Descartes Systems NASDAQ: DSGX was trading higher Thursday as shares of the supply-chain management software maker continued working on a flat base.

The Canada-based company offers solutions for the shipping-industry customers to better communicate with each other.

Descartes’ flagship product is the Global Logistics Network. According to the company’s own description, Global Logistics Network “manages the real-time flow of commercial, logistics, customs and product information. It connects hundreds of thousands of logistics and transportation, manufacturing, distribution, retail, government, and e-commerce businesses in over 160 countries.”

The network connects carriers, shippers, governments and other parties, such as brokers and forwarders.

The company’s business model also includes additional software upsells from the basic GLN package.

The sales strategy appears to be working. In the past four quarters, revenue growth accelerated from 4% to 24%. During that time, earnings grew from 20% to 125%, increasing each quarter.

The company is slated to report its third quarter on December 1, after the market close. Analysts are expecting earnings of $0.23 per share on revenue of $108.46 million, which would mark year-over-year increases on both the top- and bottom lines.

MarketBeat earnings data show that Descartes Systems missed earnings views in the most recent quarter, while topping revenue expectations. The company beat views in the previous three quarters.

Network Reaches A Milestone

Last month, the company said its MacroPoint Capacity Network now covers more than a million truckload transportation lanes in the U.S. and Canada.

The MacroPoint Capacity Network helps freight brokers locate carrier capacity for customer loads, even in markets and regions with limited capacity or in new lanes where shippers may not already have an existing carrier network.

Descartes Systems says transportation coverage is available for more than 216,000 carriers through network customers sharing their load data.

“By using machine learning to match potential carriers in near real-time to open loads, the solution helps brokers to better rank carrier matches,” according to the company. “Brokers can send load offers to carriers either manually or automatically via configurable business rules that can incorporate considerations such as market indicators, pricing and company preference notifications. Through this use of intelligent automation, brokers have achieved on average 15 times more loads matched than processed manually.”

Clearly, in today’s tight supply-chain environment, this is the type of service that can help speed the movement of goods.

Analysts Like What They See

Wall Street’s consensus rating on Descartes is a “buy,” MarketBeat analyst data show.

Since the company’s second-quarter report on September 8, eight analysts boosted their price target or reiterated a “buy” rating.

The consensus price target on Descartes is $86.94, representing a 0.79% upside.

Mid-session Thursday, the stock was trading at $86.17.

So what does it mean for a stock’s prospects if it’s essentially met its consensus price target already? Should you avoid a buy right now?

Price targets reflect what analysts estimate a stock’s price will be after a particular time frame, generally in the range of one year to 18 months. Price targets may be raised (or lowered) at any time. These targets are based on what analysts’ estimates for the company’s earnings and cash flow over the next one to two years.

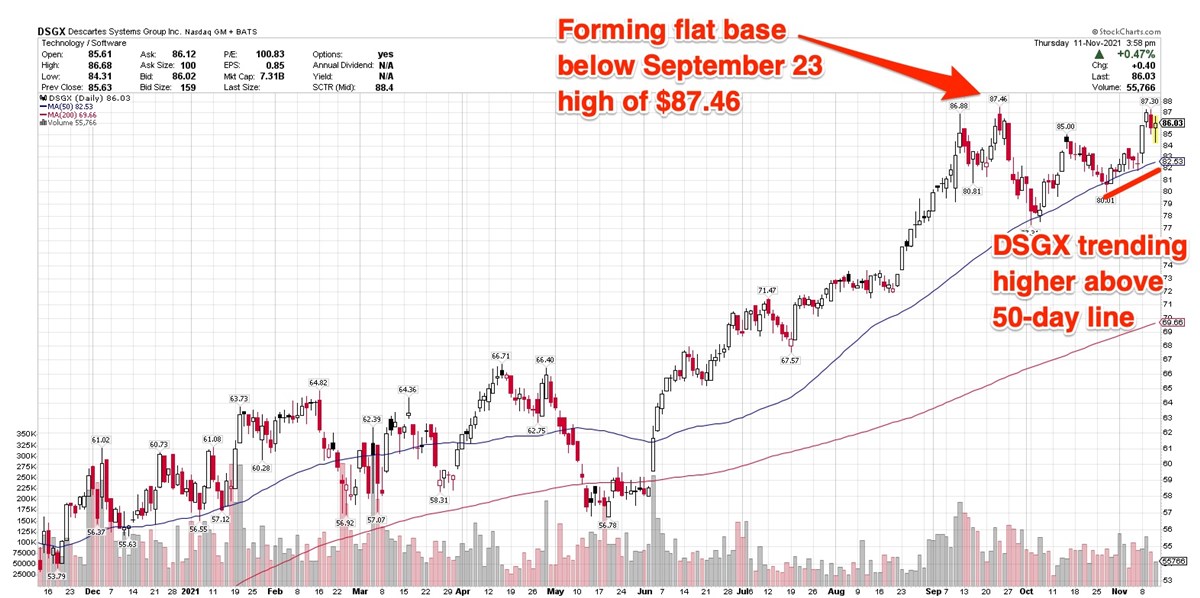

The base structure is also an indicator of the stock’s future potential. It’s been forming a flat base with a 12% correction below a September 23 high of $87.46. While forming this base, the stock successfully tested its 50-day line twice. It’s been trending higher along that line since the most recent test on October 27.

Currently, the buy point remains that September high, or just below it, as a short-term trend line indicates. One looming risk, of course, is the December 1 earnings report. It’s possible this stock could be a short-term swing trade before the report, but more conservative investors and traders may want to wait until the earnings report to be sure nothing causes a selloff.

Before you consider The Descartes Systems Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Descartes Systems Group wasn't on the list.

While The Descartes Systems Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report