Stealthy like UV Rays

Daqo New Energy NYSE: DQ has been quietly expanding its annual polysilicon production capacity from a mere 18,000 Metric Tons in FY2018 to a current 132,000 Metric Tons as of 3Q'22. This massive growth is shown in their achieved economies of scale and lower production costs, which stood at approximately $9.40/kg in FY2016 to a fantastic $6.82/kg as of 3Q'22.

This low-cost advantage is met with unprecedented demand for the finished good, from the solar panel industry to semiconductor wafer production. Daqo New Energy, being a Chinese company, naturally generates most of its revenue from Chinese enterprises with a smaller component from the U.S. and EU regions. This dynamic provides a major tailwind for the company, given that China is the largest polysilicon and solar panels producer and the largest buyer of the two.

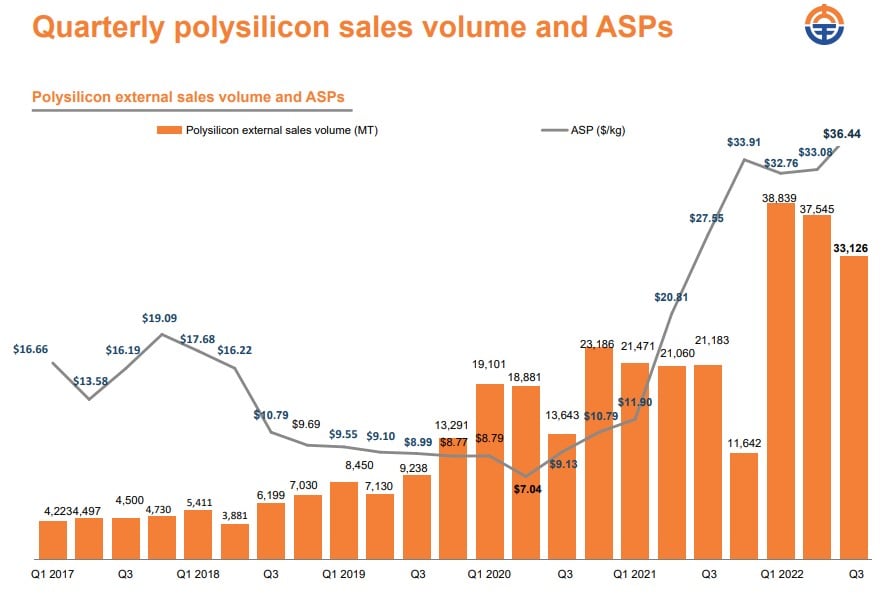

Taken from Daqo's 3Q'22 earnings presentation, investors can appreciate the extraordinary environment the industry is currently benefitting from - speaking to ASP/kg -. Polysilicon has reached a near 2-year trend price per kilogram of $32-$36, tied to Daqo's 52-week high price in the high 70s.

Despite these prices being out of the norm, management and other sources like PV Magazine, First-Green Consulting, and the World Economic Forum have stated their cases for sustained high prices in the material. Being Cautious investors, however, we have projected financials based on a reasonable historical price and production capacity below management guidance.

Is going Green Profitable?

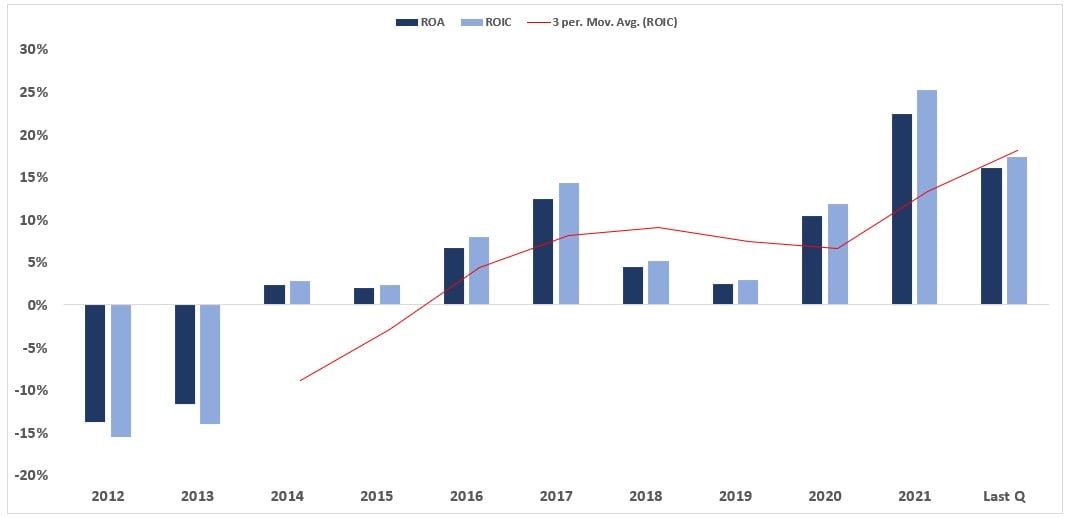

Most investors grew apart from terms like "green energy" or "EVs" and even "Metaverse," some with good reason. It should be clear that Daqo - even among other speculative firms in this category - has demonstrated resilience and strong profits through more than a couple of business cycles.

A few things should be pointed out to express the historical profitability of this business. Throughout the 2010-2013 period, China's PV tariffs and policy challenged the industry greatly, thus many contracts fell through and wiped out many, if not most, of the operators in the country. 2014-2017 saw the market reopening through easier policy and tariffs on polysilicon.

Thus prices rose and increased Daqo's profitability, allowing for CAPEX into expansion projects as described in the Metric Ton Capacity. 2018-2020 experienced lower demand and trade troubles when the U.S. looked to slap further tariffs on Chinese goods, thus profitability and cash flows suffered greatly.

The 2020-Present day represents the strongest macro environment for the industry and Daqo, who prepared by paying off all outstanding debt as of 3Q'22 and is looking to deploy a large part of its liquidity into Mongolian expansion projects for a total Metric Ton annual capacity of 300,000+.

Should Markets Switch to Solar?

Just like buying a car, house, groceries and stocks, people want more for less. Daqo potentializes exactly that:

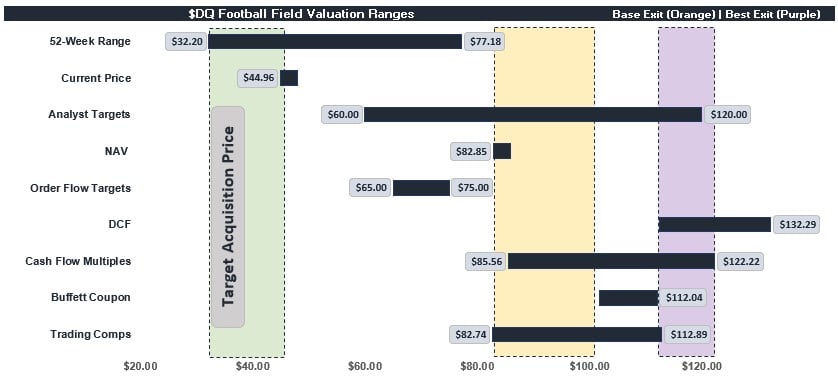

Utilizing several methods of valuing this business, there are two scenarios in Orange/Purple for a sensible exit. Despite being bullish for the stock, these two scenarios are still derived from conservative projections in the price of polysilicon and underlying margins in the business.

Base Exit:

Covering the Orange bar above, a sensible price target for Daqo lies in the $90-$110 range. This is not far from what Wall Street analysts are predicting, where NAV lies and reasonable multiples are considered.

Best Exit:

Keeping polysilicon prices closer to the current trend and demand + production near guidance, we end up at the higher end of analyst estimates and assumptions. This best scenario covering the purple bar above represents an implied value of $115-120.

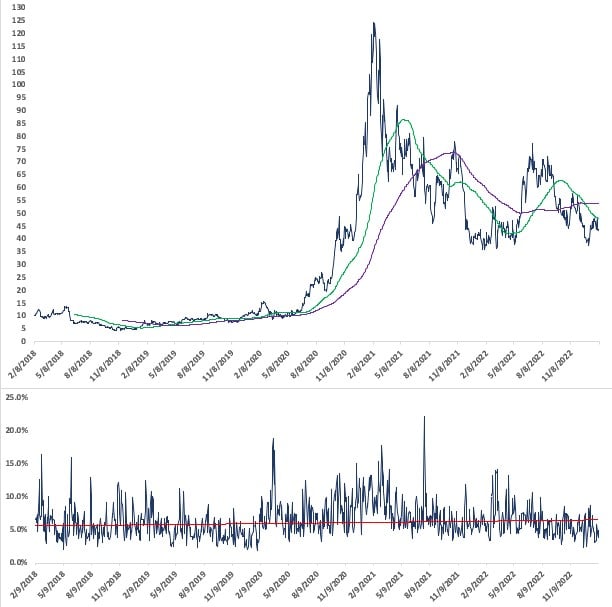

Entry Points

Speaking to technicals, Daqo is trading in the "Golden Ratio" in the weekly Fibonacci levels, weekly RSIs hovering near the oversold region, and weekly stochastics are bouncing off the oversold area.

Volatility also seems to be compressed, pointing to a possible near catalyst incoming, namely earnings being announced toward the end of February. This catalyst could push volatility along with bullish technical setups for a bullish rally.

Before you consider DAQO New Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DAQO New Energy wasn't on the list.

While DAQO New Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.