A long-standing business like Coca-Cola NYSE: KO can only remain so by harnessing and growing a loyal consumer and investor base; some of these audience members come to invest in the company because of its brand name, some because of relentless fundamentals which always seem to find a new way to keep pushing onward.

Whatever the case may be, people around the globe are loyal to Coke products despite price increases of around 11% across the mix.

Coca-Cola reported its first quarter of 2023 earnings on Monday, and the stock had good reason to rise by as much as it did (clocking in a nearly 2% rally in the trading session). Global unit case volumes rose by 3%, thus signaling that despite double-digit price increases amid rising input costs for the beverage maker, its consumer base remained strong.

Some bears state that the company cannot keep getting away with price increases and that the stock may be due for a sell-off as the consumer becomes more worried about inflation at home, among other propaganda items pushing toward healthier alternatives; however, Coca-Cola bulls have plenty to look forward to in the coming years with regards to the company's fundamental drivers.

Hidden Upside, Selective Pricing

Management was pleased to announce that the company grew its revenue by 4.7% annually from various unit case growth rates across the different regions where Coke products are consumed. In comparison, EMEA (Europe, Middle East, and Africa) saw a 3% unit case volume decline due to the unfortunate events of the war in Ukraine and a deadly earthquake in Turkey.

Latin American markets grew case volume by 5%, led by Mexico and Brazil, as respective currencies and economies rose against the dollar during the period. In North America, unit volumes were flat even after an 11% price increase; the brand gained market share in the NARTD (Non-Alcoholic Ready To Drink) beverage market.

What is important for investors is the 10% unit case volume increase in Asia Pacific and the further potential for growth in the coming months. Driven by China's reopening and significant consumption volumes during the Chinese new year celebration, the company was able only to increase prices in the country by 5% and stated in the Q&A section of the earnings call that management is "... cautiously optimistic on the rest of the year for China." making remarks on how the nation is still opening up and has yet to reach pre-pandemic levels of consumption.

While North America saw 11% price hikes, other nations, like Asia already mentioned, saw less aggressive price strategies. This could be due to the underlying consumption gap, which drives many bullish cases for the stock to see a rebirth rally. For example, in the United States, according to volumes and share of consumption from the company's website, people drink two cans of Coca-Cola per day; in China, the average citizen drinks one can of Coca-Cola per week, thus creating a wide value gap to be closed for investors, a feat which would not be aided by aggressive price hikes such as the ones seen in North America.

Will Doubters be Wrong Again?

After delivering a 12% annual increase in earnings per share, considering the buyback of 12 million shares from the open market, concerns are brewing within the cost items for the company. As gross margins decreased from 61% to 60.7%, some analysts raised questions about the trend of input costs, to which the company pointed to the rapid rise of sweetener costs and aluminum prices, which drove down margins. In addition, interest rate hikes by the FED have effectively reduced inflation lately. A subsequent effect has been the decline in capacity utilization for the primary metals industry, which indicates possibly lower input costs for Coca-Cola in the coming months.

Under this view, management has given Bulls some positive guidance to look forward to in 2023, expecting revenue growth between 7-8% organically. Commodity inflation is still a headwind on input costs; however, it is expected to be mid-single digits rather than the obscene double-digit inflation figures recently experienced. What investors looking to figure out what to pay for Coca-Cola stock care about is the earnings per share guidance of 7-9% toward $2.48.

Looking at Coca-Cola's financials, achieving earnings per share of $2.48 would be the highest earning achieved in at least a five-year lookback period. As the stock is a global conglomerate with evident pricing power and concrete consumer loyalty, a typical P/E ratio falls between 25x and 35x, where a $2.48 earnings per share figure would 'normally' send the stock to price ranges of $62 and $86.

Cautious investors can take note of the recent triple-top pattern being formed in Coca-Cola's chart and the dividend yield of 2.88%, where historically its been closer to 3.2%, thus implying a bit of overvaluation for the stock currently. What to do? Investors comfortable with paying what may be fair or above value will be okay with it. Still, those looking to squeeze the most juice out of this lemon can wait for the support range (aided by fundamental levels as mentioned) of $55-$62 to start blowing the dust out of checkbooks.

Before you consider Coca-Cola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola wasn't on the list.

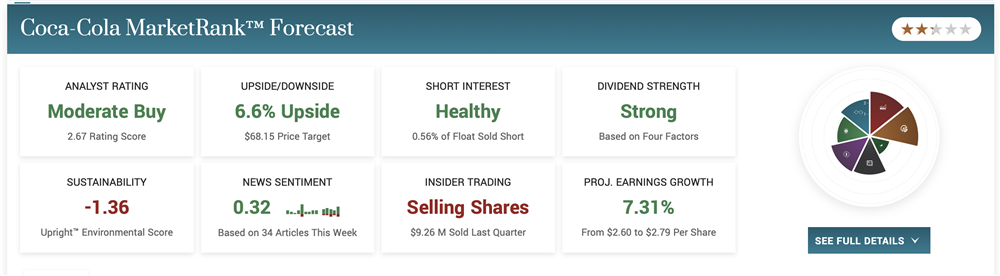

While Coca-Cola currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.