The country’s largest restaurant operator

Darden Restaurants NYSE: DRI is using its massive size to dampen price increases to instill value and grow loyalty for its brands. Darden operates eight popular restaurant brands ranging from casual dining experiences like Olive Garden, Bahama Breeze, Cheddar’s, Season’s 52, and Longhorn Steakhouse to premium restaurants like The Capital Grille, and Eddie V’s Prime Seafood. The pandemic created a war of attrition that saw numerous mom and pop establishments close up shop leaving only the best capitalized restaurants with the deepest pockets to weather the

storm during lockdowns. Under those conditions, the big players gained market share in the reopening. Yet, another round of attrition is emerging. This time it’s being driven by record-setting Inflation, falling consumer spending, and a tight

labor market ultimately squeezing already thin margins for restaurants as even more smaller players close up shop. Darden is proving itself to be the best restaurant operator in the country as they continue to drive top and bottom line growth to underscore the

value proposition for its customers. In contrast, competitors like

Brinker International NYSE: EAT are getting their

margins squeezed hard.

Can’t Pass the Buck

Passing all the inflation onto the customer has proven to be a failing and sophomoric solution as it turns off consumers. While the premium brands may get away with it, the lower budget cost-conscious consumers are especially price sensitive at casual dining restaurants. Darden utilized precision pricing below the rate of inflation and to allow the strength of its brands to grow margins even higher than pre-COVID levels. As the largest restaurant operator, Darden has the economies of scale to mitigate some inflationary pressures on margins by implementing a masterful pricing strategy just below the rate of inflation. While competitors are noticeably raising menu prices, Darden has been slow to raise prices modestly to encourage customers to stick with them in tighter times and earning more loyalty as customers appreciate the value proposition.

Strong Finishing Performance for Fiscal 2022

Despite record inflation, Darden was able finish its fiscal 2022 on a strong note. On June 23, 2022, Darden released its fourth-quarter fiscal 2022 results for the quarter ending May 2022. The Company reported a non-GAAP diluted earnings-per-share (EPS) of $2.24 versus $2.21 consensus analyst estimates, beating by $0.03. Revenues grew 14.2% year-over-year (YoY) to $2.06 billion, beating consensus analyst expectations for $2.54 billion. Comparable restaurant sales rose 11.7%. Darden also issued a new $1 billion stock buyback program. Darden CEO Rick Cardenas commented, "We had a strong quarter despite experiencing high inflation, and fiscal 2022 was a solid year. Darden's competitive advantages enabled our brands to strengthen their business models while our restaurant teams continued to deliver exceptional guest experiences in a challenging operating environment. As we begin our new fiscal year, our focus remains on driving profitable sales, investing in the guest experience and simplifying operations. Darden's strategy, and our strong balance sheet, positions us well regardless of the operating environment."

Here’s What the Charts Say

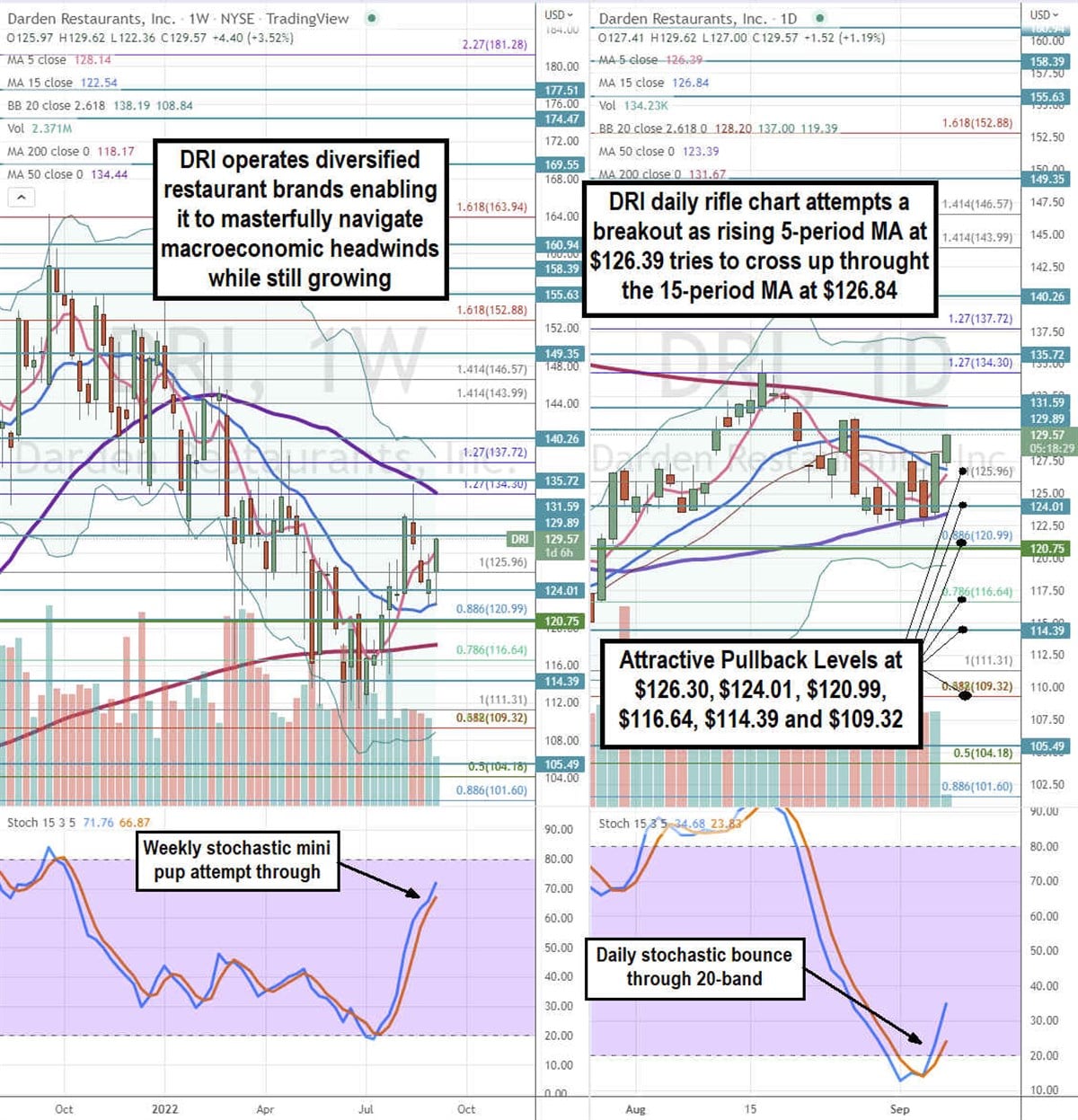

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for DRI stock. The weekly rifle chart has an uptrend with a rising 5-period moving average (MA) support followed by the 15-period MA support at $122.54. The weekly 200-period MA support is at $128.14 and 50-period MA resistance sits near the $134.30 Fibonacci (fib) level. The weekly stochastic formed a bullish mini pup oscillation towards the 80-band. The weekly upper Bollinger Bands (BBs) sit at $138.19 with rising lower BBs at $108.84. The daily rifle chart is attempting to breakout as the rising 5-period MA at $126.39 attempts a crossover up through the 15-period MA at $126.84. The daily 50-period MA is rising at $123.39 and daily 200-period MA is falling at $131.67. The daily stochastic is coiling back up through the 20-band. The daily market structure low (MSL) breakout triggered above $120.75. Attractive pullback levels sit at $126.30 daily 5-period MA, $124.01, $120.99 fib, $116.64 fib, $114.39, and the $109.32 fib level.

Pricing Strategy

Darden CFO Raj Vennam pointed out how their pricing strategy is resulting in maintaining operating margins while competitors are getting squeezed. He commented, “During the quarter, we took additional pricing to help offset a portion of the growing inflation that brought total pricing to 6% for the quarter and 3% for the full year. This is well below our annual inflation of just over 6% as we continue to execute our strategy to strengthen our value leadership position.” Basically, they are raising their prices much slower than competitors due to their massive size. This should ingrain a sense of value and loyalty among its customers as well as pull in new customers while competitors helplessly raise prices to mitigate margin pressures.

Looking Ahead to Fiscal 2023

The Company reigned in expectations in light of the macroeconomic environment. Darden provided fiscal 2023 guidance for EPS between $7.40 to $8.00 versus $8.13 consensus analyst estimates. Full-year fiscal 2023 revenues are expected between $10.2 billion to $10.4 billion versus $10.24 billion. Same store sales are expected to grow between 4% to 6%. Growth is still expected while competitors expect margins to continue to fall. Shares are trading at 16.5X forward earnings and has a 3.78% dividend yield.

Before you consider Darden Restaurants, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darden Restaurants wasn't on the list.

While Darden Restaurants currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.