Hardware and infrastructure solutions provider

Dell Technologies NASDAQ: DELL is a diversified technology company comprised of two main segments, Infrastructure, and Client Solutions. The segment that manufactures and sells PCs, monitors, accessories and gaming hardware is the Client Solutions segment. The acquisition of

storage solutions provider EMC over a decade ago helped shape the storage and networking solutions segment known as the Infrastructure Solutions Group. While the Client Solutions Group (CSG) saw revenues fall due to

normalization from the pandemic driven 2021 comps, its Infrastructure Solutions Group (ISG) continues to set record revenues. The Company also Alienware gaming systems, SecureWorks cybersecurity, and

cloud computing management software company Virtustream. Dell also divested its 81% stake in virtualization company

VMWare NASDAQ: VMW. The Company has continued to gain commercial PC market share in 35 of the past 39 quarters and has been able to reduce quarterly operating expenses by more than $300 million since Q1 2022. Despite the

strong U.S. dollar having a 500-basis point impact, Dell handily beat its Q3 2022 EPS estimates and like rival

HP Inc. NYSE: HPQ may be indicating that the bottom of the

normalization process for PC sales may have been made.

Pandemic Bolsters APEX As-a-Service Solutions Model

The pandemic was also a boon to Dell’s infrastructure business as companies pulled back on heavy capex spending for infrastructure due to the unpredictability of the COVID pandemic and the budgetary constraints from lockdowns. This caused more companies to consider as-a-service subscription plans (IE: Software-as-a-Service, Storage-as-a-Service, Hardware-as-a-Service, etc.) that allowed for lower costs in the face of uncertainty while gaining more flexibility, value and capacity. For Dell and other as-a-service (aaS) providers, it meant steady, predictable, and consistent cash flows. Dell’s APEX allowed for companies to procure hardware, storage, software, security and cloud in a single offering with complete end-to-end maintenance and management making it scalable and affordable with no overage charges under its hybrid subscription and consumption billing plans. This was especially accommodating to companies employing a growing remote workforce and suited for the “new normal” of hybrid work and the elastic office.

Strong Beat But Still...

On Nov. 21, 2022, Dell released its third-quarter fiscal 2022 results for the quarter ending October 2022. The Company reported earnings-per-share (EPS) of $2.30 excluding non-recurring items versus consensus analyst estimates for a profit of $1.61, a $0.69 per share beat. Revenues fell (-6.4%) year-over-year (YoY) to $24.72 billion, beating consensus analyst estimates for $24.61 billion. The comparisons to 2021 were tough since it was a banner year for the Client Services segment as consumer PC and hardware sales hit record levels driven by the pandemic. Dell COO Jeff Clarke commented, “Stepping back, the near-term market remains challenged and uncertain. On one hand, we are seeing some customers delay IT purchases. Other customers continue to move ahead with Dell given the criticality of technology to their long-term competitiveness and a growing need to drive near-term productivity through IT. The world continues to digitally transform, data continues to grow exponentially, and customers continue to look to technology to drive their business forward, no matter the economic climate.” On Nov. 16, 2022, Dell also announced a $1 billion settlement in a class action lawsuit regarding its return as a public company. It’s insurers may pay part of the settlement but still needs final approval from a Delaware Chancery Court judge.

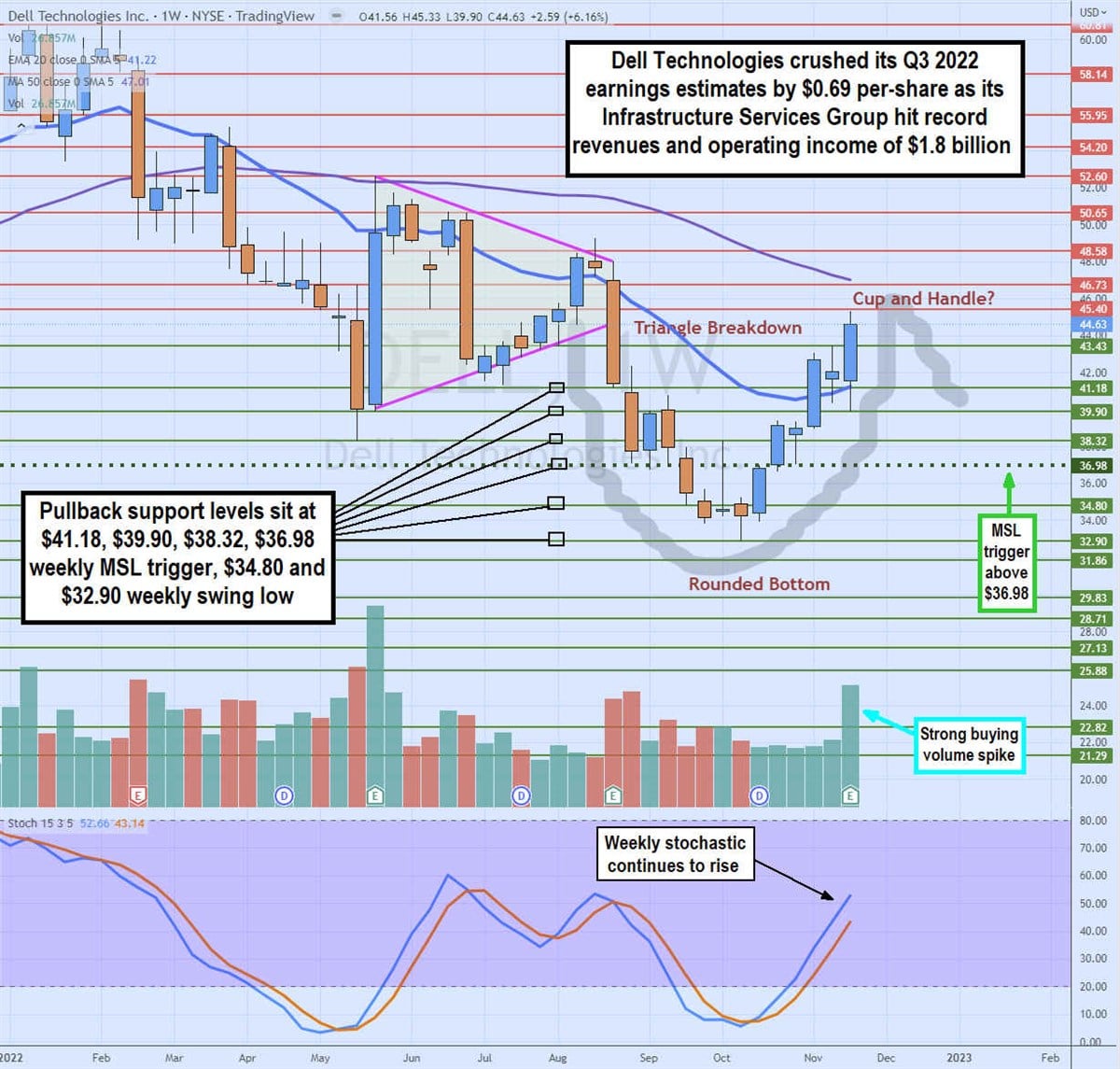

DELL Weekly Cup and Handle Pattern

The weekly candlestick charts illustrate the triangle breakdown occurring in August 2022 setting the stage for the collapse under the $45 level taking shares down to the swing low at $32.90. Shares managed to stage a rally upon forming a rounded bottom leading to the weekly market structure low (MSL) breakout through $36.98 trigger driven by the weekly stochastic bounce through the 20-band. Shares broke higher through the weekly 20-period exponential moving average (EMA) resistance which has now become support at $41.22 as shares head towards the weekly 50-period MA resistance at $47.01. The rally is causing shares to form a potential weekly cup and handle formation upon peaking at the lip area between $45.40 and $46.73, which was also the earlier triangle apex and breakdown level. A shallow pullback towards low $40s and a breakout through the weekly 50-period MA would trigger the pattern. Since the weekly stochastic is only at the 50-band, there is potential for a higher move. Pullback support levels sit at the $41.18, $39.90, $38.32, $36.98 weekly MSL trigger, $34.80, and the $32.90 weekly swing low.

Before you consider Dell Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dell Technologies wasn't on the list.

While Dell Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.