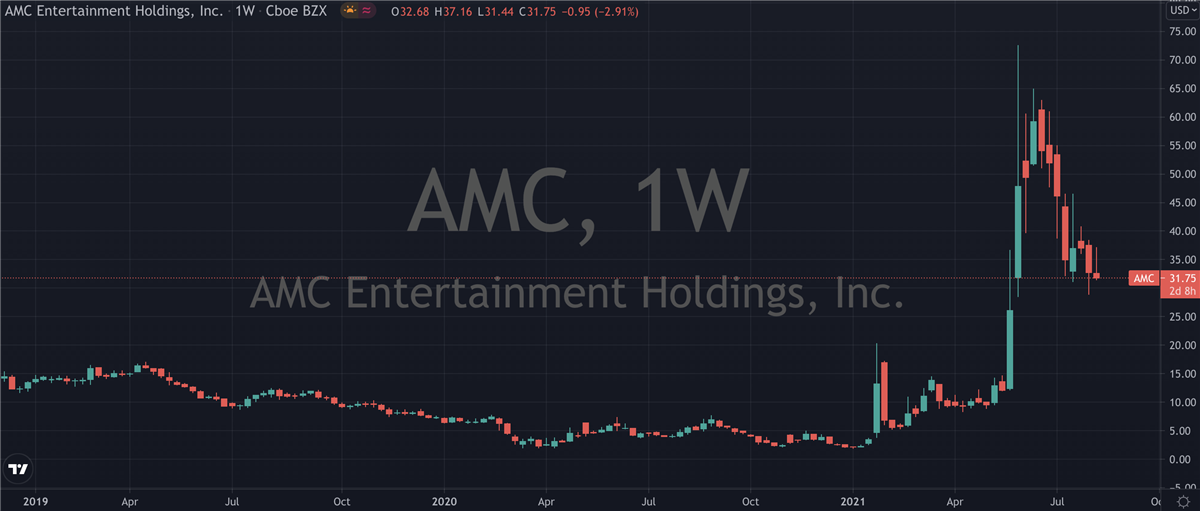

Despite having had to watch their shares

crumble more than 90% from 2017 into early 2021, investors of well-known cinema name

AMC Entertainment (NYSE: AMC) have had a serious reversal of fortunes in the six months since. As has been well documented, they started to find themselves high on lists of the most shorted stocks back in February, as retail traders organized online and began to orchestrate short squeezes. And it’s this market phenomenon that investors have to thank.

A short squeeze works when a heavily shorted stock comes under intense buying pressure which drives the price up, breaking what’s usually been a solid downtrend. As the price increases, short-sellers come under pressure to maintain their positions as most brokers have strict requirements and won’t hesitate to close out a short-seller’s position if it goes too far offside. In order to close out a short position, shares must be purchased, which in turn adds to the buying pressure and fuels a vicious circle.

Meme Stocks

Gamestop (NYSE: GME) might have grabbed the most headlines when their short squeeze sent shares up more than 2,000% in just two weeks at the start of the year, but AMC investors had their fair share of excitement too. An 800% jump in January was followed up by a 600% jump in June, and though shares have since given back about 50% of the most recent move, they’re still trading around where AMC shares had previously set all-time highs in 2015 and 2016.

But sooner or later they’ll want to shed their meme stock tag and get back to business. The company’s Q2 earnings, released after Monday’s session, shows them to be well on their way to doing just that. Revenue for the quarter was well ahead of expectations and up more than 2,200% on the same period last year - a startling increase until one remembers that AMC’s revenue streams were effectively bone dry this time last year as the economy was close to complete lockdown.

Back Towards Normal

Still, it was confirmation that AMC is on a path back towards normality, even if their version of normal still needs to be defined. There were additional areas of positive momentum, with 100% of AMC’s domestic theatres and 95% of their international theatres reported to be back in operation, while the company reported an impressive available liquidity figure in the region of $2 billion. Management has said that this latter figure in particular will be used to “go on the offense” in the coming months.

Adam Aron, Chairman and CEO of AMC commented; “new blockbuster films released during the quarter drove successive new pandemic-era box office records. And fortunately for us, as guests returned to our theatres, they splurged on our food & beverage offerings, which admittedly is quite a high-margin business. At the same time, we diligently managed our costs in every aspect of our operations. These actions produced financial results in the quarter that were considerably well ahead of our own and third-party expectations.” Aron added; “AMC’s journey through this pandemic is not finished, and we are not yet out of the woods. However, while there are no guarantees as to what the future will bring in a still infection-impacted world, one can look ahead and envision a happy Hollywood ending to this story.”

Getting Involved

Aron backed up his bullish sentiment by confirming that he hasn’t sold a single one of his AMC shares, despite the four digit percentage increase in the seven or eight months. However, it’s important to note that while these numbers and the current momentum are undoubtedly impressive in the context of the ongoing recovery, AMC still has a long way to go.

For starters, current attendance numbers are still below their pre-pandemic levels and the movie theatre chain is a long way from being profitable. It has

some decent tailwinds behind it right now in the form of a blockbuster earnings report and a ton of hype, but as the latter starts to dwindle more and more focus will be put on the former. And investors won’t have to look very deeply until the shine starts to come off it. Even with the recent dip, AMC shares are still trading close to 400% higher than where they were before the pandemic hit. It’s a tough argument to make that their outlook has improved that much in the meantime.

Before you consider AMC Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMC Entertainment wasn't on the list.

While AMC Entertainment currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.