 in the following days. Let’s examine why it reversed and what it bodes for the company moving forward.

Headline FQ4 2024 EPS Numbers and Metrics Were Worse Than Last Year

The headline numbers Ciena reported for fiscal Q4 2024 were disappointing and triggered an initial sell-off. Ciena reported EPS of 54 cents, which fell shy of consensus estimates by 11 cents. Revenue fell 0.5% year-over-year (YoY) to $1.12 billion, slightly beating consensus estimates of $1.1 billion. Its adjusted gross margin fell 210 bps to 41.6%. Operating expenses rose to $400.8 million, up from $395 million. Operating margin fell to 280 bps YoY to 5.3%.

In other words, Ciena generated fewer sales at a higher cost, making less money than last year. By all accounts, the stock sell-off was justified.

Ciena Took Control of the Narrative on the Conference Call

The stock market is always forward-looking. This holds during earnings season when companies report their past performance and provide guidance for future performance. By the time a company reports its quarterly results, they are already a few weeks into the next quarter. This is why the forward guidance is so critical. Sometimes, a company will save its forward guidance until its conference call after it explains the past quarter's results.

In Ciena’s case, the company took control of the narrative, painting an optimistic take on its FQ4 performance during the conference call.

The cloud computing recovery, growing streaming services, 5G networks, internet of Things (IoT), and artificial intelligence (AI) boom ensures data traffic will continue to increase exponentially. As such, Ciena is positioned to benefit from the increased spending on network systems upgrades and expansions. Bandwidth demand is the lifeblood of Ciena’s business, and it’s been growing 30% YoY for over two decades.

This theme was echoed by Ciena CEO Gary Smith, "Our Q4 revenue and strong order flow reflect our significant and increasing technology leadership and positive industry dynamics. As Cloud and AI drive bandwidth demand across the network, we are positioned for accelerated revenue growth and market share expansion moving forward."

Ciena Delivers the Knockout Punch With Strong Upside Guidance

Ciena MarketRank™ Stock Analysis

- Overall MarketRank™

- 91st Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 12.4% Downside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -0.77

- News Sentiment

- 0.77

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 61.06%

See Full AnalysisThen, they proceeded to issue upside guidance for FQ1 2025 and fiscal full year 2025. Revenue for FQ1 is expected to be between $1.01 and $1.09 billion versus $1 billion consensus estimates. Fiscal full-year 2025 revenues are expected to rise 8% to 11%, or $4.34 billion to $4.46 billion, versus $4.31 billion. This is a huge leap from the 0.5% YoY revenue drop in its FQ4 2024. It signals FQ4 as a turning point.

Ciena also raised its long-term average annual revenue growth for fiscal years 2025 to 2027 to the 8% to 11% range, up from the previously expected range of 6% to 8%. The company is confident enough in its business moving forward that it provided an updated set of long-term targets driven by strong CapEx investments by its cloud provider clients, and they continue to invest in networks to help support AI training and inferencing.

AI Boom Goes Beyond the Data Center, Impacting All Areas of the Network

Ciena expected an adjusted operating margin of 15% to 16% for fiscal 2027. Ciena emphasized that AI is not just a data center phenom. Traffic is flowing out of the data center to impact all areas of the network. Providers inevitably need to upgrade their networks to Ciena's next-gen intelligent line systems. Service provider orders outpaced revenue in North America for the first time in two years in FQ4.

Ciena’s clients include the major hyperscalers like Microsoft Co. NASDAQ: MSFT Azure, Amazon.com Inc. NASDAQ: AMZN AWS and Alphabet Inc. NASDAQ: GOOGL Google Cloud to media giants like The Walt Disney Co. NYSE: DIS and Netflix Inc. NASDAQ: NFLX and major telcos like AT&T Inc. NYSE: T and Verizon Communications Inc. NYSE: VZ.

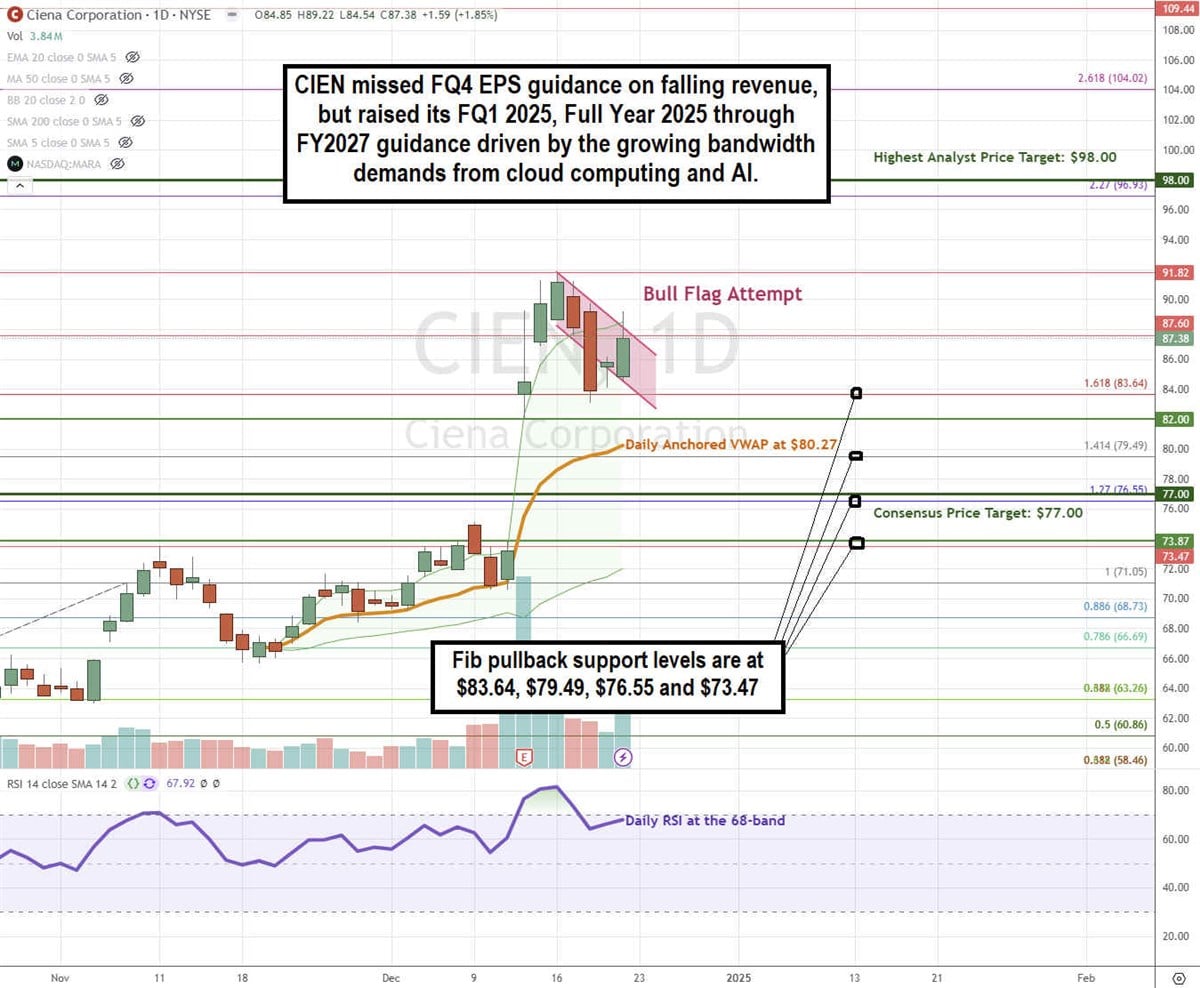

CIEN Stock Attempts a Bull Flag Breakout

A bull flag pattern is comprised of two parts. First, the underlying stock forms the flagpole, which is a steep run-up in the stock price, usually at a 45-degree or higher angle. The flagpole completes when the stock forms its peak. The flag is formed on the parallel descending trendlines comprised of lower highs and lower lows. The bull flag triggers when the stock surges through its upper descending trendline and past the peak of the flagpole.

CIEN triggered a gap of up to $82.00 following its FQ4 2024 earnings conference call to form gap-fill levels at $73.87 and $82.00. CIEN continued to grind higher for the next two days, reaching a flagpole peak of $91.82. The flag formed on the parallel descending trendlines with a bull flat trigger on the breakout above $87.60. The daily VWAP support is rising at $80.27. The daily RSI is slowly rising at the 68-band. Fibonacci (Fib) pullback support levels are at $83.64, $79.49, $76.55, and $73.47.

CIEN's average consensus price target is $92.45, implying an 11.88% downside and its highest analyst price target sits at $98.00. It has seven Buy ratings and six Hold Ratings. The stock has a 4.41% short interest.

Actionable Options Strategies: Bullish investors can wait for CIEN to pull back and consider using cash-secured puts at the Fib pullback support levels to buy the dip. If assigned the shares, then writing covered calls at upside Fib levels executes a wheel strategy for income opportunities while hedging the downside by the premium received.

Before you consider Ciena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ciena wasn't on the list.

While Ciena currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.