China-based social e-commerce platform

Pinduoduo NASDAQ: PDD stock has been a rocket ship since its blowout Q3 2022 earnings report. Unlike

China’s largest e-commerce and internet company

JD.com NYSE: JD, Pinduoduo incorporates an interesting twist to e-commerce by adding a true social element to purchases.

It’s kind of a cross between

Amazon NASDAQ: AMZN,

eBay NASDAQ: EBAY, Etsy NASDAQ: ETSY,

Pinterest NASDAQ: PINS, and

Facebook NASDAQ: META. Pinduoduo has found amazing success executing a social e-commerce model which sounds good in theory, but the execution has been astounding. Top line growth has been sizzling at 65% in Q3 2022 during the

COVID lockdowns and accelerating sequentially, up from just 7% in Q1 2022. They have contracted directly with manufacturers and farmers to connect with their users and control their

supply chains with tactical precision.

The Social E-Commerce Model

The concept is unique as it enables consumers on its app to form teams when purchasing products for a large discount for the group directly from manufacturers. By cutting out the middlemen, the discounts are passed down to the consumers. Users can “pin” products they find interesting or desirable and the discounts grow as more users pin the product for purchase.

This incentivizes users to use their social media to derive larger discounts. In fact, the app tells you how much it would cost if purchased individually and the discounted price if purchased with a team. As you connect with more users, the app also provides updates on what other team members are pinning and purchasing and what items are trending.

The intuitive interface provides recommendations with the number of pins and discounted costs. It’s a browsing-centric, not search-centric, app akin to walking through a massive online bazaar with furious activity among millions of users.

The low prices can range from 20% to 90% off retail. It also has a large agriculture segment accommodating farmers to sell items in bulk directly to consumers using the team buying model.

Staggering Pace of Growth

On Nov. 28, 2022, Pinduoduo reported its fiscal Q3 2022 earnings. The Company reported earnings-per-share (EPS) of $1.20 per share beating consensus analyst estimates by ($0.47). Revenues climbed 65% year-over-year (YoY) to $4.99 billion, beating analyst estimates by $621 million.

Operating profits rose 388% to $2.14 billion. Pinduoduo CEO Chen Lei commented, “We are helping to upgrade real economy enterprises and manufacturers by connecting them directly with the end consumers. Our pioneering team purchase model can quickly and directly connect devices by gathering consumer demand.

We have leveraged digital e-commerce technology to shorten the product development cycle and help manufacturers to create products that closely manages market needs. This can help manufacturers to build their brand.”

Seed Wave Breakout Pattern

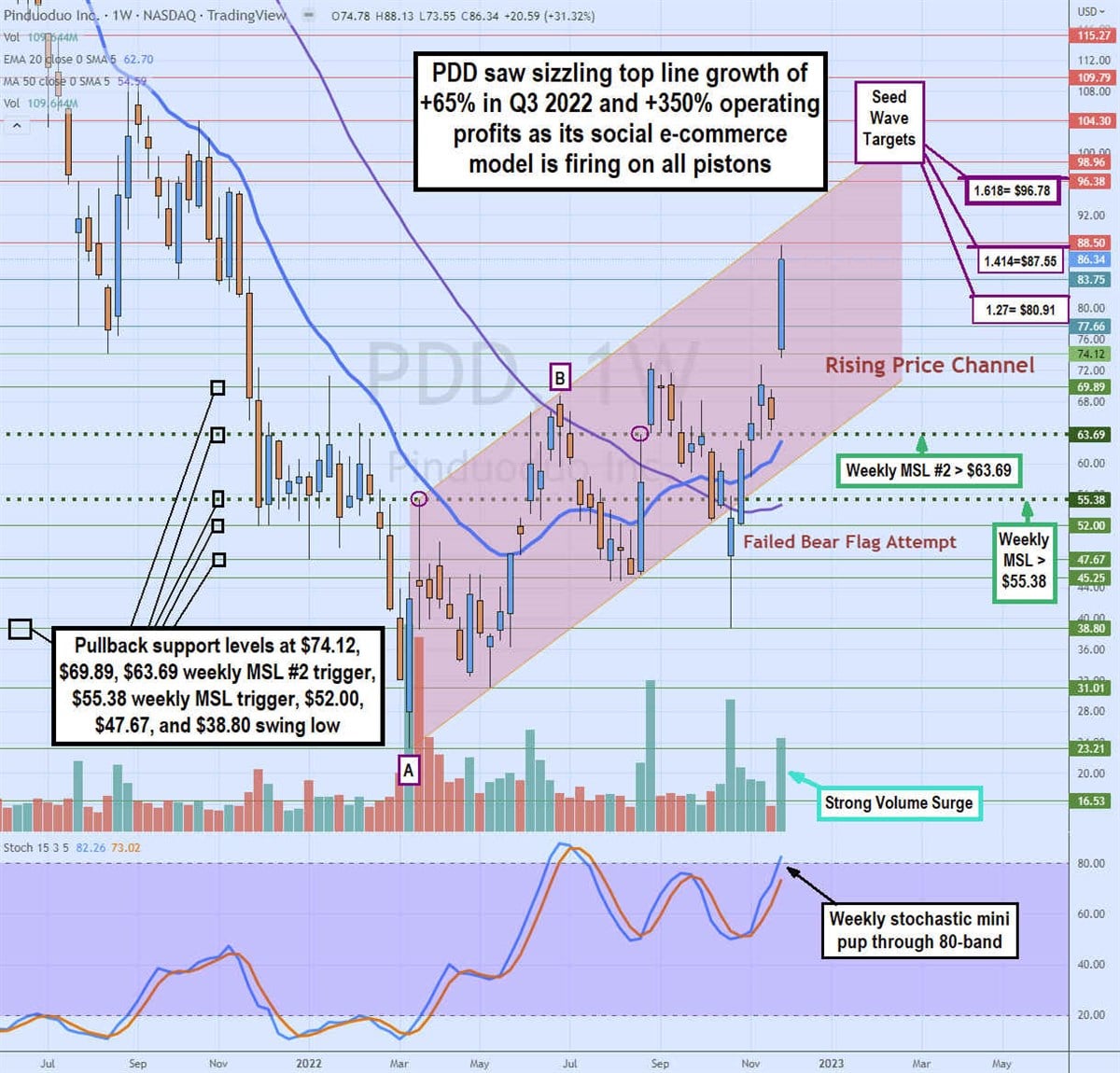

The candlestick chart on PDD has triggered a rare seed wave breakout. Shares were downtrending with a falling weekly 20-period exponential moving average (EMA) followed by the 50-period MA. PDD shares made a market structure low (MSL) of $23.21 (A) on March 14, 2022.

The stochastic bounced up through the 20-band to form its first MSL trigger on a $55.38 breakout, which didn’t materialize until June 6, 2022. Shares proceeded to rally until it peaked forming a market structure high (MSH) at $68.71 (B) on June 27, 2022.

It fell back under the weekly 50-period MA and weekly 20-period EMA to bottom at $45.25 and form a second MSL trigger on a breakout through $63.69 which occurred on Aug. 29, 2022, which then collapsed back under the lower rising price channel under $55.38 to form a bear flag.

This prompted short-sellers to pile on as shares fell to a swing low of $38.80 before coiling back up through the $63.39 second MSL trigger on Nov. 7, 2022. This bear trap and short squeeze helped spawn the rare and powerful seed wave breakout which is defined by two sequential higher MSL triggers.

When this occurs, a Fibonacci (fib) extension is drawn from the first MSL at point A at $23.21 to the first MSH at point B at $68.71. The three fib extensions provide upside targets based on the 1.27, 1.414, and 1.68 ratios. This provides for upside targets at $80.91, $87.55, and $96.78, which are also price reversal zones (PRZs).

It’s critical not to chase at these fib target levels but watch for reversals to support levels if looking for entries. Pullback support levels sit at $74.12, $69.89 gap fill zone, $63.69 weekly MSL #2 trigger, $55.38 weekly MSL trigger, $52.00, $47.67, and the $38.80 weekly swing low.

China zero-COVID Restrictions Easing

There has been much criticism for the zero COVID restrictions in China that have been literally choking its economy. Protests among students and citizens appear to be having an impact as many regions have started loosening restrictions. This has helped to bolster the surge back into Chinese stocks including strong spikes in JD.com, XPeng NASDAQ: XPEV, Bilibili NASDAQ: BILI, Alibaba NASDAQ: BABA, and Baidu NASDAQ: BIDU.

Pinduoduo has expanded its platform into the U.S. with its Temu app in hopes of duplicating its success in China with the social e-commerce model. Temu includes discounted price, reviews, ratings, messaging, sold stats and well as buy now pay later options from Afterpay NYSE: SQ and Klarma.

Cutting Out the Middlemen

The only real drawback is the delivery times can range up to 11 days since most of the products are shipped out of China. However, the unbelievable price discounts are enough to justify the wait. While critics may bash the quality of Chinese products, keep in mind that China makes around 28.4% of the world’s manufacturing output.

Consumers can actually see identical products on Amazon.com at much cheaper prices because but they are shipped directly from the manufacturers rather than through third-party sellers who mark up the prices many folds.

Before you consider Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Block wasn't on the list.

While Block currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.