Dillard’s NYSE: DDS stock has had a difficult time recovering ground from pandemic lows made in February 2020. The reaction from the last earnings disaster set the bar very low for Dillard’s heading into the Q2 earnings report. Shares are underperforming the benchmark

S&P 500 index NYSEARCA: SPY even as peers like

Hibbett Sports NYSE: HIBB lifted forecasts indicating quarterly sales recovery upwards of 70% of prior year’s quarterly sales. With shares still trading near pandemic lows, risk tolerant investors may want to consider taking entries on opportunistic price levels for a recovery bounce while shares remain depressed.

Q1 FY2020 Earnings Release

On May 14, 2020, Dilliard’s released its first-quarter fiscal 2020 results for the quarter ending April 2020. The Company reported a loss of (-$6.94) per share versus consensus analyst estimates of a loss of (-$0.97) per share, missing estimates by whopping (-$5.97) per share. Revenues fell 46.3% year-over-year (YoY) to $786.7 million missing analyst estimates of $895.8 million by (-$109.10 million). Gross margins shrank to 12.8% versus 37.8% as inventory shrank by (-14%). The closure of retail outlets and malls due to the stay-at-home mandates wreaked havoc the revenues. The Company started closing stores on March 19th and by April 9th, all 285 stores were closed. Re-openings commenced on May 5th with 45 stores with limited hours tracking 56% of YoY performance. At the peak of closures, 90% of the 38,000 employees were furloughed.

COVID-19 Actions

The Company took actions quickly to combat the financial effects of COVID-19 and bolster liquidity. The CEO gave up his annual salary and 20% salaried pay cuts were implemented. Payroll expenses were slashed by (-35%) to $168.5 million from $257.5 million for 13 weeks ending May 2, 2020. Dillard’s extended vendor payment terms, reduced merchandise purchases by (-33%) and took “extraordinary measures to clear” inventory. The Company marked down merchandise by (-40%) starting March 24th and an additional (-50%) through April to May 12th.

Positive Factors

Dillard’s owns 90% of its retail storage square footage and 100% of its corporate headquarters, distribution and fulfillment facilities thereby store rent obligations are significantly smaller than the industry. The Company amended its $800 million credit revolver with no covenants as long as $100 million liquidity exists, and no default events occur.

Competition and Industry Trends

Dillard’s remains quiet about business effects after the earnings release lacking conference call transcripts. This requires sniffing out clues from competitors to gauge industry trends. Key competitor HIBB reported improved industry trends that caused a 25% gap on July 20th. Dick’s Sport Goods NYSE: DKS shares have nearly returned to 2020 highs recovering all losses and turning positive on the year. Dillard’s doesn’t provide much communications as its peers and the bar continues to be set low as it heads into earnings. Using peers HIBB and DKS as a sentiment indicator, DDS is either decoupled from the industry or trading as a laggard with the bar set too low as it remains to chop near pandemic lows. Risk tolerant investors may want to step in before transparency firms up after the earnings release.

DDS Price Trajectories

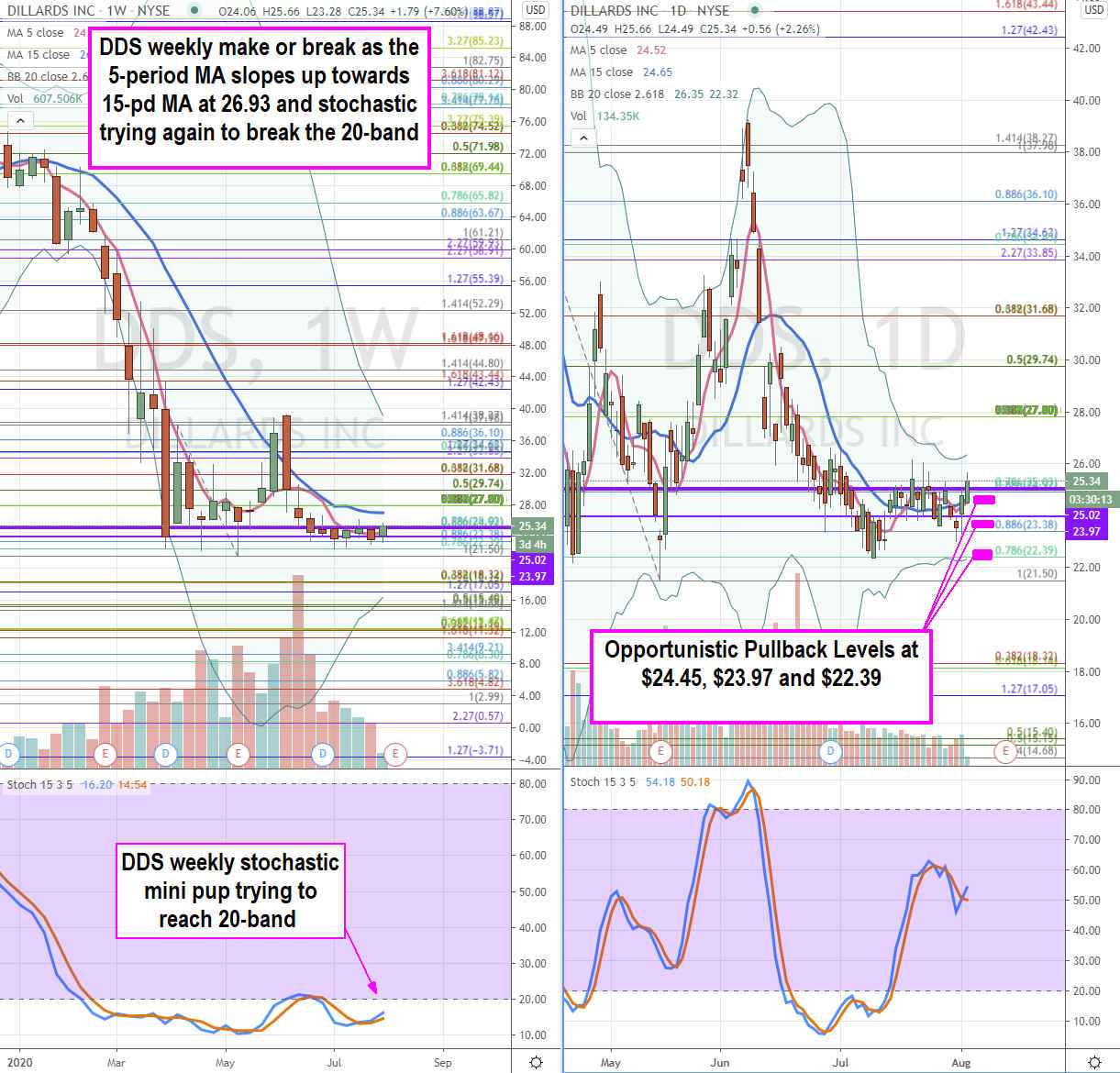

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for DDS stock. The weekly rifle chart triggers a market structure low (MSL) buy trigger above $25.02 as the stochastic attempts to mini pup back up through the 20-band. The weekly 5-period moving average (MA) support is sloping up at $24.46 with a 15-period MA at $26.93. The daily rifle chart formed a MSL above $23.97 as the stochastic tries to coil back up to form a pup breakout. The daily Bollinger Bands (BBs) have been compressed and starting to expand. The big question is the direction of the expansion. Upside trajectories sit at the $27.80 Fibonacci (fib) level , $29.74 fib and $31.68 fib. While both the weekly and monthly charts are in make or break modes, the potential for opportunistic pullback entry levels sit at the $24.45 weekly 5-period MA, $23.97 daily MSL trigger and the $22.39 fib and sticky 2.50s zone. Keep an eye on how peers DKS and HIBB share trade since DDS is a laggard. The higher they scale the more steam builds with DDS for a breakout and daily BB expansion upwards.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.