After a fairly hot start to 2020 across the global markets, growing fears from the coronavirus outbreak are starting to filter through to equities. Shares of

US airlines like American

NYSE: AAL, Delta

NYSE: DAL and United

NYSE: UAL have fallen about 10% in the past two weeks while the likes of Wynn Resorts

NASDAQ: WYNN and Royal Carribean Cruises

NYSE: RCL lost about 8% in yesterday’s session alone.

Looking at US markets from a high level, all the major indices started this week off with about a 1-2% haircut yesterday for their worst day this year so far.

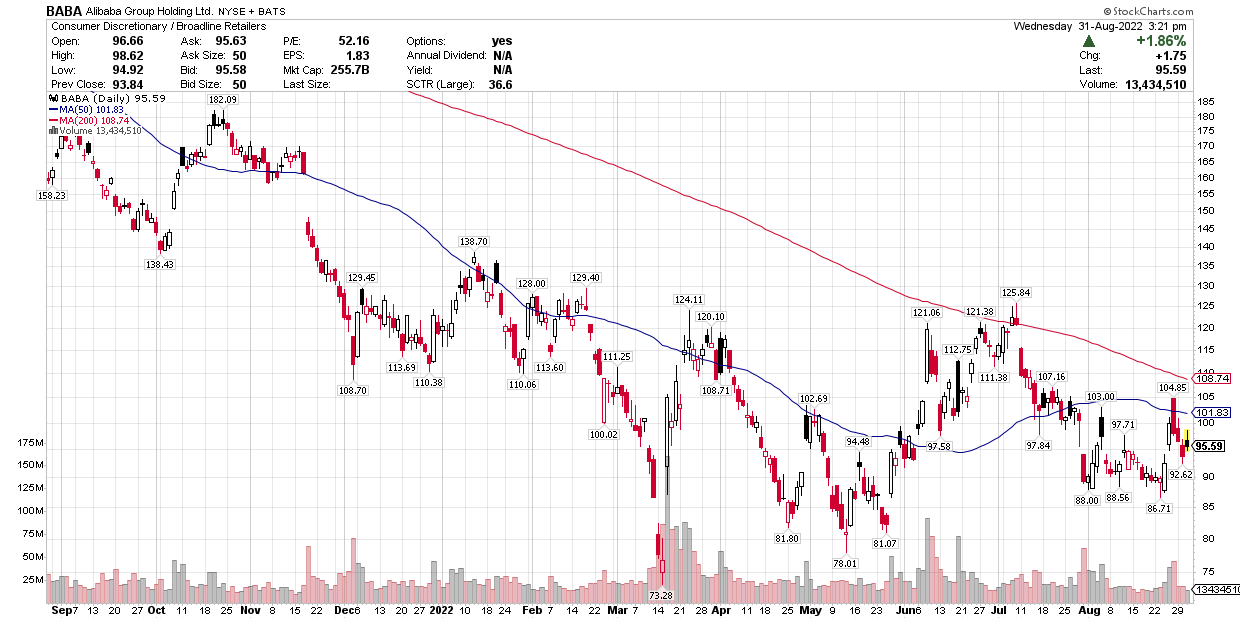

But given the heart of the disease is in China, it makes sense that Chinese based stocks are the most exposed. The large-cap China ETF, FXI NYSE: FXI is down close to 12% and is fast undoing all the growth seen since the cooling of the US-China trade war since August. Even Alibaba NYSE: BABA with its $550 billion market cap isn’t immune.

After notching all time highs earlier this month, the e-commerce giant has seen its stock pull back over 13%. It opened yesterday with a gap down of 6% which Wall Street clearly thought was overdone as shares caught a decent bid off the lows throughout the day but still finished down 4%. For many investors, assuming the coronavirus doesn't spell the end of the world, these fear-driven dips are welcome. Stocks like BABA were starting to look a little frothy, with RSI well over 70 going into last weekend, indicating overbought conditions as its shares had rallied nearly 40% since October.

Strong Internal Momentum

BABA’s most recent earnings reports shows an e-commerce engine that’s running well and justified the rally. They comfortably beat analyst expectations for EPS and revenue in their Q2 report last November with the latter figure showing 40% growth year on year. The company’s move into cloud computing is bearing fruit, with revenue from that division alone up 64%. Income from all operations was up over 50% year on year.

Coming into 2020, shares were up over 150% from their US IPO in 2014. Towards the end of last November, the company listed on the Hong Kong stock exchange and hit the ground running with a 7% on their debut. With close to $12 billion raised, it was 2019’s biggest IPO. If it weren’t for the current outbreak, almost all signs would be pointing upwards.

Since 2016, its stock has gone toe to toe with Amazon NASDAQ: AMZN with very little between them until the second half of last year. BABA’s attempts to break into Europe by undercutting Amazon’s seller fees haven’t borne fruit just yet and the US-China trade war has been a significant headwind for them. The coronavirus outbreak adds to this but none of these are fundamentally worrying red flags.

The company dominates the Chinese and Asian markets and has a sales engine that’s only waiting for the current headwinds to ease for it to continue stretching its legs.

Getting Involved

Technically, there’s a strong upward trend line in play since 2015 that could be a natural entry point if coronavirus driven weakness continues in the coming weeks. If shares fall below the $200 mark, investors could look to work orders in the $170-$180 range and consider it a gift if they’re filled. Monday’s trading action showed there are plenty of dip buyers on the sidelines looking to get involved, who may have been put off by the frothiness that shares were seeing in the past month.

The company’s next earnings report is due Feb 12th and will hopefully confirm the momentum we’ve been seeing in their recent reports. It will likely be the following report in May before any potential damage to revenue and sales from the epidemic filters through.

Until that happens though, investors have a $550 billion e-commerce company that’s growing revenue at 40% year over year down and whose stock is down 10% from all-time highs on fears of a health epidemic. This has all the signs of being a golden opportunity to buy the dip.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.