The homebuilding sector is showing no signs of slowing down. Median home sales prices continue to set record-highs.

Mortgage rates below 3% are starting to seem like the new-normal. And the NAHB Index another record high in October,

increasing two points from September’s reading.

On top of all of that, COVID-19 cases are peaking, which in many ways, is a net gain for homebuilders. The massive shift to work-at-home has been largely responsible for the housing boom, as people have abandoned their city apartments in favor of suburban living arrangements. Some companies are already committing to work-at-home structures well into 2021. I expect even more to do so during the winter months.

As you can imagine, there are a lot of solid plays in this sector, and it can be tough to narrow down your choices. D.R. Horton NYSE: DHI is one of the best options not just because it’s well-positioned for success in our current environment – a lot of others can say that – but because it is likely to outperform if (when) conditions change.

With DHI’s earnings set to be released tomorrow, now is a good time to evaluate the company’s prospects.

A Hedge Against Higher Rates

D.R. Horton’s average closing price is at the lower end at just over $300,000. There are several reasons for the housing boom, but record low mortgage rates may be the biggest.

A 1% mortgage rate increase may seem miniscule, but its impact on home affordability is far from it. Toll Brothers NYSE: TOL, a luxury homebuilder, noted, “For example, with a 3% versus 4% mortgage rate, a person can afford a $900,000 home versus an $800,000 home with the same monthly payment.”

So, if (when) rates increase, homebuyers are going to have to trim their budgets and start buying from the D.R. Hortons of the world.

D.R. Horton Starting to Take Advantage of Single-Family Opportunity

Housing starts came in at a seasonally-adjusted annual rate of 1.42 million in September, up 1.9% from August levels. The month-over-month growth may seem low, but comps have been getting tougher: Back in June, for example, housing starts happened at a seasonally adjusted rate of 1.19 million, which was a 17% increase over May.

How does this all relate to D.R. Horton, in particular?

Well, multi-family construction activity actually dipped – again – but there was an 8.5% increase in single-family starts. On its last earnings call, DHI signaled that it’s ready to take advantage of growth in the single-family segment:

“We also continue to evaluate our opportunities in the market for single-family rental homes. We are currently building and leasing homes in nine single-family rental communities across our operations, as we are in the early stages of our participation in this growing segment of the housing market.”

Backlog Bodes Well

Last quarter, DHI noted that its sales order backlog increased 41% yoy. That bodes well for the future.

Consensus estimates for the current quarter are calling for revenue of $5.88 billion, up 18.2% yoy, and earnings of $1.76 per share, up 30.4% yoy. The revenue growth would be an improvement over last quarter’s 9.8% yoy revenue growth, while the earnings growth would be a slowdown from last quarter’s 36.5% yoy earnings growth.

Last quarter’s numbers blew away expectations, so have DHI investors already priced in a beat? I don’t think so.

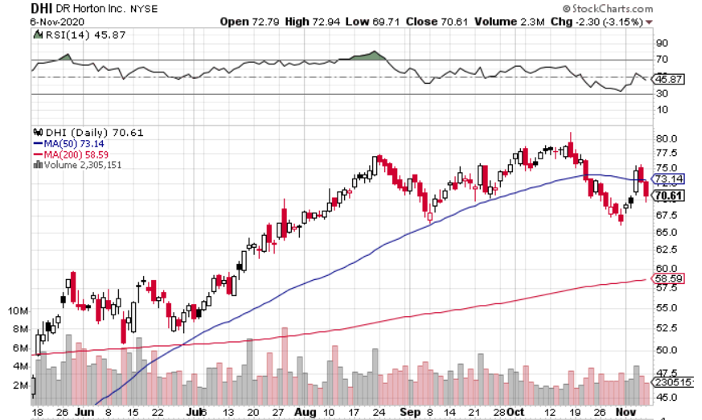

DHI shares were basically going up in a straight line going into the last earnings report, in late July. But this time around, shares have been range-bound for more than two months, and have dipped more than 5% over the past two sessions.

Of course, it’s impossible to pinpoint the whisper numbers, but every indication is that they are reasonable.

The Value is Still There

Back in July, I said there’s a lot to like when you look at DHI’s valuation metrics. A few months later, that’s still the case, with shares trading at 10.15x forward earnings and 1.12x forward sales. Bargain levels, particularly for a growing company.

And even if the housing market is approaching a cyclical high – which is very possible – DHI is where you want to be in the event of a slowdown.

Look to get in ahead of tomorrow’s report.

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.