Spirits and beverages producer Constellation Brands NYSE: STZ stock has rebound towards its all-time highs despite the weakness in the benchmark indices. The maker of popular brands like Corona and Modelo added 30 million cases of high-end growth in fiscal 2022 making it the #1 high-end beer supplier and top share gainer in the U.S. It’s high-end premium brands outpaced the U.S. category driven by sales of Kim Crawford, the Prisoner, and Meiomi. The Company has also committed to reduce its greenhouse emissions by 15% by fiscal 2025 and replenish one billion gallons of water withdrawals to disadvantaged communities. Constellation Brands continues to believe in its $5 billion investment in Canopy Growth as it seeks to turn a profit in Canada and awaits possible U.S. federal legalization of cannabis. Prudent investors seeking a recession-resistant segment to consider investment can watch for opportunistic pullbacks in shares of Constellation Brands.

Q4 2022 Earnings Release

On April 7, 2022, Constellation Brands released its fourth-quarter fiscal 2022 results for the quarter ending February 2022. The Company reported earnings-per-share (EPS) of $2.37 versus consensus analyst estimates for $2.12, a $0.25 per share beat. Revenues rose 7.1% year-over-year (YoY) to $2.1 billion, beating analyst estimates for $2.02 billion. The Company raised its dividend to $0.80 per share. Constellation Brands expects full-year fiscal 2023 EPS of $11.20 to $11.50 versus to $11.49 consensus analyst estimates.

Conference Call Takeaways

Constellation Brands CEO Bill Newlands stated that the Sands family proposal to declassify Constellation’s dual share class structure is being reviewed by the Special Committee and Board of Directors and would require approval from Class A common shareholders. He set the tone, “As I reflect on our performance for fiscal '22, I'm extremely proud of how our team pulled together to deliver a year of double-digit organic net sales growth and strong cash flow generation. Our team accomplished this while battling through year 2 of the pandemic, including various supply chain challenges, adverse weather events, rising inflation, rapidly shifting consumer preferences, and a host of other issues in the surrounding environment. Through it all, we stayed true to who we are and remain laser-focused on our consumers and building brands that people love.” The beer segment leads the performance delivering its 12th consecutive year of growth. Its flagship Modelo and Corona brands experienced 11% net sales growth extending its positions as the #1 high-end beer supplier and #1 share gainer in the U.S. beer market. It’s wine and spirits business grew 9% driven mostly by Kim Crawford, Meiomi and the Prisoner. The Company announced a 500 million share accelerated stock buyback program. He expects significant growth in the flavored category which includes wavered malt beverages, RTD spirits, seltzers, and flavored beers. Modelo Especial is the #2 beer brand sales leader in the country. However, it only has an 80% of household penetration as Corona Extra. The Company is planning to bolster total market penetration for Modelo Especial to Corona Extra to access over 2 million incremental customers. Cora Extra has seen a resurgence in the U.S. beer market. CEO Newlands stated, “Overall, we plan to recruit new drinkers through advertising, investments in digital media and localized programming. In addition, our portfolio initiatives will be enabled by increasing adoption of our Shopper-First Shelf approach, which continues to drive results and gain traction. We completed 14,000 shopper-first shelf sets last year, our highest total to date.” He believes the cannabis market has significant long-term growth and its Canopy Growth investment will see it reach profitability in Canada as its maintained the #1 share position in premium flower products.

STZ Price Trajectories

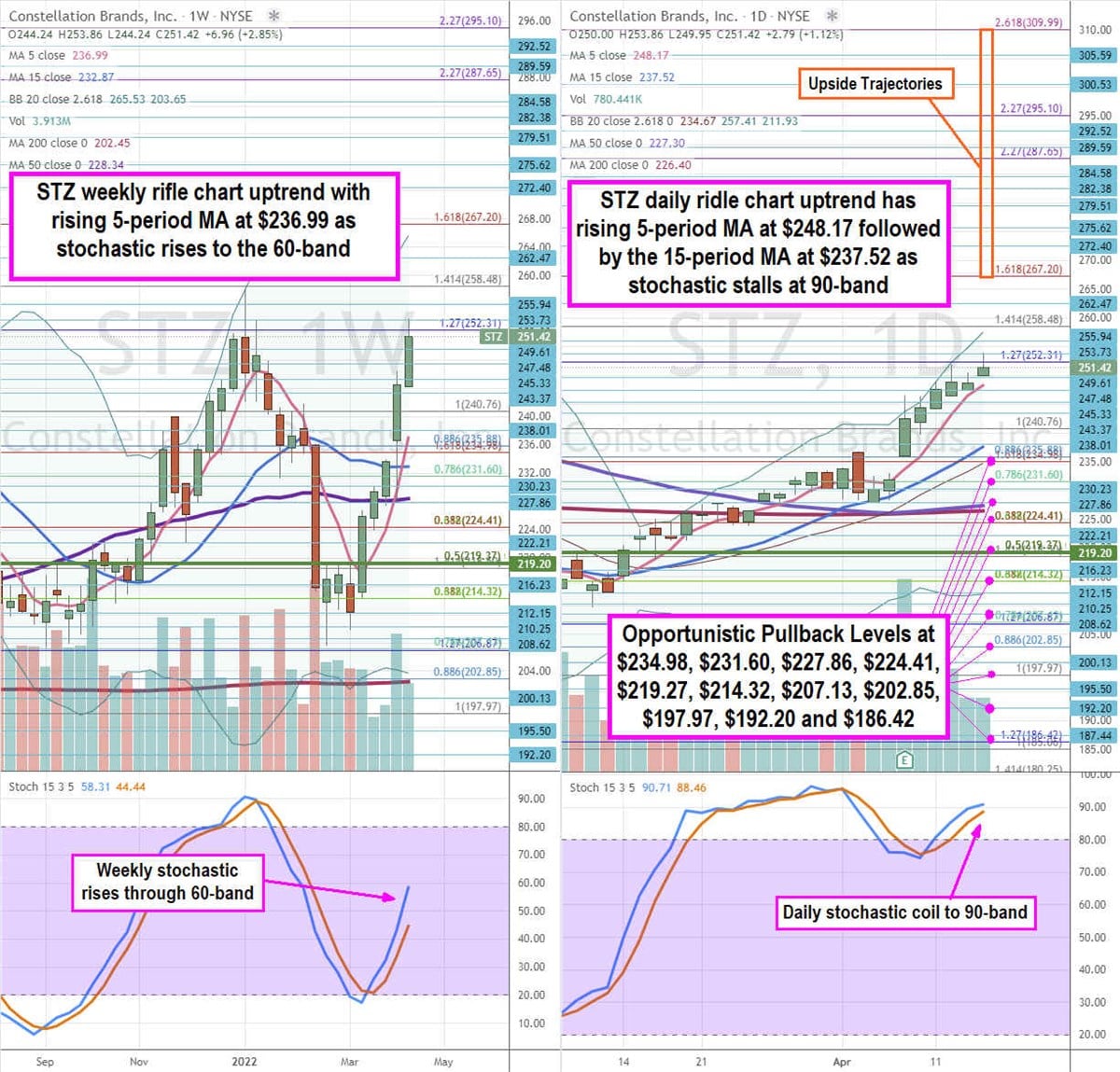

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for STZ stock. The weekly rifle chart peaked near the $258.48 Fibonacci (fib) level before selling off to the $206.87. The weekly market structure low (MSL) buy triggered a breakout through $219.20. The weekly uptrend has a rising 5-period moving average (MA) at $236.99 followed by the 15-period MA at $232.87. The weekly 50-period MA sits at $228.34 and weekly lower Bollinger Bands (BBs) sit at $203.65 near the weekly 200-period MA at $202.45. The weekly stochastic is oscillating up through the 60-band. The daily rifle chart has an uptrend with a rising 5-period MA at $248.17 with daily upper BBs at $257.41. The daily 15-period MA is rising at $237.52. The daily 50-period MA sits at $227.30 and the 200-period MA sits at $226.40. The daily stochastic crossed back up through the 80-band as it attempts to form a mini pup. Prudent investors can watch for opportunistic pullback levels at the $234.98 fib, $231.60 fib, $227.86, $224.41 fib, $219.27 fib, $214.32 fib, $207.13 fib, $202.85 fib, $197.97 fib, $192.20, and the $186.42 fib level. Upside trajectories range from the $267.20 fib up towards the $309.99 fib level.

Before you consider Constellation Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellation Brands wasn't on the list.

While Constellation Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.