Restaurant operator

Dine Brands NYSE: DIN stock has been a consistent performer since recovering from its pandemic lows. The operator of well-known

restaurant brands Applebee’s and IHOP is seeing double-digit

same-store sales growth as COVID-19 restrictions have been lifted. The Company plans to resume its net unit growth in 2023 for Applebee’s and doubling the historic rate for IHOP. Additionally, the Company will be

bolstering its loyalty programs and continuing to build out its

digital ecosystem as it comprised of 20% of total sales in the recent quarter. Management also intends to spawn new revenue pipelines with virtual brands and ghost kitchens. The Company has weathered the effect of the

pandemic and is positioned to resume its growth. Prudent investors can watch for opportunistic pullbacks levels in shares of Dine Brands.

Q3 Fiscal 2021 Earnings Release

On Nov. 4, 2021, Dine Brands released its third-quarter fiscal 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $1.55 excluding non-recurring items versus consensus analyst estimates for a profit of $1.36, beating estimates by $0.19. Revenues rose 29.5% year-over-year (YoY) to $228.72 million falling short of $223.47 million consensus analyst estimates. Applebee’s same store sales rose 27.7% YoY. IHOP same store sales rose 40.1% YoY. Full-year 2021 is expected between $245 million to $250 million. Dine Brands CEO John Peyton commented, ““This was another strong quarter for Dine Brands. We recorded a second consecutive period of both IHOP and Applebee’s beating their competitive sets, average weekly sales for both brands exceeded 2019 pre-pandemic levels, and we delivered a 48% increase in quarter-over-quarter EBITDA. The strength of our two world-class brands, combined with the benefits of our asset-lite business model, is fueling the acceleration in system-wide sales growth across each of our brands and driving long-term sustainable growth in the business. Our asset-light structure allows us to keep our operations lean and our movements agile; it reduces complexity, requires less capital and is a significant generator of cash. Our highly franchised model allows us to invest in what we do best—menu, marketing, and technology innovation.”

Conference Call Takeaways

CEO Peyton set the tone. “Dine's posting results like this for two reasons: the resilience of our two world-class brands; and the value of our asset-light model. And Q3 reinforced again the benefits of our highly franchised business, in driving our strong performance versus our peers. Let me explain why that is. First our model reduces complexity and is a significant generator of cash. It allows us to keep our operations lean and our movements agile. And during moments like this, when labor and commodity costs are rising and guest behavior is uncertain due to the pandemic, we delivered less volatile results from period to period. Said another way, asset-light allows us to invest in what we do best, which is menu innovation, marketing and building technology. And at the same time, Applebee's and IHOP continue to gain share, because guests trust us, they love us and they appreciate that we're focused on delivering delicious food at great value while also providing experiences that are enjoyable and safe.” He concluded, “So in 2022 and beyond, you'll see us invest in growth initiatives to a greater extent than we have in the past. As a result, you can expect a balanced approach to capital allocation that incorporates returning cash to shareholders, judicious ROI-driven investments in both organic and strategic growth, diligent management of our debt and maintaining the financial flexibility needed right now to address any remaining uncertainty from the pandemic, as well as potential opportunities to pursue scalable acquisitions at the right time. With that as context, our performance year-to-date and our cautiously optimistic view of the remainder of 2021 and 2022 enables us to reinstate both our quarterly dividend in Q4 and our share buyback program. We're also able to share EBITDA guidance for the remainder of 2021 and Vance will discuss details on both our guidance and our dividend and share repurchase programs in just a few moments.“

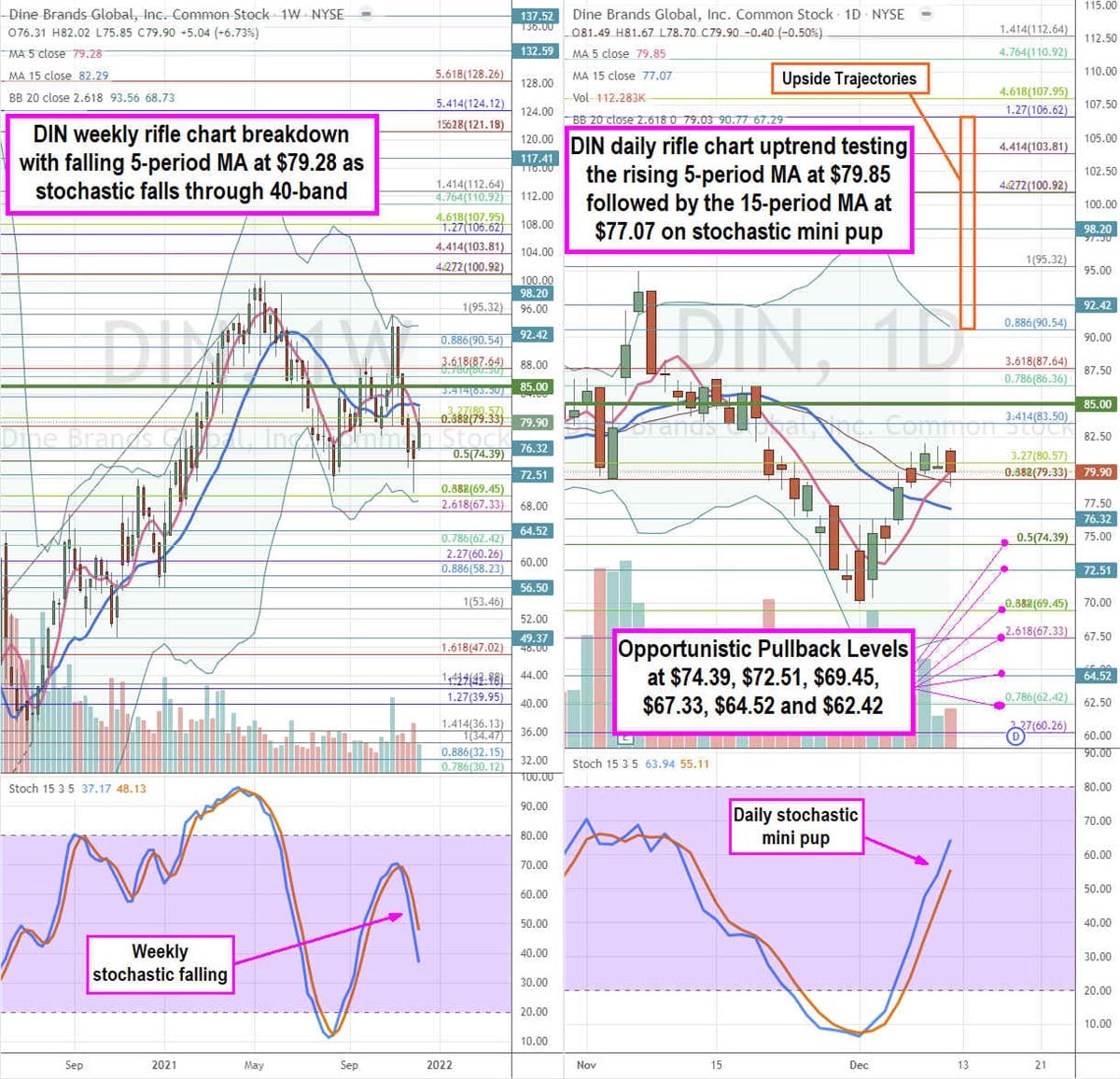

DIN Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for DIN stock. The weekly rifle chart peaked near the $100.92 Fibonacci (fib) level before tanking towards the $69.45 fib double bottom. The weekly rifle chart breakdown formed on a falling 5-period moving average (MA) at $79.28 followed by the 15-period MA at $82.29. The weekly stochastic is falling down through the 40-band with lower Bollinger Bands (BBs) at $68.73. The weekly market structure low (MSL) buy triggers on the $79.28 breakout. The daily rifle chart breakout has a rising 5-period MA being tested at $79.85 followed by the 15-period MA at $77.07. The daily stochastic has a mini pup with daily upper BBs at $90.77. Prudent investors can watch for opportunistic pullback levels at the $74.39 fib, $72.51, $69.45 fib, $67.33 fib, $64.52, and the $62.42 fib level. Upside trajectories range from the $90.54 fib up towards the $106.62 fib level.

Before you consider Dine Brands Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dine Brands Global wasn't on the list.

While Dine Brands Global currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.